Answered step by step

Verified Expert Solution

Question

1 Approved Answer

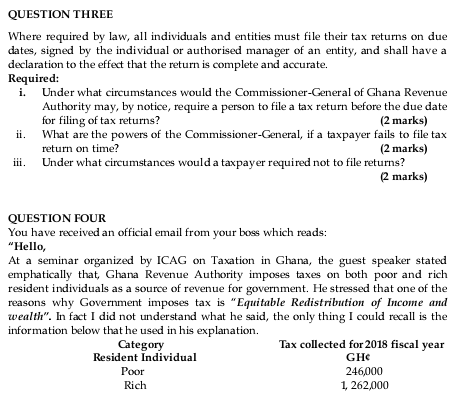

QUESTION THREE Where required by law, all individuals and entities must file their tax returns on due dates, signed by the individual or authorised manager

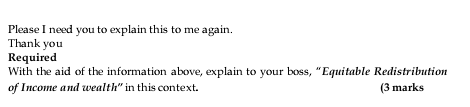

QUESTION THREE Where required by law, all individuals and entities must file their tax returns on due dates, signed by the individual or authorised manager of an entity, and shall have a declaration to the effect that the return is complete and accurate. Required: i. Under what circumstances would the Commissioner-General of Ghana Revenue Authority may, by notice, require a person to file a tax return before the due date for filing of tax returns? (2 marks) ii. What are the powers of the Commissioner-General, if a taxpayer fails to file tax return on time? (2 marks) Under what circumstances would a taxpayer required not to file returns? ( marks) iii. QUESTION POUR You have received an official email from your boss which reads: "Hello, At a seminar organized by ICAG on Taxation in Ghana, the guest speaker stated emphatically that, Ghana Revenue Authority imposes taxes on both poor and rich resident individuals as a source of revenue for government. He stressed that one of the reasons why Government imposes tax is "Equitable Redistribution of Income and wealth". In fact I did not understand what he said, the only thing I could recall is the information below that he used in his explanation. Category Tax collected for 2018 fiscal year Resident Individual GHC Poor 246,000 Rich 1, 262,000 Please I need you to explain this to me again. Thank you Required With the aid of the information above, explain to your boss, "Equitable Redistribution of Income and wealth" in this context. (3 marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started