Question:

Transactions to help answer question above:

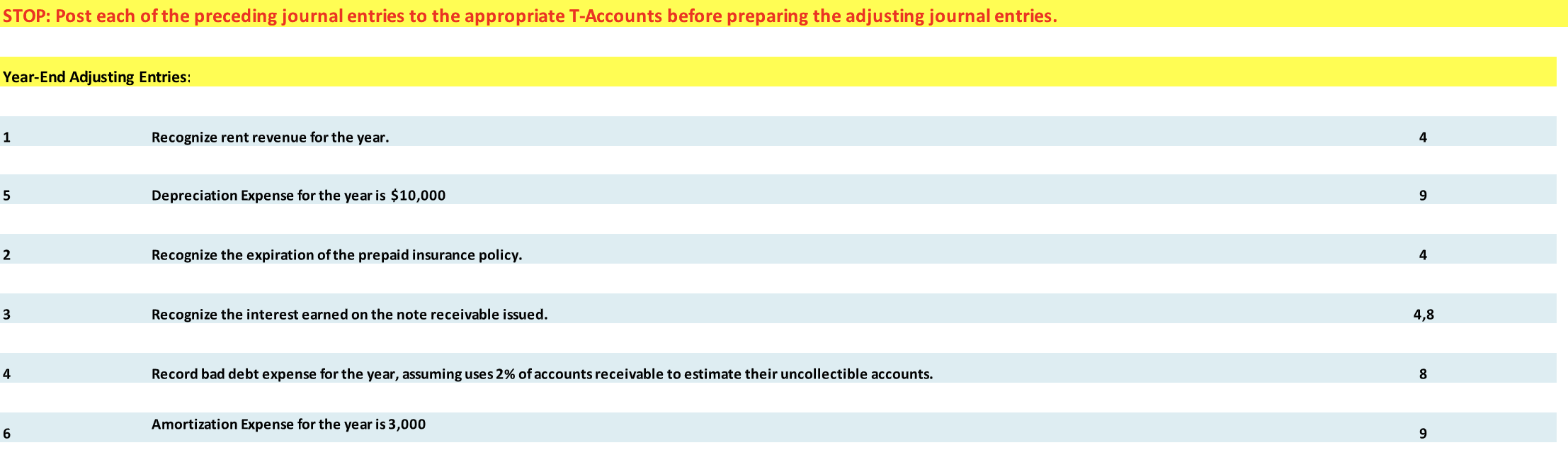

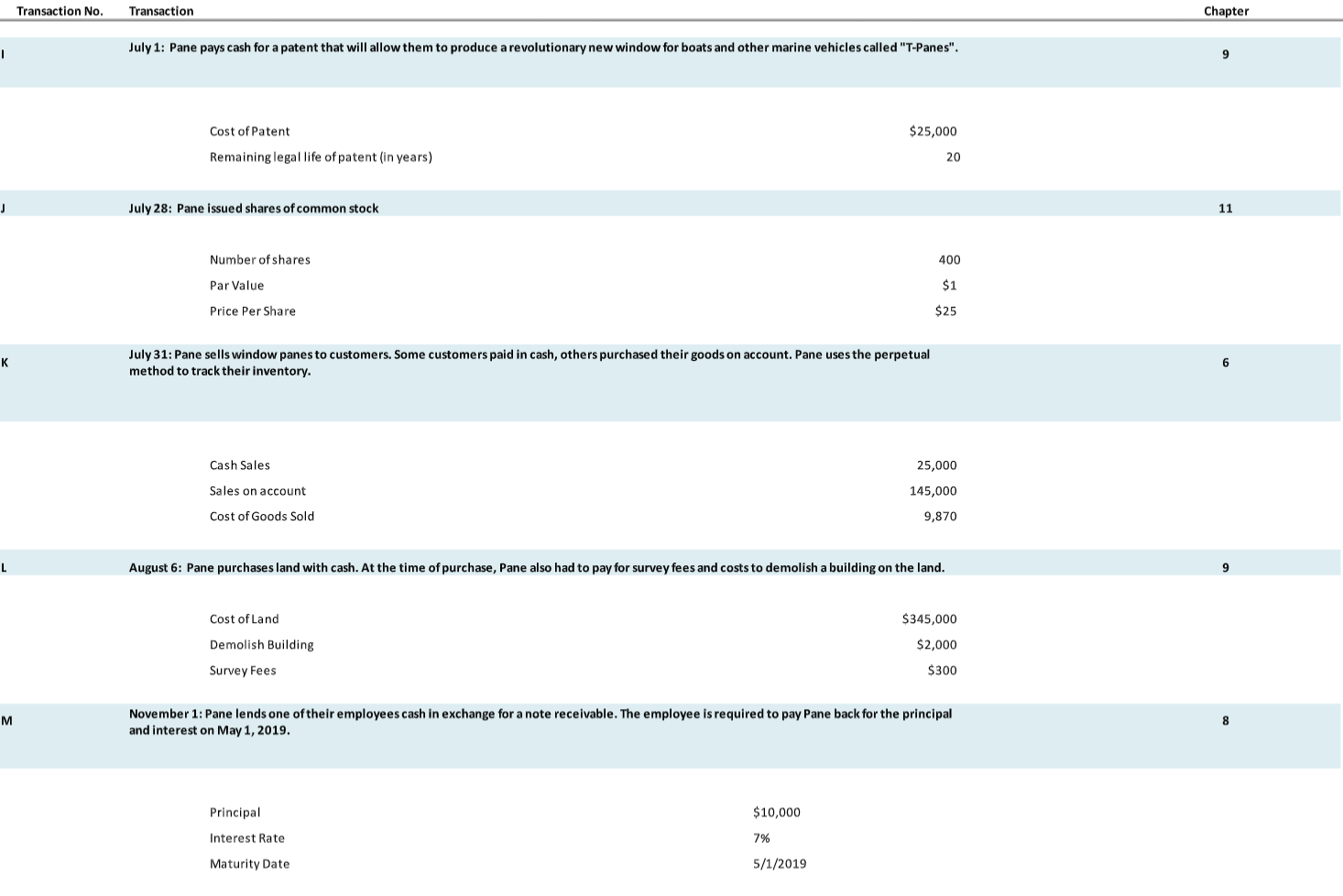

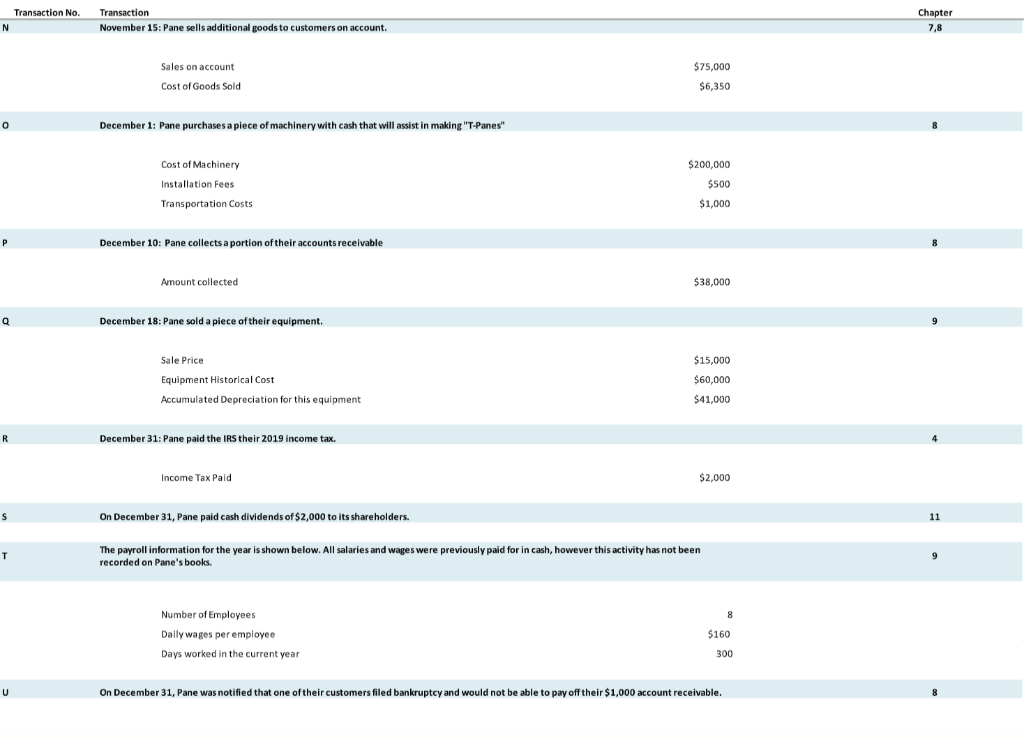

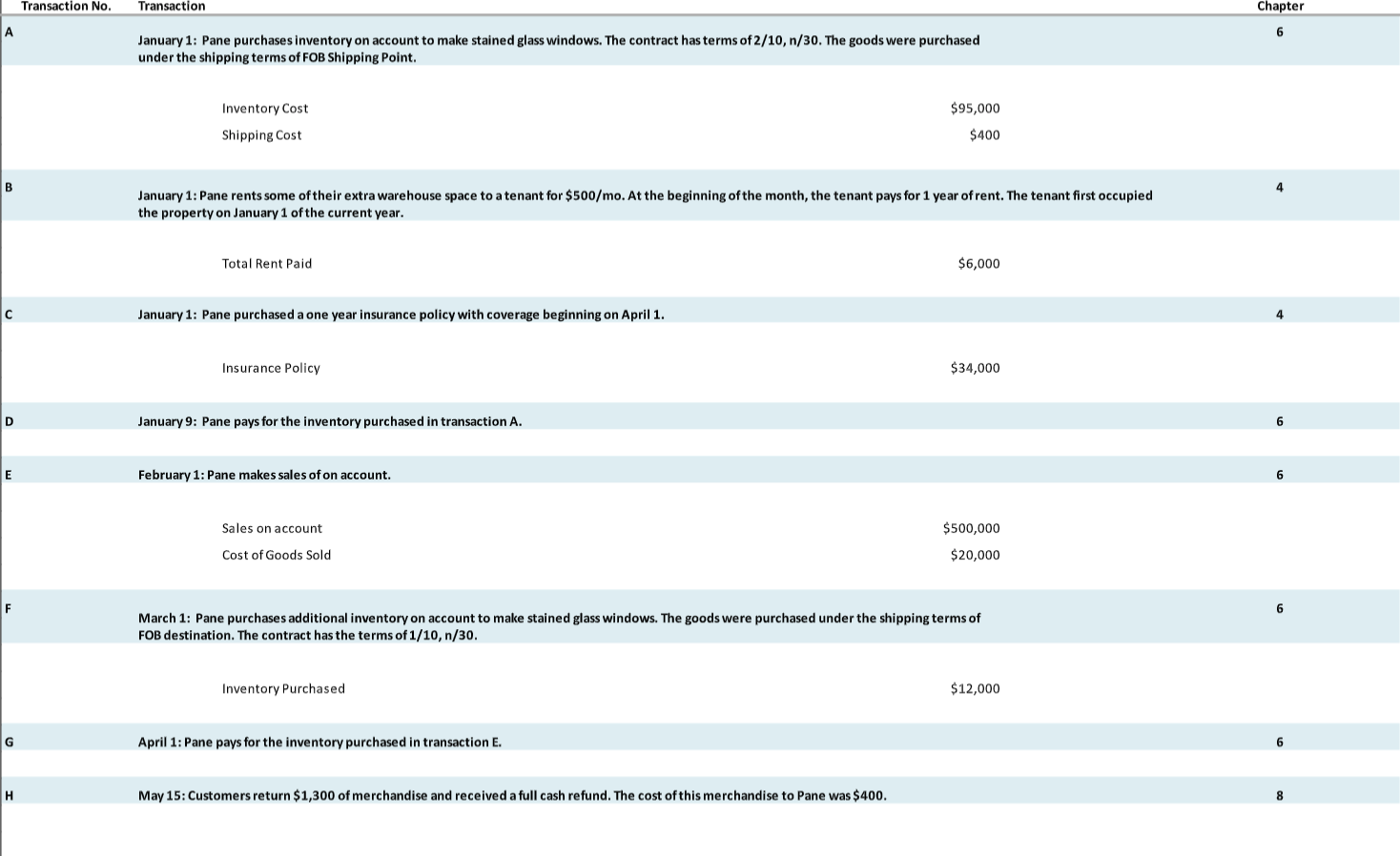

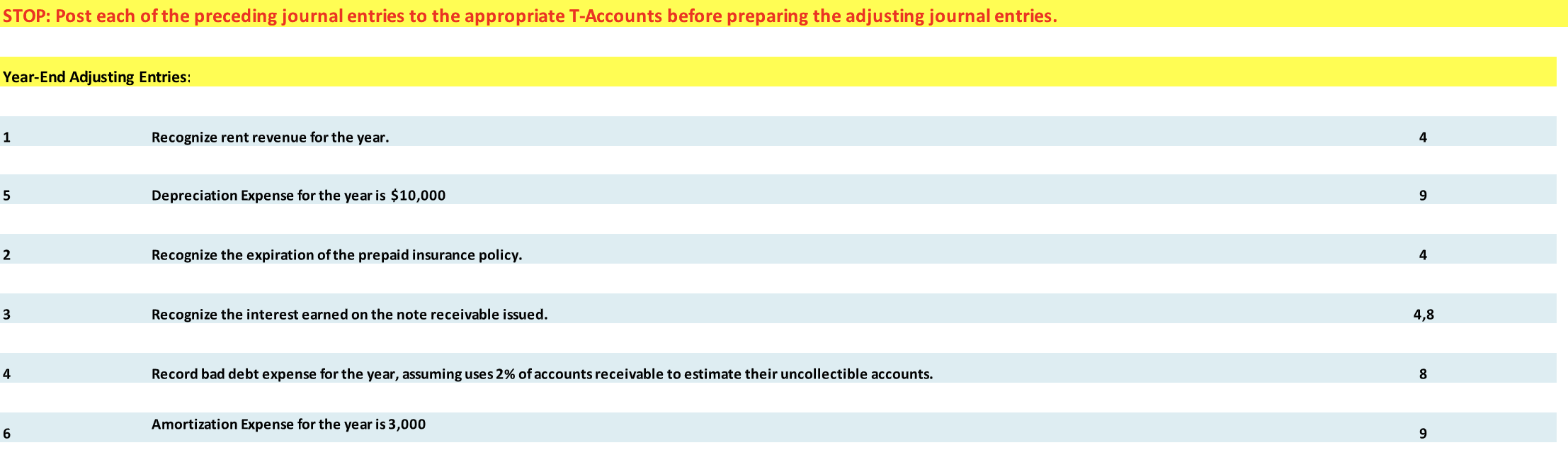

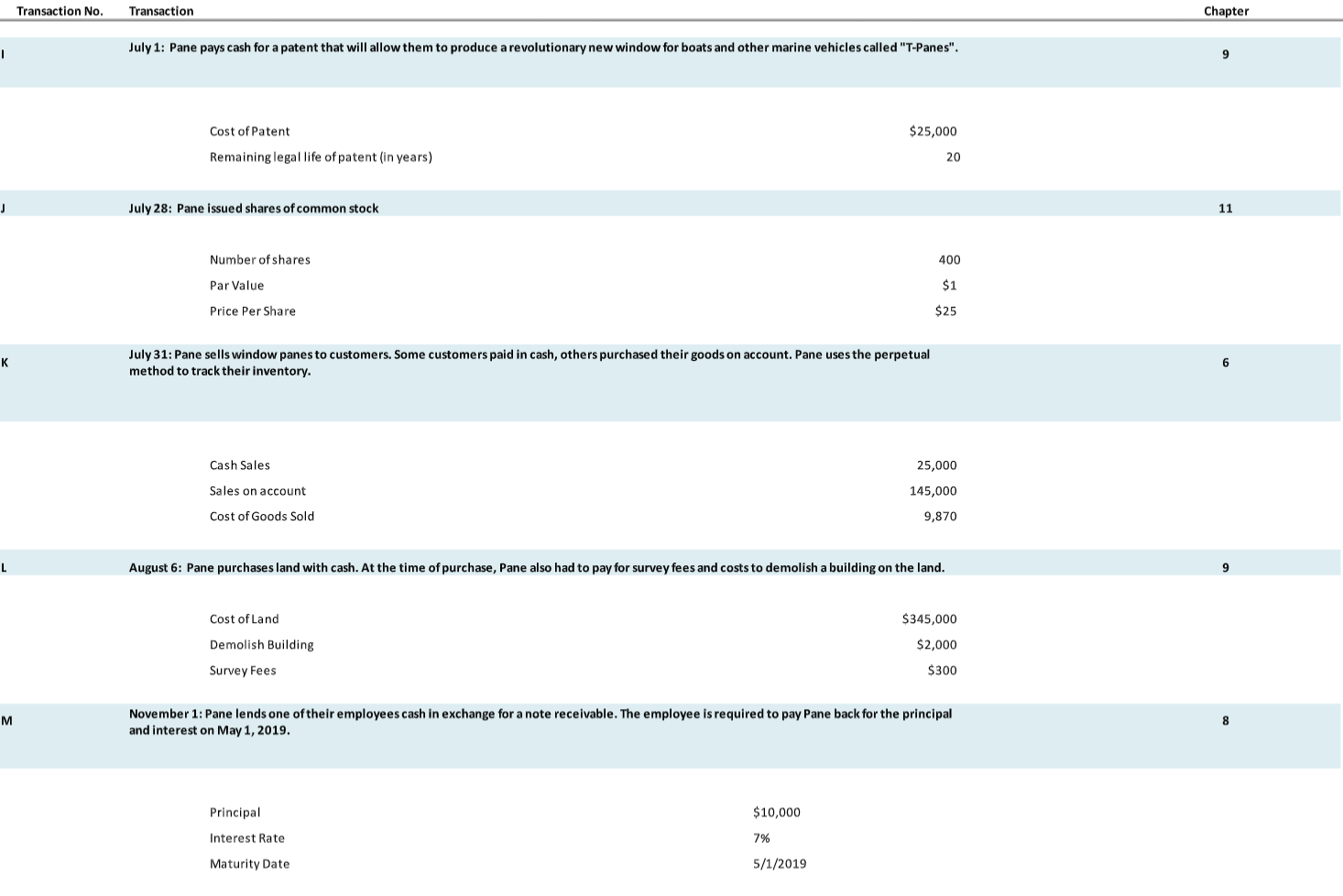

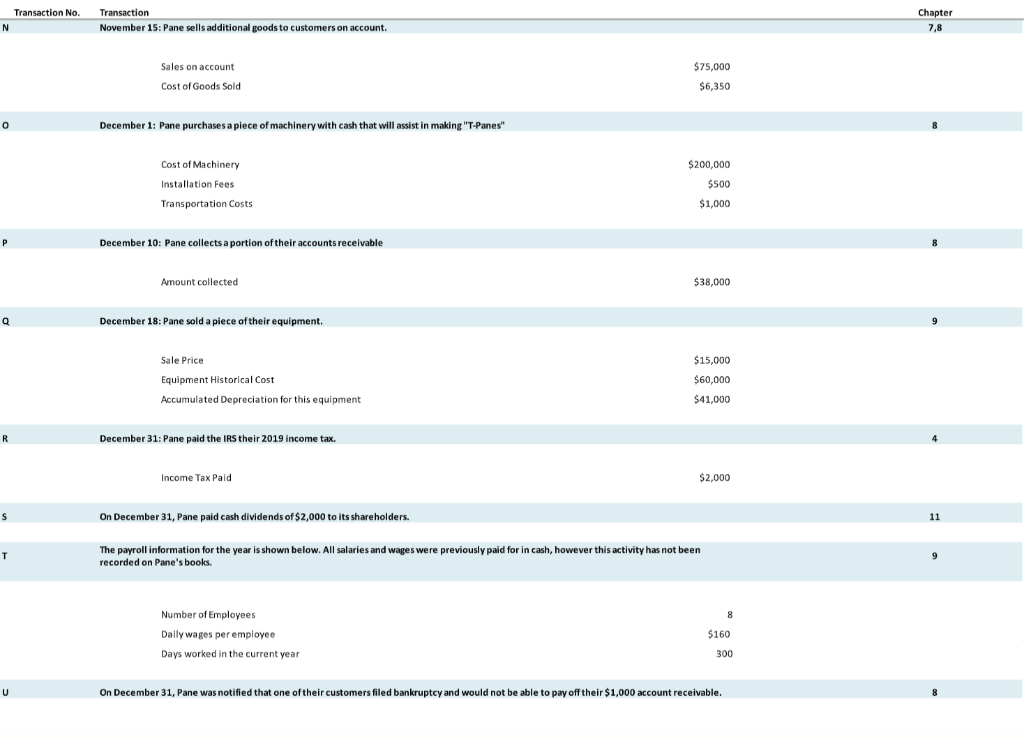

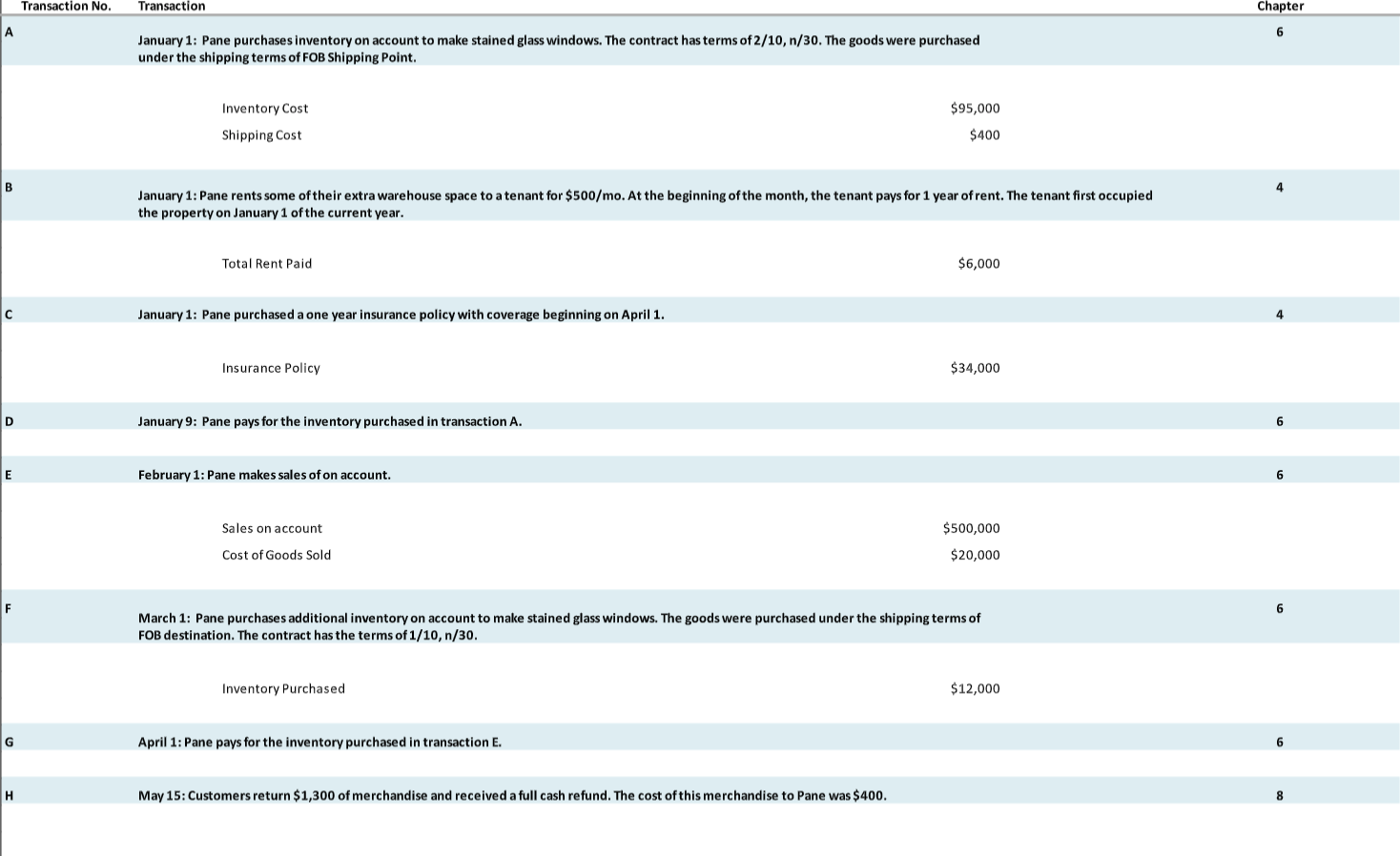

STOP: Post each of the preceding journal entries to the appropriate T-Accounts before preparing the adjusting journal entries. Year-End Adjusting Entries: Recognize rent revenue for the year. 4. Depreciation Expense for the year is $10,000 Recognize the expiration of the prepaid insurance policy. Recognize the interest earned on the note receivable issued. Record bad debt expense for the year, assuming uses 2% of accounts receivable to estimate their uncollectible accounts. Amortization Expense for the year is 3,000 Transaction No. Transaction Chapter July 1: Pane pays cash for a patent that will allow them to produce a revolutionary new window for boats and other marine vehicles called "T-Panes". vehicles called "T-Panes". $25,000 Cost of Patent Remaining legal life of patent (in years) July 28: Pane issued shares of common stock Number of shares 400 Par Value Price Per Share $25 July 31: Pane sells window panes to customers. Some customers paid in cash, others purchased their goods on account. Pane uses the perpetual method to track their inventory. Cash Sales Sales on account Cost of Goods Sold 25,000 145,000 9,870 August 6: Pane purchases land with cash. At the time of purchase, Pane also had to pay for survey fees and costs to demolish a building on the land. Cost of Land Demolish Building $345,000 $2,000 $300 Survey Fees M November 1: Pane lends one of their employees cash in exchange for a note receivable. The employee is required to pay Pane back for the principal and interest on May 1, 2019. Principal $10,000 Interest Rate 7% Maturity Date 5/1/2019 Transaction No. Transaction November 15: Pane sells additional goods to customers on account. Chapter 7,8 Sales on account Cost of Goods Sold $75,000 $6,350 December 1: Pane purchases a piece of machinery with cash that will assist in making "T-Panes" Cost of Machinery $200,000 $500 Installation Fees Transportation Costs $1,000 December 10: Pane collects a portion of their accounts receivable Amount collected $38,000 December 18: Pane sold a piece of their equipment. Sale Price Equipment Historical Cost Accumulated Depreciation for this equipment $15,000 $60,000 $41,000 December 31: Pane paid the IRS their 2019 income tax. Income Tax Paid $2,000 On December 31, Pane paid cash dividends of $2,000 to its shareholders. The payroll information for the year is shown below. All salaries and wages were previously paid for in cash, however this activity has not been recorded on Pane's books. Number of employees Daily wages per employee Days worked in the current year $160 300 On December 31, Pane was notified that one of their customers filed bankruptcy and would not be able to pay off their $1,000 account receivable. Transaction No. Transaction Chapter January 1: Pane purchases inventory on account to make stained glass windows. The contract has terms of 2/10, n/30. The goods were purchased under the shipping terms of FOB Shipping Point. $95,000 Inventory Cost Shipping Cost $400 January 1: Pane rents some of their extra warehouse space to a tenant for $500/mo. At the beginning of the month, the tenant pays for 1 year of rent. The tenant first occupied the property on January 1 of the current year. Total Rent Paid $6,000 c January 1: Pane purchased a one year insurance policy with coverage beginning on April 1. Insurance Policy $34,000 January 9: Pane pays for the inventory purchased in transaction A. February 1: Pane makes sales of on account. Sales on account $500,000 Cost of Goods Sold $20,000 March 1: Pane purchases additional inventory on account to make stained glass windows. The goods were purchased under the shipping terms of FOB destination. The contract has the terms of 1/10, n/30. Inventory Purchased $12,000 April 1: Pane pays for the inventory purchased in transaction E. May 15: Customers return $1,300 of merchandise and received a full cash refund. The cost of this merchandise to Pane was $400. STOP: Post each of the preceding journal entries to the appropriate T-Accounts before preparing the adjusting journal entries. Year-End Adjusting Entries: Recognize rent revenue for the year. 4. Depreciation Expense for the year is $10,000 Recognize the expiration of the prepaid insurance policy. Recognize the interest earned on the note receivable issued. Record bad debt expense for the year, assuming uses 2% of accounts receivable to estimate their uncollectible accounts. Amortization Expense for the year is 3,000 Transaction No. Transaction Chapter July 1: Pane pays cash for a patent that will allow them to produce a revolutionary new window for boats and other marine vehicles called "T-Panes". vehicles called "T-Panes". $25,000 Cost of Patent Remaining legal life of patent (in years) July 28: Pane issued shares of common stock Number of shares 400 Par Value Price Per Share $25 July 31: Pane sells window panes to customers. Some customers paid in cash, others purchased their goods on account. Pane uses the perpetual method to track their inventory. Cash Sales Sales on account Cost of Goods Sold 25,000 145,000 9,870 August 6: Pane purchases land with cash. At the time of purchase, Pane also had to pay for survey fees and costs to demolish a building on the land. Cost of Land Demolish Building $345,000 $2,000 $300 Survey Fees M November 1: Pane lends one of their employees cash in exchange for a note receivable. The employee is required to pay Pane back for the principal and interest on May 1, 2019. Principal $10,000 Interest Rate 7% Maturity Date 5/1/2019 Transaction No. Transaction November 15: Pane sells additional goods to customers on account. Chapter 7,8 Sales on account Cost of Goods Sold $75,000 $6,350 December 1: Pane purchases a piece of machinery with cash that will assist in making "T-Panes" Cost of Machinery $200,000 $500 Installation Fees Transportation Costs $1,000 December 10: Pane collects a portion of their accounts receivable Amount collected $38,000 December 18: Pane sold a piece of their equipment. Sale Price Equipment Historical Cost Accumulated Depreciation for this equipment $15,000 $60,000 $41,000 December 31: Pane paid the IRS their 2019 income tax. Income Tax Paid $2,000 On December 31, Pane paid cash dividends of $2,000 to its shareholders. The payroll information for the year is shown below. All salaries and wages were previously paid for in cash, however this activity has not been recorded on Pane's books. Number of employees Daily wages per employee Days worked in the current year $160 300 On December 31, Pane was notified that one of their customers filed bankruptcy and would not be able to pay off their $1,000 account receivable. Transaction No. Transaction Chapter January 1: Pane purchases inventory on account to make stained glass windows. The contract has terms of 2/10, n/30. The goods were purchased under the shipping terms of FOB Shipping Point. $95,000 Inventory Cost Shipping Cost $400 January 1: Pane rents some of their extra warehouse space to a tenant for $500/mo. At the beginning of the month, the tenant pays for 1 year of rent. The tenant first occupied the property on January 1 of the current year. Total Rent Paid $6,000 c January 1: Pane purchased a one year insurance policy with coverage beginning on April 1. Insurance Policy $34,000 January 9: Pane pays for the inventory purchased in transaction A. February 1: Pane makes sales of on account. Sales on account $500,000 Cost of Goods Sold $20,000 March 1: Pane purchases additional inventory on account to make stained glass windows. The goods were purchased under the shipping terms of FOB destination. The contract has the terms of 1/10, n/30. Inventory Purchased $12,000 April 1: Pane pays for the inventory purchased in transaction E. May 15: Customers return $1,300 of merchandise and received a full cash refund. The cost of this merchandise to Pane was $400