Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hilty Hotel is one of many hotels owned by a large hotel group. Guests are booked into the hotel for accommodation only. All guests

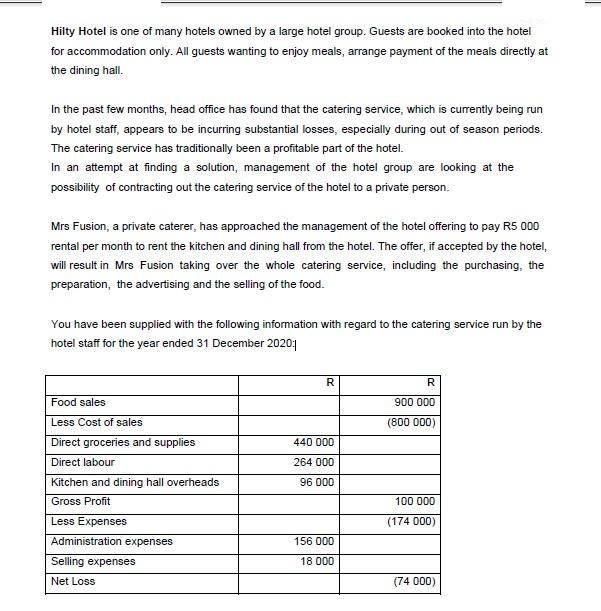

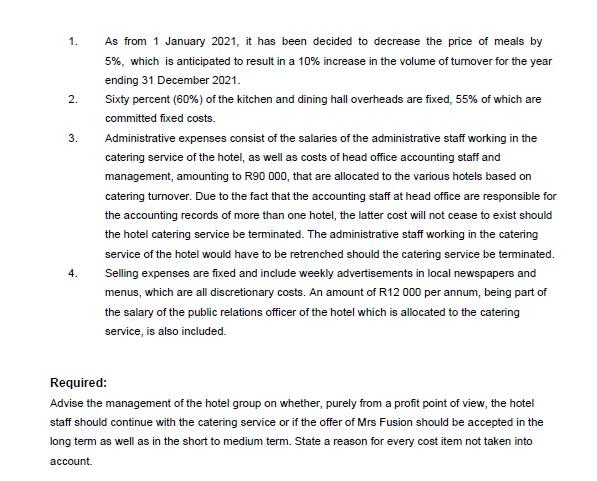

Hilty Hotel is one of many hotels owned by a large hotel group. Guests are booked into the hotel for accommodation only. All guests wanting to enjoy meals, arrange payment of the meals directly at the dining hall. In the past few months, head office has found that the catering service, which is currently being run by hotel staff, appears to be incurring substantial losses, especially during out of season periods. The catering service has traditionally been a profitable part of the hotel. In an attempt at finding a solution, management of the hotel group are looking at the possibility of contracting out the catering service of the hotel to a private person. Mrs Fusion, a private caterer, has approached the management of the hotel offering to pay RS 000 rental per month to rent the kitchen and dining hall from the hotel. The offer, if accepted by the hotel, will result in Mrs Fusion taking over the whole catering service, including the purchasing, the preparation, the advertising and the selling of the food. You have been supplied with the following information with regard to the catering service run by the hotel staff for the year ended 31 December 2020: R Food sales 900 000 Less Cost of sales (800 000) Direct groceries and supplies 440 000 Direct labour 264 000 Kitchen and dining hall overheads 96 000 Gross Profit 100 000 Less Expenses (174 000) Administration expenses 156 000 Selling expenses 18 000 Net Loss (74 000) 1. As from 1 January 2021, it has been decided to decrease the price of meals by 5%, which is anticipated to result in a 10% increase in the volume of turnover for the year ending 31 December 2021. 2. Sixty percent (60%) of the kitchen and dining hall overheads are fixed, 55% of which are committed fixed costs. 3. Administrative expenses consist of the salaries of the administrative staff working in the catering service of the hotel, as well as costs of head office accounting staff and management, amounting to R90 000, that are allocated to the various hotels based on catering turnover. Due to the fact that the accounting staff at head office are responsible for the accounting records of more than one hotel, the latter cost will not cease to exist should the hotel catering service be terminated. The administrative staff working in the catering service of the hotel would have to be retrenched should the catering service be terminated. Selling expenses are fixed and include weekly advertisements in local newspapers and 4. menus, which are all discretionary costs. An amount of R12 000 per annum, being part of the salary of the public relations officer of the hotel which is allocated to the catering service, is also included. Required: Advise the management of the hotel group on whether, purely from a profit point of view, the hotel staff should continue with the catering service or if the offer of Mrs Fusion should be accepted in the long term as well as in the short to medium term. State a reason for every cost item not taken into account.

Step by Step Solution

★★★★★

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Given Advice on whether purely from a profit point of view the hotel staff should continue ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started