Question

QUESTION TWO [25] Sweetpea Ltd has a choice of two projects to invest in. The following details relate to these projects: Project Raisins Project Chocolate

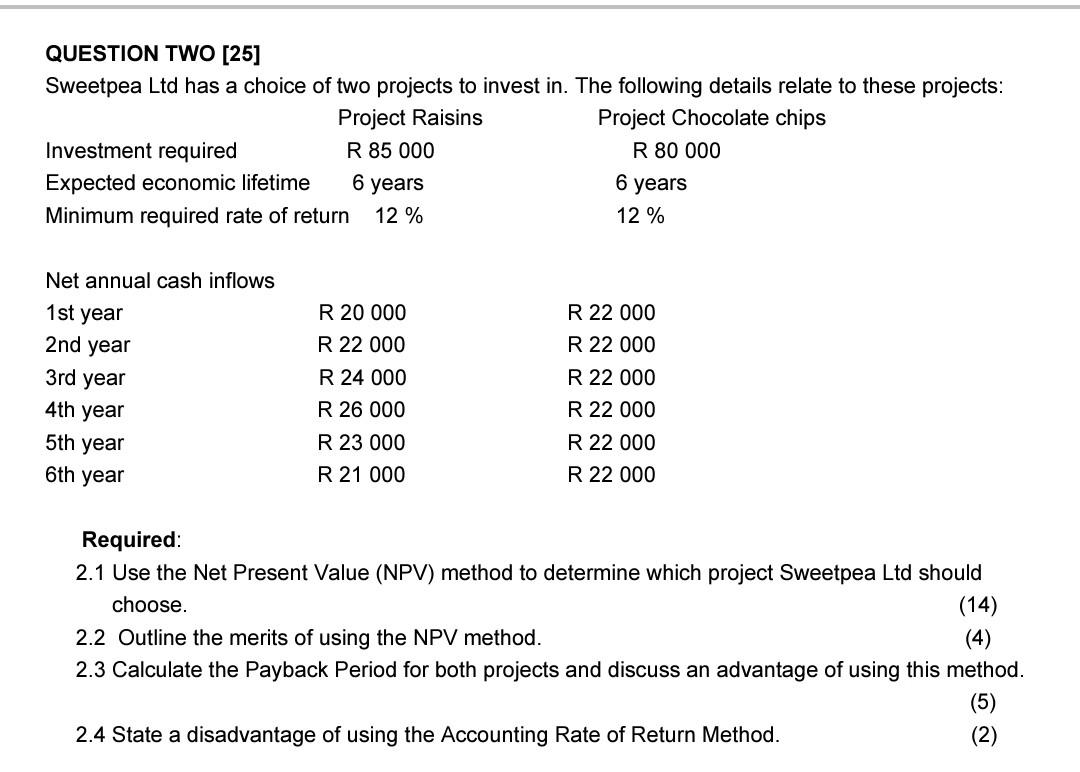

QUESTION TWO [25] Sweetpea Ltd has a choice of two projects to invest in. The following details relate to these projects: Project Raisins Project Chocolate chips Investment required R 85 000 R 80 000 Expected economic lifetime 6 years 6 years Minimum required rate of return 12 % 12 % Net annual cash inflows 1st year R 20 000 R 22 000 2nd year R 22 000 R 22 000 3rd year R 24 000 R 22 000 4th year R 26 000 R 22 000 5th year R 23 000 R 22 000 6th year R 21 000 R 22 000 Required: 2.1 Use the Net Present Value (NPV) method to determine which project Sweetpea Ltd should choose. (14) 2.2 Outline the merits of using the NPV method. (4) 2.3 Calculate the Payback Period for both projects and discuss an advantage of using this method. (5) 2.4 State a disadvantage of using the Accounting Rate of Return Method

QUESTION TWO [25] Sweetpea Ltd has a choice of two projects to invest in. The following details relate to these projects: Required: 2.1 Use the Net Present Value (NPV) method to determine which project Sweetpea Ltd should choose. (14) 2.2 Outline the merits of using the NPV method. (4) 2.3 Calculate the Payback Period for both projects and discuss an advantage of using this method. (5) 2.4 State a disadvantage of using the Accounting Rate of Return Method. (2)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started