Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question Two [5 marks cach] a. What is the yield to maturity on a simple loan for $1 million that requires a repayment of $2

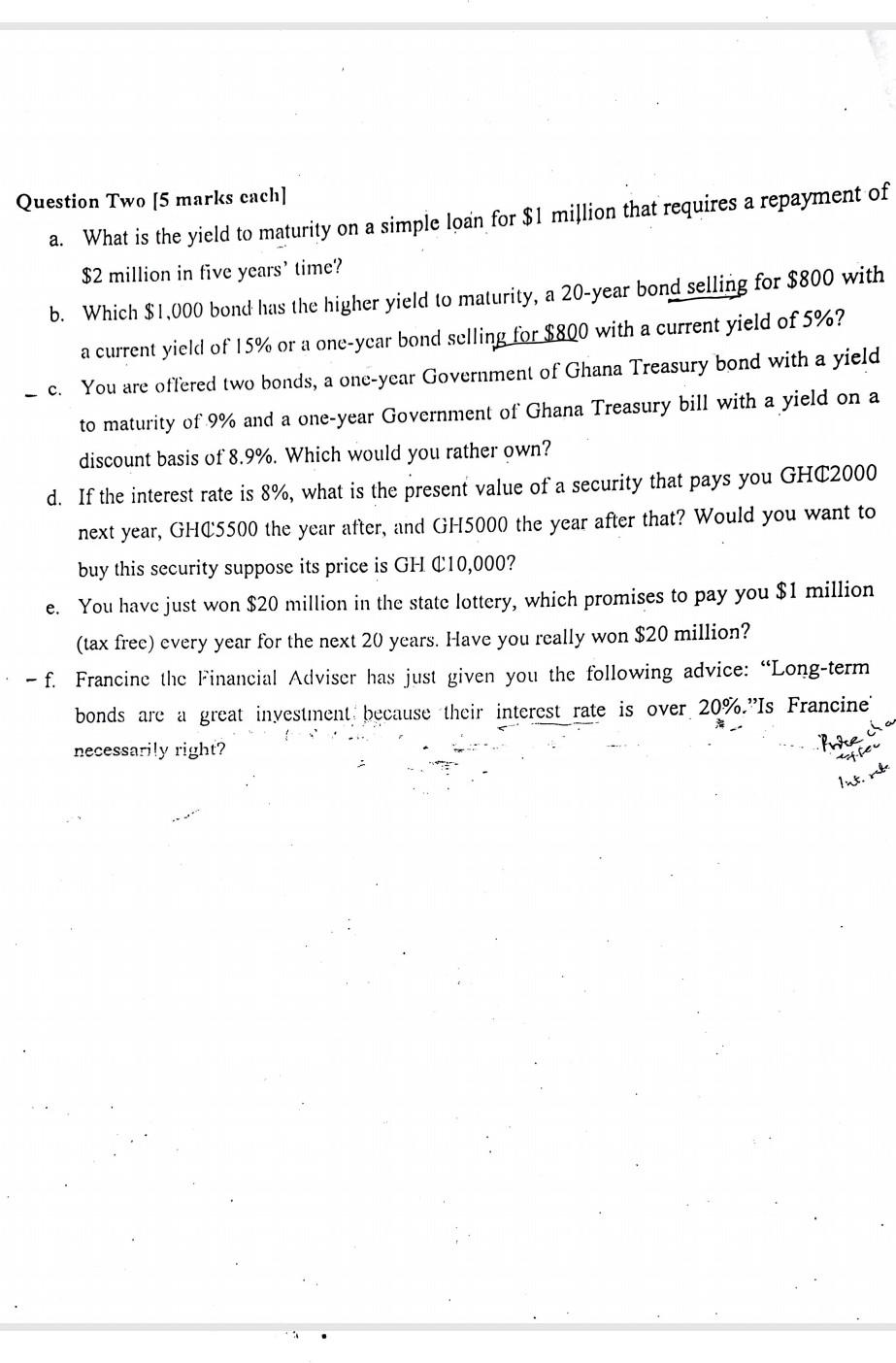

Question Two [5 marks cach] a. What is the yield to maturity on a simple loan for $1 million that requires a repayment of $2 million in five years' time? b. Which $1,000 bond has the higher yield to maturity, a 20-year bond selling for $800 with a current yield of 15% or a one-year bond selling for $800 with a current yield of 5%? - c. You are offered two bonds, a one-year Government of Ghana Treasury bond with a yield to maturity of 9% and a one-year Government of Ghana Treasury bill with a yield on a discount basis of 8.9%. Which would you rather own? d. If the interest rate is 8%, what is the present value of a security that pays you GHC2000 next year, GH@5500 the year after, and GH5000 the year after that? Would you want to buy this security suppose its price is GH 10,000? e. You have just won $20 million in the state lottery, which promises to pay you $ 1 million (tax free) every year for the next 20 years. Have you really won $20 million? - f. Francine the Financial Adviser has just given you the following advice: Long-term bonds are a great investment because their interest rate is over 20%.Is Francine necessarily right? effen Int. rat

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started