Question: It is widely said that all Financial Statements globally cannot stand without obeying the Double Entry Principle. Miss Bawsaw and Dickson Daniels were newly

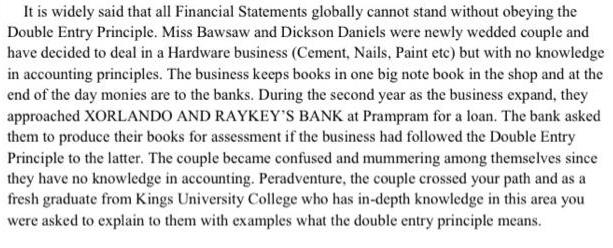

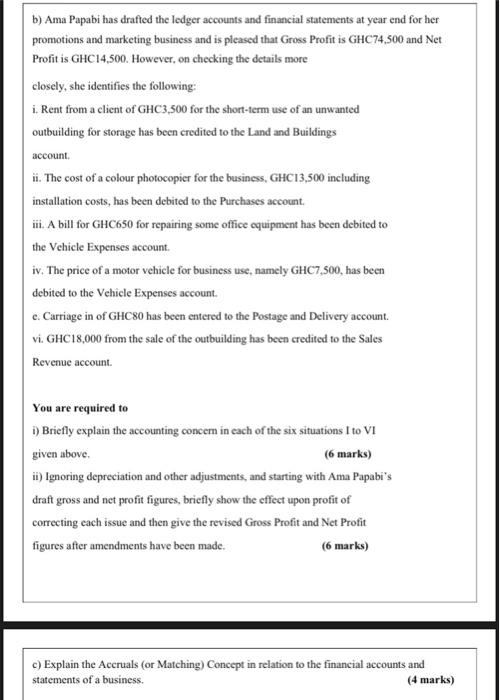

It is widely said that all Financial Statements globally cannot stand without obeying the Double Entry Principle. Miss Bawsaw and Dickson Daniels were newly wedded couple and have decided to deal in a Hardware business (Cement, Nails, Paint etc) but with no knowledge in accounting principles. The business keeps books in one big note book in the shop and at the end of the day monies are to the banks. During the second year as the business expand, they approached XORLANDO AND RAYKEY'S BANK at Prampram for a loan. The bank asked them to produce their books for assessment if the business had followed the Double Entry Principle to the latter. The couple became confused and mummering among themselves since they have no knowledge in accounting. Peradventure, the couple crossed your path and as a fresh graduate from Kings University College who has in-depth knowledge in this area you were asked to explain to them with examples what the double entry principle means. b) Ama Papabi has drafted the ledger accounts and financial statements at year end for her promotions and marketing business and is pleased that Gross Profit is GHC74,500 and Net Profit is GHC 14,500. However, on checking the details more closely, she identifies the following: i. Rent from a client of GHC3,500 for the short-term use of an unwanted outbuilding for storage has been credited to the Land and Buildings account. ii. The cost of a colour photocopier for the business, GHC13,500 including installation costs, has been debited to the Purchases account. iii. A bill for GHC650 for repairing some office equipment has been debited to the Vehicle Expenses account. iv. The price of a motor vehicle for business use, namely GHC7,500, has been debited to the Vehicle Expenses account. e. Carriage in of GHC80 has been entered to the Postage and Delivery account. vi. GHC18,000 from the sale of the outbuilding has been credited to the Sales Revenue account. You are required to i) Briefly explain the accounting concern in each of the six situations I to VI given above. (6 marks) ii) Ignoring depreciation and other adjustments, and starting with Ama Papabi's draft gross and net profit figures, briefly show the effect upon profit of correcting each issue and then give the revised Gross Profit and Net Profit figures after amendments have been made. (6 marks) c) Explain the Accruals (or Matching) Concept in relation to the financial accounts and statements of a business. (4 marks)

Step by Step Solution

3.37 Rating (150 Votes )

There are 3 Steps involved in it

i Brief ly explain the accounting conce m in each of the six situations I to VI given above 6 marks ANS WER The six situations given above all relate ... View full answer

Get step-by-step solutions from verified subject matter experts