QUESTION TWO Allowance for doubtful debts was Sh.350,000 on 30 November 2014 and Sh.500,000 on 31 August 2015. Inventory on 31 August 2015 was

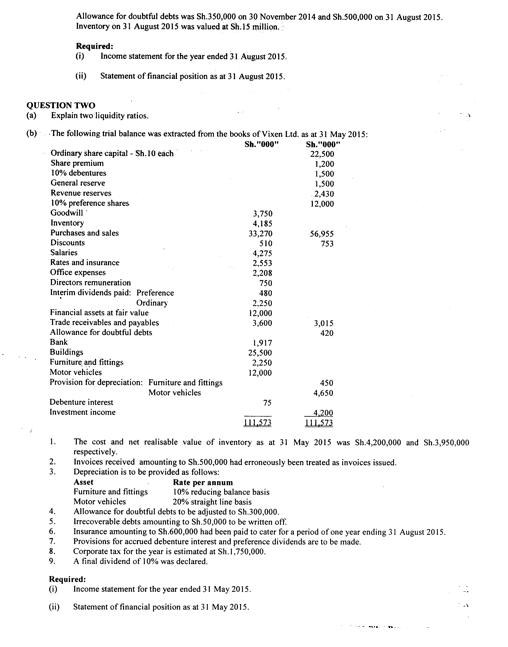

QUESTION TWO Allowance for doubtful debts was Sh.350,000 on 30 November 2014 and Sh.500,000 on 31 August 2015. Inventory on 31 August 2015 was valued at Sh. 15 million. Explain two liquidity ratios. Required: (i) Income statement for the year ended 31 August 2015. (ii) Statement of financial position as at 31 August 2015. (b) The following trial balance was extracted from the books of Vixen Ltd. as at 31 May 2015: Sh."000" Sh."000" 22,500 Ordinary share capital - Sh.10 each Share premium 10% debentures General reserve Revenue reserves 10% preference shares Goodwill Inventory Purchases and sales Discounts Salaries Rates and insurance Office expenses Directors remuneration Interim dividends paid: Preference Ordinary Financial assets at fair value Trade receivables and payables Allowance for doubtful debts Bank Buildings Furniture and fittings Motor vehicles Provision for depreciation: 1. Debenture interest Investment income 2. 3. 4. 5. 6. 7. 8. 9. Furniture and fittings Motor vehicles 3,750 4,185 33,270 510 4,275 2,553 2,208 750 480 2,250 12,000 3,600 1,917 25,500 2,250 12,000 Asset Furniture and fittings Motor vehicles 75 Rate per annum 10% reducing balance basis 20% straight line basis Allowance for doubtful debts to be adjusted to Sh.300,000. 1,200 1,500 1,500 2,430 12,000 56,955 753 111.573 The cost and net realisable value of inventory as at 31 May 2015 was Sh.4,200,000 and Sh.3,950,000 respectively. Corporate tax for the year is estimated at Sh.1,750,000. A final dividend of 10% was declared. Required: (6) Income statement for the year ended 31 May 2015. (ii) Statement of financial position as at 31 May 2015. 3,015 420 Invoices received amounting to Sh.500,000 had erroneously been treated as invoices issued. Depreciation is to be provided as follows: 450 4,650 4,200 111.573 Irrecoverable debts amounting to Sh.50,000 to be written off Insurance amounting to Sh.600,000 had been paid to cater for a period of one year ending 31 August 2015. Provisions for accrued debenture interest and preference dividends are to be made.

Step by Step Solution

3.35 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Income Statement for the Year Ended 31 May 2015 Gross Profit Calculation Gross Profit Revenue Cost of Goods Sold Gross Profit 33270 4185 29085 Operating Expenses Calculation Discounts 510 Salaries 427...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started