Answered step by step

Verified Expert Solution

Question

1 Approved Answer

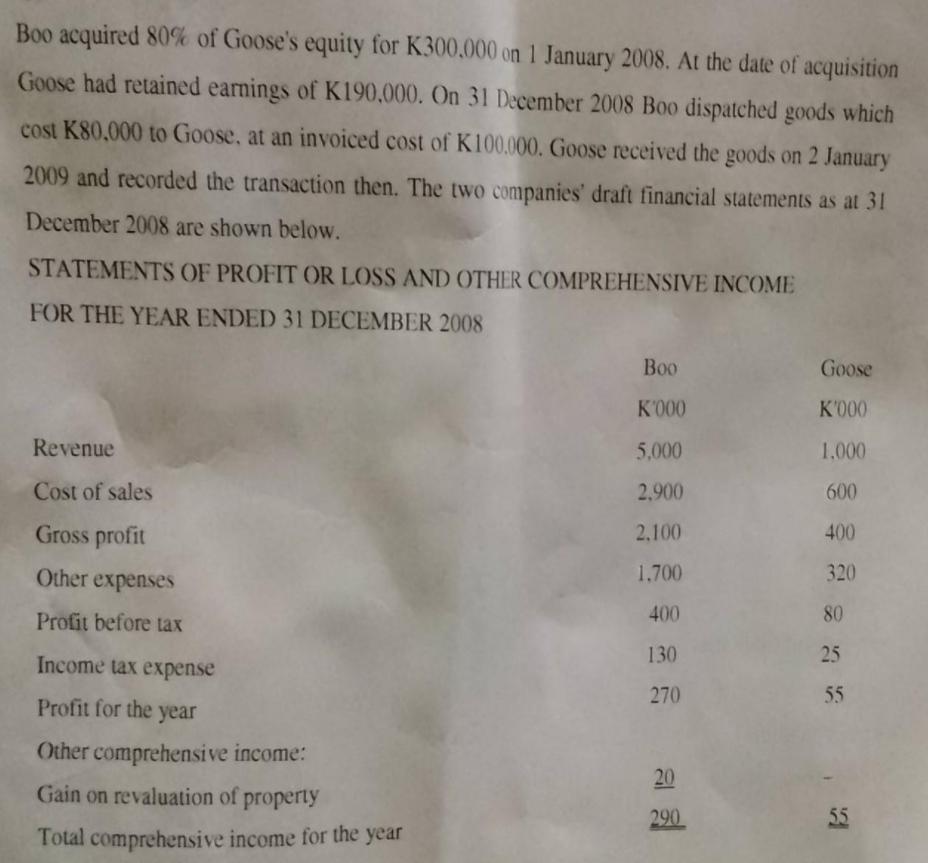

Boo acquired 80%k of Goose's equity for K300.000 on 1 January 2008. At the date of acquisition Goose had retained earnings of K190,000. On

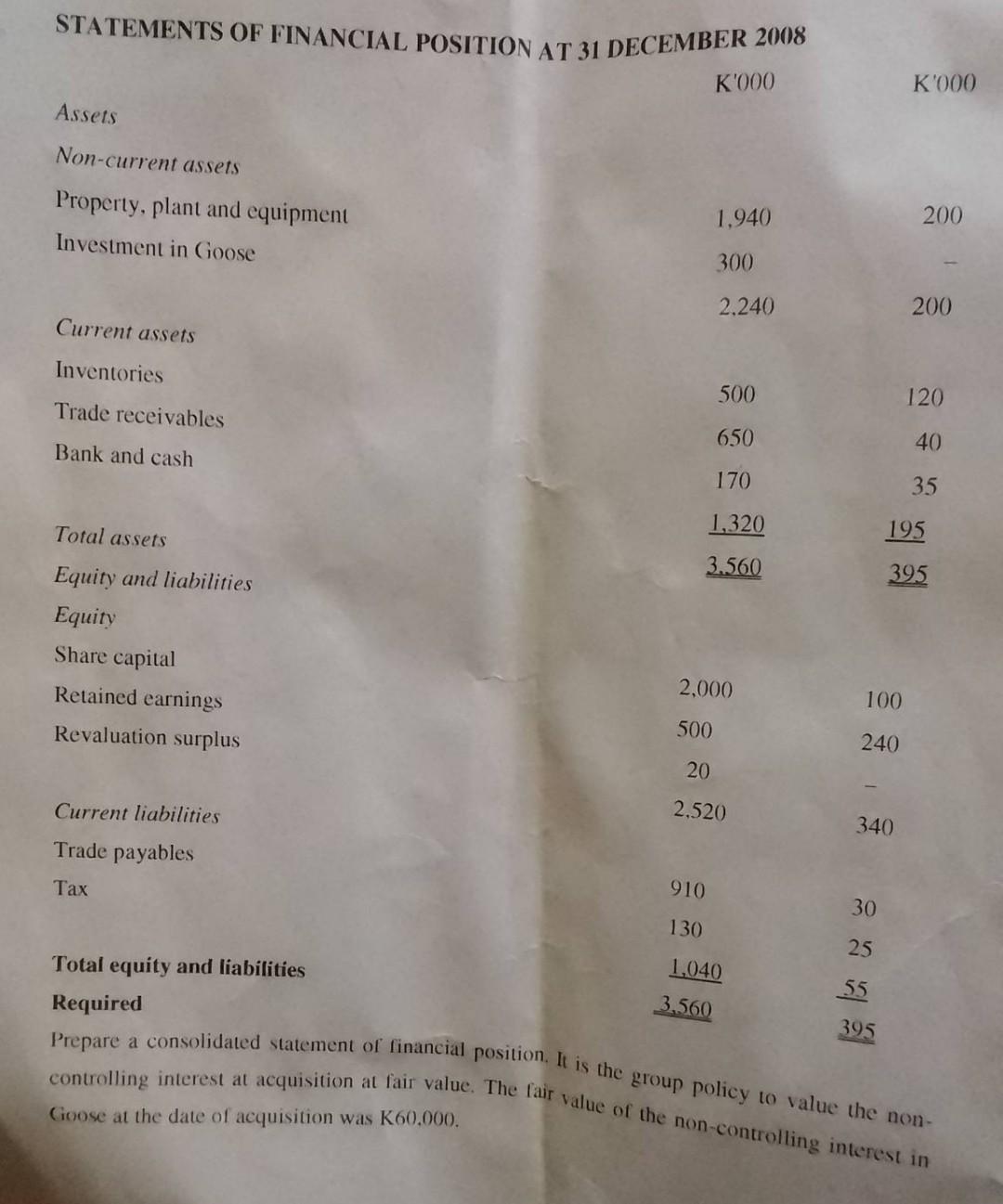

Boo acquired 80%k of Goose's equity for K300.000 on 1 January 2008. At the date of acquisition Goose had retained earnings of K190,000. On 31 December 2008 Boo dispatched goods which cost K80,000 to Goose, at an invoiced cost of K100.000. Goose received the goods on 2 January 2009 and recorded the transaction then. The two companies' draft financial statements as at 31 December 2008 are shown below. STATEMENTS OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER 2008 Boo Goose K'000 K'000 Revenue 5,000 1.000 Cost of sales 2,900 600 Gross profit 2,100 400 Other expenses 1,700 320 Profit before tax 400 80 130 25 Income tax expense 270 55 Profit for the year Other comprehensive income: 20 Gain on revaluation of property 290 55 Total comprehensive income for the year STATEMENTS OF FINANCIAL POSITION AT 31 DECEMBER 2008 K'000 K'000 Assets Non-current assets 200 Property, plant and equipment 1,940 Investment in Goose 300 2.240 200 Current assets Inventories 500 120 Trade receivables 650 40 Bank and cash 170 35 1,320 195 Total assets 3.560 395 Equity and liabilities Equity Share capital 2,000 100 Retained earnings 500 240 Revaluation surplus 20 2,520 340 Current liabilities Trade payables 910 30 x 130 25 1.040 Total equity and liabilities 55 3.560 Required 395 Prepare a consolidated statement of financial position. It is the group policy to value the non- controlling interest at acquisition at fair value. The fair value of the non-controlling interest in Goose at the date of acquisition was K60,000.

Step by Step Solution

★★★★★

3.60 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Statement of Financial Position at 31st December 2008 I EQUITY AND LIABILITIES Amount K000 Sha...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started