Answered step by step

Verified Expert Solution

Question

1 Approved Answer

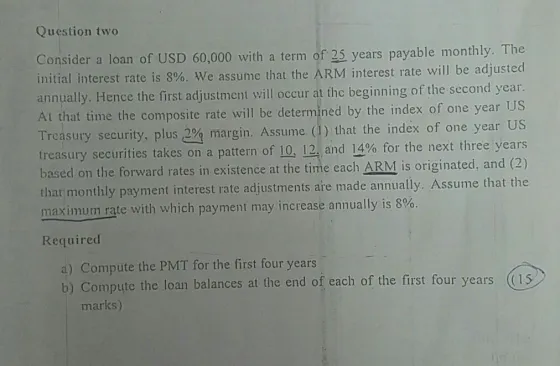

Question two Consider a loan of USD 60,000 with a term of 25 years payable monthly. The initial interest rate is 8%. We assume

Question two Consider a loan of USD 60,000 with a term of 25 years payable monthly. The initial interest rate is 8%. We assume that the ARM interest rate will be adjusted annually. Hence the first adjustment will occur at the beginning of the second year. At that time the composite rate will be determined by the index of one year US Treasury security, plus 2% margin. Assume (1) that the index of one year US treasury securities takes on a pattern of 10, 12, and 14% for the next three years based on the forward rates in existence at the time each ARM is originated, and (2) that monthly payment interest rate adjustments are made annually. Assume that the maximum rate with which payment may increase annually is 8%.. Required a) Compute the PMT for the first four years. b) Compute the loan balances at the end of each of the first four years ((15) marks) Question two Consider a loan of USD 60,000 with a term of 25 years payable monthly. The initial interest rate is 8%. We assume that the ARM interest rate will be adjusted annually. Hence the first adjustment will occur at the beginning of the second year. At that time the composite rate will be determined by the index of one year US Treasury security, plus 2% margin. Assume (1) that the index of one year US treasury securities takes on a pattern of 10, 12, and 14% for the next three years based on the forward rates in existence at the time each ARM is originated, and (2) that monthly payment interest rate adjustments are made annually. Assume that the maximum rate with which payment may increase annually is 8%.. Required a) Compute the PMT for the first four years. b) Compute the loan balances at the end of each of the first four years ((15) marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Loan Parameters Loan amountUSD 60000 Term25 years 300 months Payment frequencyMonthly Initial intere...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started