Answered step by step

Verified Expert Solution

Question

1 Approved Answer

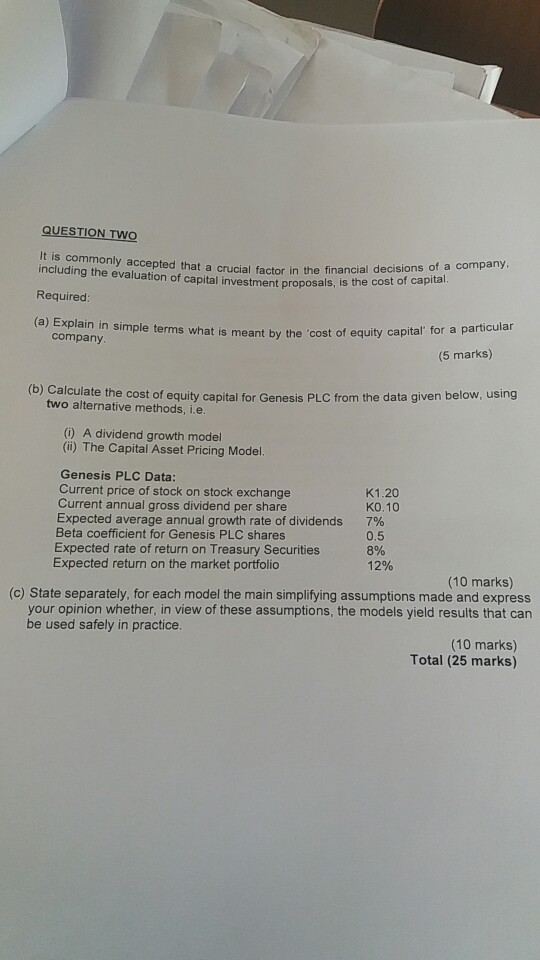

QUESTION TWO It is commonly accepted that a crucial factor in the financial decisions of a company, including the evaluation of capital investment proposals, is

QUESTION TWO It is commonly accepted that a crucial factor in the financial decisions of a company, including the evaluation of capital investment proposals, is the cost of capital. Required: (a) Explain in simple terms what is meant by the 'cost of equity capital for a particular company (5 marks) (b) Calculate the cost of equity capital for Genesis PLC from the data given below, using two alternative methods, i.e. (i) A dividend growth model (ii) The Capital Asset Pricing Model. Genesis PLC Data: Current price of stock on stock exchange Current annual gross dividend per share Expected average annual growth rate of dividends Beta coefficient for Genesis PLC shares Expected rate of return on Treasury Securities Expected return on the market portfolio K1.20 .10 7% 0.5 8% 12% (10 marks) (c) State separately, for each model the main simplifying assumptions made and express your opinion whether, in view of these assumptions, the models yield results that can be used safely in practice. (10 marks) Total (25 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started