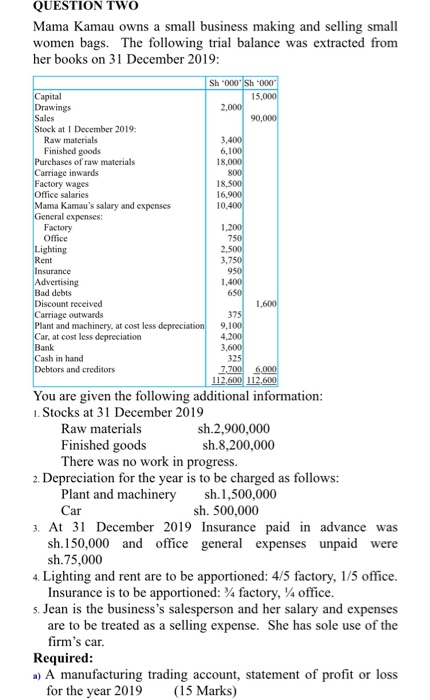

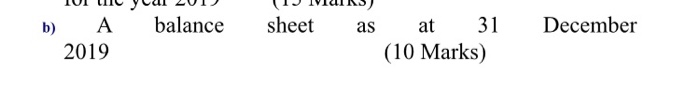

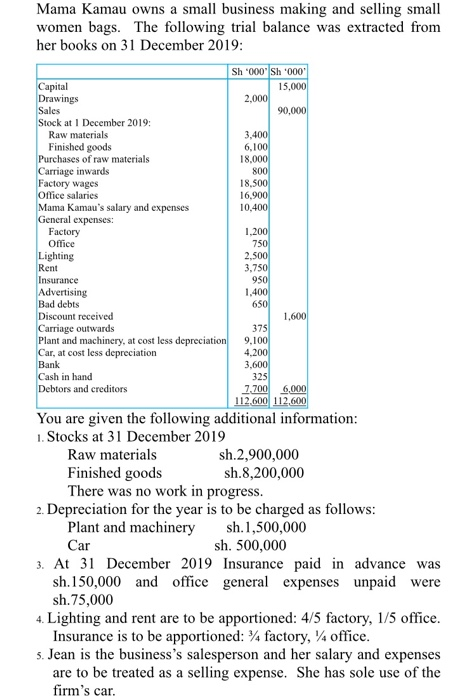

QUESTION TWO Mama Kamau owns a small business making and selling small women bags. The following trial balance was extracted from her books on 31 December 2019: Sh.000 Sh"000 15,000 2.000 90,000 3.400 6,100 18,000 800 18,500 16,900 10,400 Capital Drawings Sales Stock at 1 December 2019: Raw materials Finished goods Purchases of raw materials Carriage inwards Factory wages Office salaries Mama Kamau's salary and expenses General expenses: Factory Office Lighting Rent Insurance Advertising Bad debts Discount received Carriage outwards Plant and machinery, at cost less depreciation Car, at cost less depreciation Bank Cash in hand Debtors and creditors 1.200 750 2.500 3,750 950 1.400 650 1.600 375 9.100 4,200 3.600 325 7.700 6,000 112,600 112.600 You are given the following additional information: 1. Stocks at 31 December 2019 Raw materials sh.2,900,000 Finished goods sh.8,200,000 There was no work in progress. 2. Depreciation for the year is to be charged as follows: Plant and machinery sh.1,500,000 Car sh. 500,000 3. At 31 December 2019 Insurance paid in advance was sh.150,000 and office general expenses unpaid were sh.75,000 4. Lighting and rent are to be apportioned: 4/5 factory, 1/5 office. Insurance is to be apportioned: 4 factory, 14 office. 5. Jean is the business's salesperson and her salary and expenses are to be treated as a selling expense. She has sole use of the firm's car. Required: a) A manufacturing trading account, statement of profit or loss for the year 2019 (15 Marks) balance sheet December b) A 2019 as at 31 (10 Marks) 2.000 Sales 750 Mama Kamau owns a small business making and selling small women bags. The following trial balance was extracted from her books on 31 December 2019: Sh"000" Sh '000 Capital 15,000 Drawings 90,000 Stock at 1 December 2019: Raw materials 3,400 Finished goods 6.100 Purchases of raw materials 18,000 Carriage inwards 800 Factory wages 18.500 Office salaries 16,900 Mama Kamau's salary and expenses 10,400 General expenses: Factory 1,200 Office Lighting 2.500 Rent 3.750 Insurance 950 Advertising 1,400 Bad debts 650 Discount received 1,600 Carriage outwards 375 Plant and machinery, at cost less depreciation 9.100 Car, at cost less depreciation 4.200 Bank 3,600 Cash in hand 325 Debtors and creditors 7.700 6.000 112,600 112,600 You are given the following additional information: 1. Stocks at 31 December 2019 Raw materials sh.2,900,000 Finished goods sh.8,200,000 There was no work in progress. 2. Depreciation for the year is to be charged as follows: Plant and machinery sh.1,500,000 Car sh. 500,000 3. At 31 December 2019 Insurance paid in advance was sh.150,000 and office general expenses unpaid were sh.75,000 4. Lighting and rent are to be apportioned: 4/5 factory, 1/5 office. Insurance is to be apportioned: 4 factory, 14 office. 5. Jean is the business's salesperson and her salary and expenses are to be treated as a selling expense. She has sole use of the firm's car. Required: a) A manufacturing trading account, statement of profit or loss for the year 2019 (15 Marks) b) A balance sheet as at 31 December 2019 (10 Marks)