Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question Two: Mortgage Repayment (6 marks) Cindy has just bought a house for $880,000 and took an 80% mortgage for 30 years at the interest

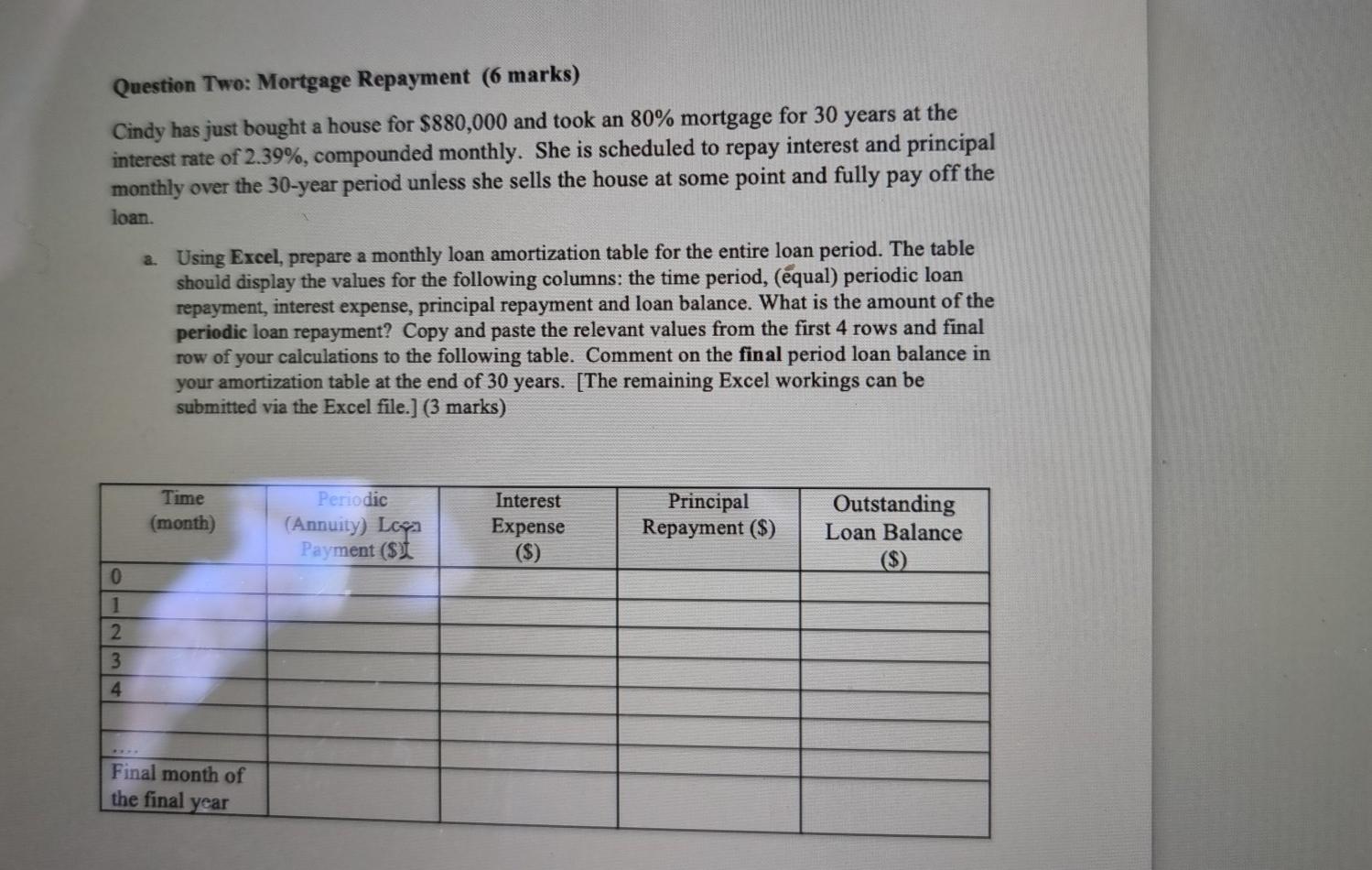

Question Two: Mortgage Repayment (6 marks) Cindy has just bought a house for $880,000 and took an 80% mortgage for 30 years at the interest rate of 2.39%, compounded monthly. She is scheduled to repay interest and principal monthly over the 30-year period unless she sells the house at some point and fully pay off the loan. a. Using Excel, prepare a monthly loan amortization table for the entire loan period. The table should display the values for the following columns: the time period, (equal) periodic loan repayment, interest expense, principal repayment and loan balance. What is the amount of the periodic loan repayment? Copy and paste the relevant values from the first 4 rows and final row of your calculations to the following table. Comment on the final period loan balance in your amortization table at the end of 30 years. [The remaining Excel workings can be submitted via the Excel file.] (3 marks) Time (month) Periodic (Annuity) La Payment ($1 Interest Expense ($) Principal Repayment ($) Outstanding Loan Balance ($) 0 1 2 3 4 Final month of the final year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started