Answered step by step

Verified Expert Solution

Question

1 Approved Answer

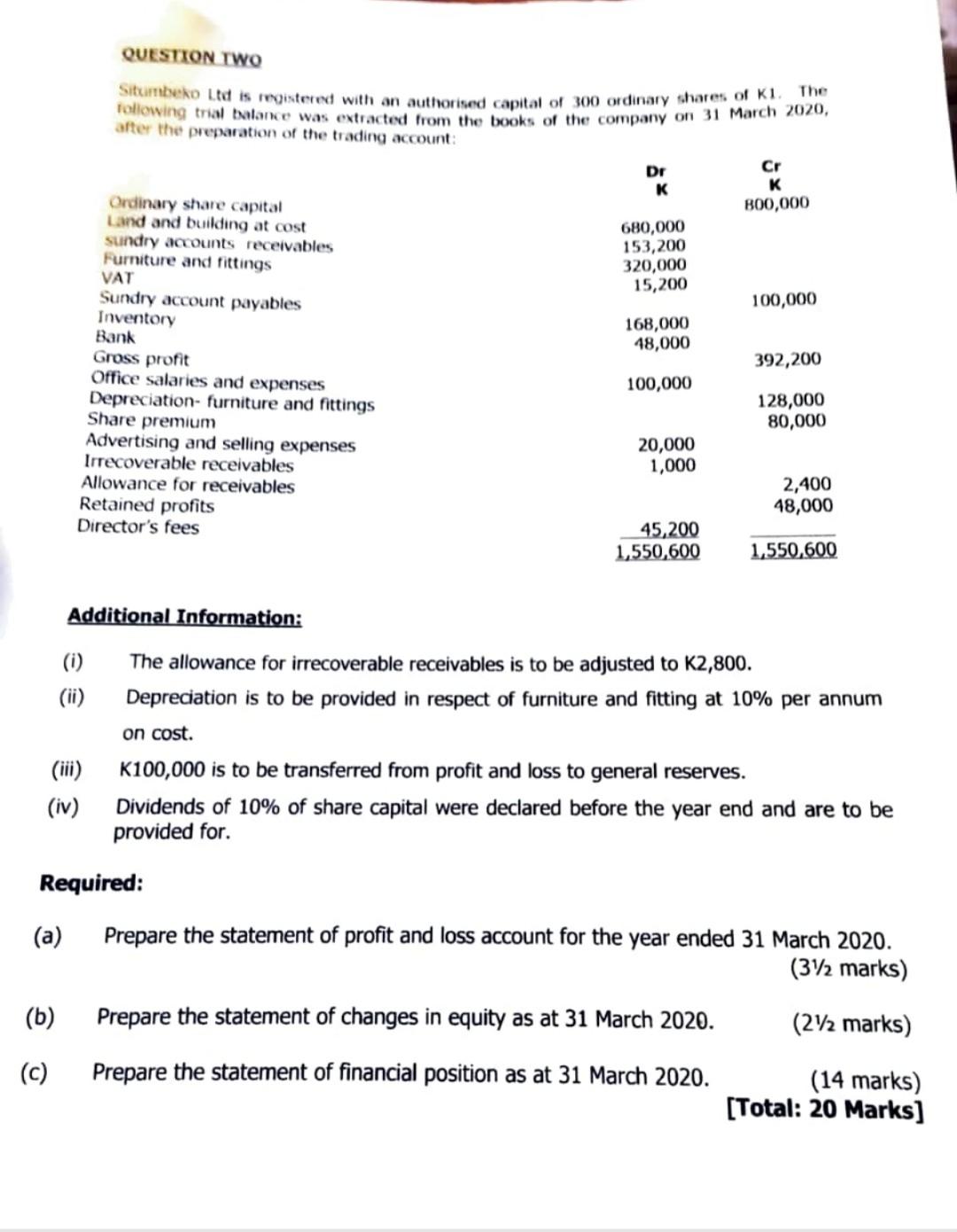

QUESTION TWO Situmbeko Ltd is reqistered with an authorised capital of 300 ordinary shares of k. The following tral balance was extracted from the books

QUESTION TWO Situmbeko Ltd is reqistered with an authorised capital of 300 ordinary shares of k. The following tral balance was extracted from the books of the company on 31 March 2020 , after the preparation of the trading account: Additional Information: (i) The allowance for irrecoverable receivables is to be adjusted to K2,800. (ii) Depreciation is to be provided in respect of furniture and fitting at 10% per annum on cost. (iii) K100,000 is to be transferred from profit and loss to general reserves. (iv) Dividends of 10% of share capital were declared before the year end and are to be provided for. Required: (a) Prepare the statement of profit and loss account for the year ended 31 March 2020. (31/2 marks) (b) Prepare the statement of changes in equity as at 31 March 2020. (21/2 marks) (c) Prepare the statement of financial position as at 31 March 2020. (14 marks) [Total: 20 Marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started