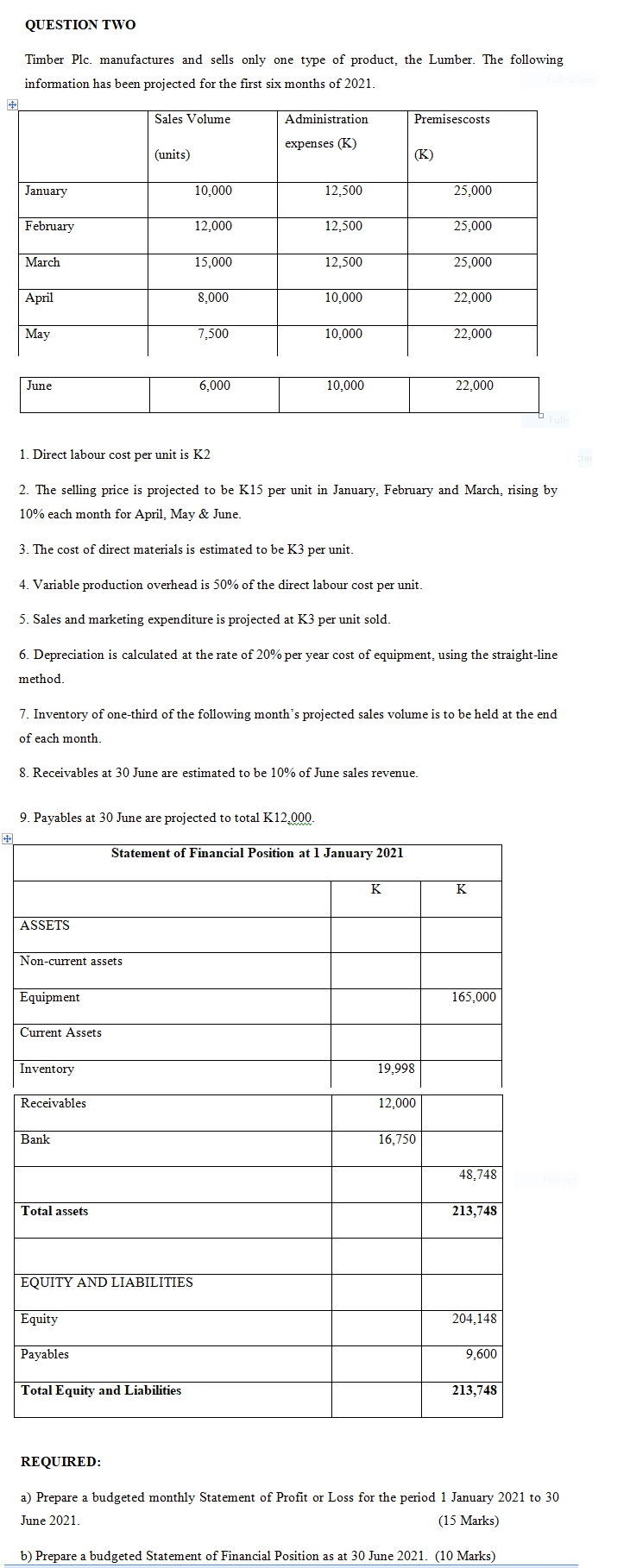

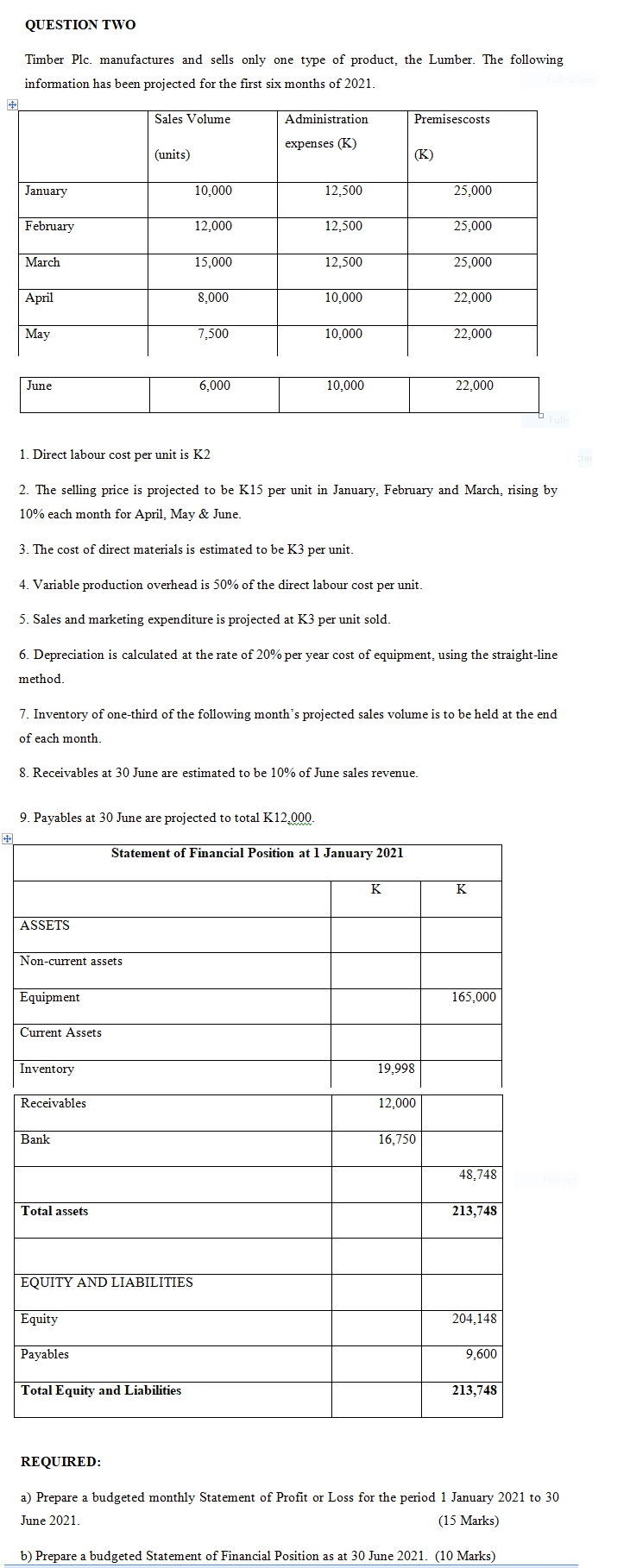

QUESTION TWO Timber Plc. manufactures and sells only one type of product, the Lumber. The following information has been projected for the first six months of 2021. Sales Volume Administration Premisescosts expenses (K) (units) (K) January 10,000 12,500 25,000 February 12,000 12,500 25,000 March 15,000 12,500 25,000 April 8,000 10,000 22.000 May 7,500 10.000 22,000 June 6.000 10,000 22,000 1. Direct labour cost per unit is K2 2. The selling price is projected to be K15 per unit in January, February and March, rising by 10% each month for April, May & June. 3. The cost of direct materials is estimated to be K3 per unit. 4. Variable production overhead is 50% of the direct labour cost per unit. 5. Sales and marketing expenditure is projected at K3 per unit sold. 6. Depreciation is calculated at the rate of 20% per year cost of equipment, using the straight-line method 7. Inventory of one-third of the following month's projected sales volume is to be held at the end of each month. 8. Receivables at 30 June are estimated to be 10% of June sales revenue. 9. Payables at 30 June are projected to total K12.000- Statement of Financial Position at 1 January 2021 K K ASSETS Non-current assets Equipment 165,000 Current Assets Inventory 19,998 Receivables 12,000 Bank 16.750 48,748 Total assets 213,748 EQUITY AND LIABILITIES Equity 204.148 Payables 9,600 Total Equity and Liabilities 213,748 REQUIRED: a) Prepare a budgeted monthly Statement of Profit or Loss for the period 1 January 2021 to 30 June 2021. (15 Marks) b) Prepare a budgeted Statement of Financial Position as at 30 June 2021. (10 Marks) QUESTION TWO Timber Plc. manufactures and sells only one type of product, the Lumber. The following information has been projected for the first six months of 2021. Sales Volume Administration Premisescosts expenses (K) (units) (K) January 10,000 12,500 25,000 February 12,000 12,500 25,000 March 15,000 12,500 25,000 April 8,000 10,000 22.000 May 7,500 10.000 22,000 June 6.000 10,000 22,000 1. Direct labour cost per unit is K2 2. The selling price is projected to be K15 per unit in January, February and March, rising by 10% each month for April, May & June. 3. The cost of direct materials is estimated to be K3 per unit. 4. Variable production overhead is 50% of the direct labour cost per unit. 5. Sales and marketing expenditure is projected at K3 per unit sold. 6. Depreciation is calculated at the rate of 20% per year cost of equipment, using the straight-line method 7. Inventory of one-third of the following month's projected sales volume is to be held at the end of each month. 8. Receivables at 30 June are estimated to be 10% of June sales revenue. 9. Payables at 30 June are projected to total K12.000- Statement of Financial Position at 1 January 2021 K K ASSETS Non-current assets Equipment 165,000 Current Assets Inventory 19,998 Receivables 12,000 Bank 16.750 48,748 Total assets 213,748 EQUITY AND LIABILITIES Equity 204.148 Payables 9,600 Total Equity and Liabilities 213,748 REQUIRED: a) Prepare a budgeted monthly Statement of Profit or Loss for the period 1 January 2021 to 30 June 2021. (15 Marks) b) Prepare a budgeted Statement of Financial Position as at 30 June 2021. (10 Marks)