Answered step by step

Verified Expert Solution

Question

1 Approved Answer

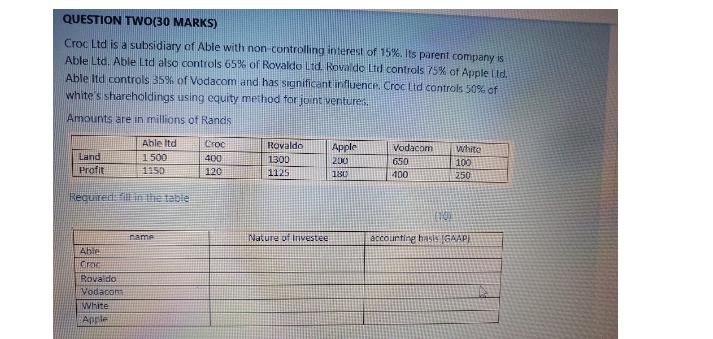

QUESTION TWO(30 MARKS) Croc Ltd is a subsidiary of Able with non-controlling interest of 15%. Its parent company is Able Ltd. Able Ltd also

QUESTION TWO(30 MARKS) Croc Ltd is a subsidiary of Able with non-controlling interest of 15%. Its parent company is Able Ltd. Able Ltd also controls 65% of Rovaldo Ltd. Rovaldo Ltd controls 75% of Apple Ltd. Able Itd controls 35% of Vodacom and has significant influence. Croc Ltd controls 50% of white's shareholdings using equity method for joint ventures. Amounts are in millions of Rands Land Profit Required: fill in the table Able Croc Rovaldo Vodacom Able Itd 1500 1150 White Apple name Croc 400 120 Rovaldo 1300 1125 Nature of Investee Apple 200 180 Vodacom 650 400 1107 White 100 250 accourting hasis (GAAPI

Step by Step Solution

★★★★★

3.24 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To determine the nature of the investee accounting basis GAAP for each company we need to consider the level of control or influence that the parent c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started