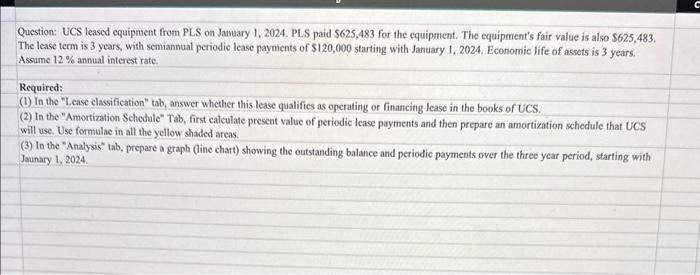

Question: UCS leased equipment from PLS on January 1, 2024. PLS paid $625,483 for the equipment. The equipment's fair value is also $625,483. The

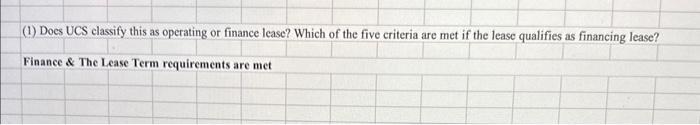

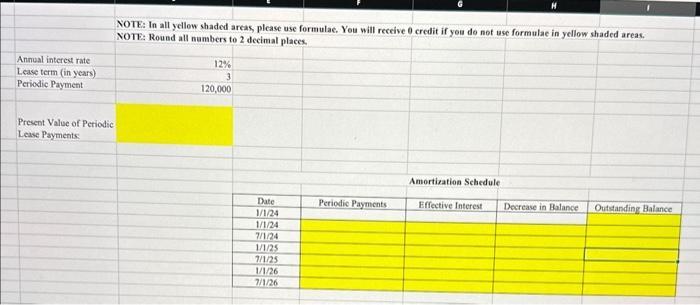

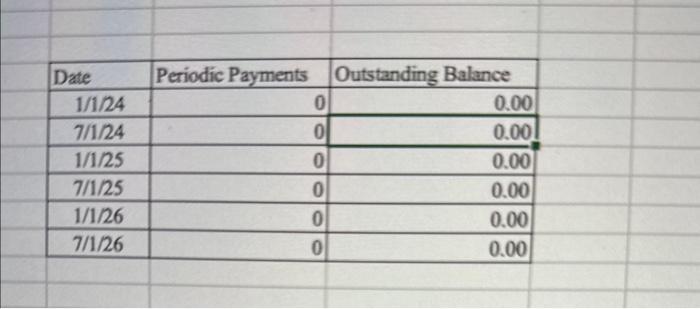

Question: UCS leased equipment from PLS on January 1, 2024. PLS paid $625,483 for the equipment. The equipment's fair value is also $625,483. The lease term is 3 years, with semiannual periodic lease payments of $120,000 starting with January 1, 2024, Economic life of assets is 3 years. Assume 12 % annual interest rate. Required: (1) In the "Lease classification" tab, answer whether this lease qualifies as operating or financing lease in the books of UCS. (2) In the "Amortization Schedule" Tab, first calculate present value of periodic lease payments and then prepare an amortization schedule that UCS will use. Use formulae in all the yellow shaded areas. (3) In the "Analysis" tab, prepare a graph (line chart) showing the outstanding balance and periodic payments over the three year period, starting with Jaunary 1, 2024. C (1) Does UCS classify this as operating or finance lease? Which of the five criteria are met if the lease qualifies as financing lease? Finance & The Lease Term requirements are met Annual interest rate Lease term (in years) Periodic Payment Present Value of Periodic Lease Payments NOTE: In all yellow shaded areas, please use formulae. You will receive 0 credit if you do not use formulae in yellow shaded areas. NOTE: Round all numbers to 2 decimal places. 12% 3 120,000 Date 1/1/24 1/1/24 7/1/24 1/1/25 7/1/25 1/1/26 7/1/26 Periodic Payments Amortization Schedule Effective Interest Decrease in Balance Outstanding Balance Date 1/1/24 7/1/24 1/1/25 7/1/25 1/1/26 7/1/26 Periodic Payments Outstanding Balance 0 0 0 0 0 0 0.00 0.00 0.00 0.00 0.00 0.00

Step by Step Solution

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started