question updated.

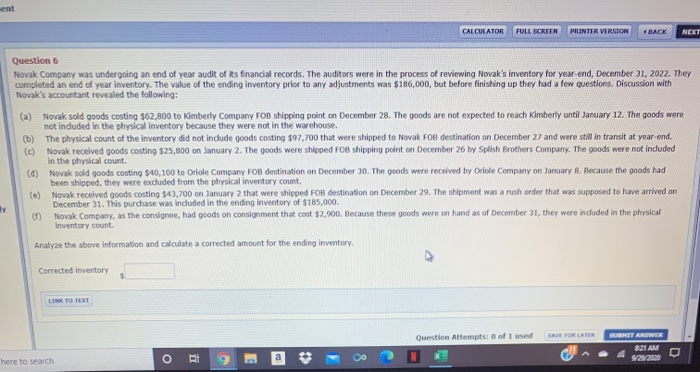

CALCULATOR FULL SCREEN PRINTER VERSION BACK NEXT Question 6 Novak Company was undergoing an end of year audit of its financial records. The auditors were in the process of reviewing Novak's inventory for year-end, December 31, 2022. They completed an end of year inventory. The value of the ending inventory prior to any adjustments was $186,000, but before finishing up they had a few questions. Discussion with Novak's accountant revealed the following: (a) Novak sold goods costing $62,800 to Kimberly Company Foo shipping point on December 28. The poods are not expected to reach Kimberly until January 12. The goods were not induded in the physical inventory because they were not in the warehouse. (b) The physical count of the inventory did not include goods costing $97,700 that were shoped to Novak Foe destination on December 27 and were still in transit at year-end. (c) Novak received goods costing $25,800 on January 2. The goods were shipped FOB shipping point on December 26 by Splish Brothers Company. The goods were not induded in the physical count. (d) Novak sold goods costing $40,100 to Orlole Company FOB destination on December 30. The goods were received by Oriole Company on January 8. Because the goods had been shipped, they were excluded from the physical inventory count. (C) Novak received goods costing $43,700 on January 2 that were shipped FOB destination on December 20. The shipment was a rush order that was supposed to have arrived on December 31. This purchase was included in the ending inventory of $185,000. Novak Company, as the consignee, had goods on consignment that cost $2,900. Because these goods were on hand as of December 31, they were included in the physical Inventory count Analyze the above information and calculate a corrected amount for the ending inventory lv Corrected Inventory LINK TO TEXT Question Attempts: 0 of 1 used SAVE FOR LATER SUBMIT ANSWER 21 AM 9/2/2000 here to search O i 9 E CALCULATOR FULL SCREEN PRINTIR VERSION BACK NEXT Questions Novak Company was undergoing an end of year audit of its financial records. The auditors were in the process of reviewing Novak's inventory for year-end, December 31, 2022. They completed an end of year inventory. The value of the ending inventory prior to any adjustments was $186,000, but before finishing up they had a few questions. Discussion with Novak's accountant revealed the following: (a) Novak sold goods coating $62,800 to Kimberly Company FOB shipping point on December 28. The goods are not expected to reach Kimberly until January 12. The goods were not included in the physical inventory because they were not in the warehouse (b) The physical count of the inventory did not include goods costing 597,700 that were shipped to Novak Fon destination on December 27 and were still in transit at year-end, 10 Novak received goods costing $25,000 on January 2. The goods were shipped FOB shipping point on December 26 by Solish Brothers Company. The goods were not included in the physical count (6) Novak sold goods costing 540,100 to Oriol Company FOB destination on December 30. The goods were received by Orole Company on January 8. Because the goods had been shipped, they were excluded from the physical inventory count () Novak received goods costing $43,700 on January 2 that were shipped rob destination on December 20. The shipment was a rush order that was supposed to have arrived on December 31. This purchase was included in the ending inventory of $185,000 Novak Company, as the conte, had goods on comment that cost $2,000. Because these goods were on hand as of December 11, they were included in the phy inventary count be Study Analyze the above information and calculate a corrected amount for the ending inventory Corrected the