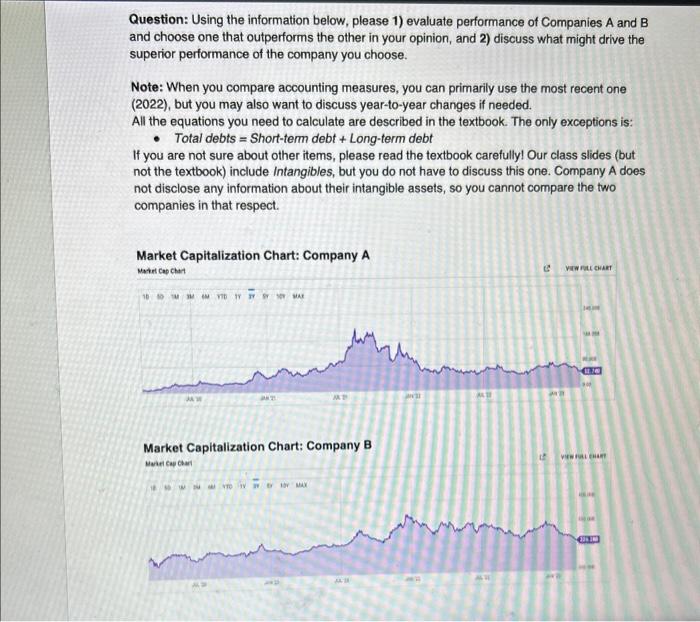

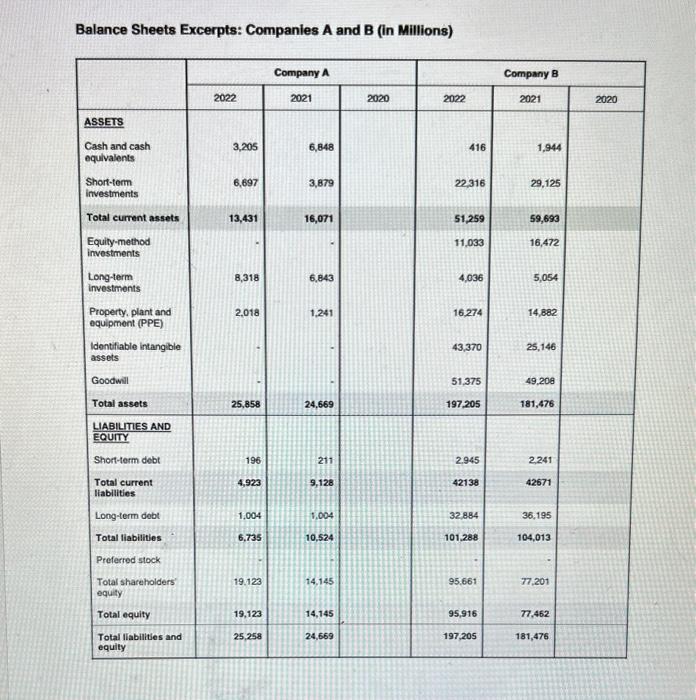

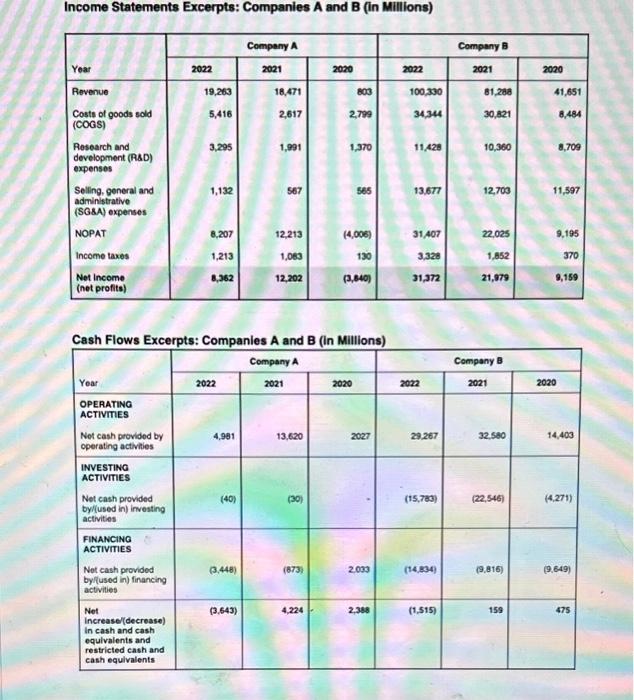

Question: Using the information below, please 1) evaluate performance of Companies A and B and choose one that outperforms the other in your opinion, and 2) discuss what might drive the superior performance of the company you choose. Note: When you compare accounting measures, you can primarily use the most recent one (2022), but you may also want to discuss year-to-year changes if needed. All the equations you need to calculate are described in the textbook. The only exceptions is: - Total debts = Short-term debt + Long-term debt If you are not sure about other items, please read the textbook carefully! Our class slides (but not the textbook) include Intangibles, but you do not have to discuss this one. Company A does not disclose any information about their intangible assets, so you cannot compare the two companies in that respect. Market Capitalization Chart: Companv A Market Capitalization Chart: Company B Balance Sheets Excerpts: Companies A and B (in Millions) Income Statements Excerpts: Companies A and B (in Millions) Question: Using the information below, please 1) evaluate performance of Companies A and B and choose one that outperforms the other in your opinion, and 2) discuss what might drive the superior performance of the company you choose. Note: When you compare accounting measures, you can primarily use the most recent one (2022), but you may also want to discuss year-to-year changes if needed. All the equations you need to calculate are described in the textbook. The only exceptions is: - Total debts = Short-term debt + Long-term debt If you are not sure about other items, please read the textbook carefully! Our class slides (but not the textbook) include Intangibles, but you do not have to discuss this one. Company A does not disclose any information about their intangible assets, so you cannot compare the two companies in that respect. Market Capitalization Chart: Companv A Market Capitalization Chart: Company B Balance Sheets Excerpts: Companies A and B (in Millions) Income Statements Excerpts: Companies A and B (in Millions)