Answered step by step

Verified Expert Solution

Question

1 Approved Answer

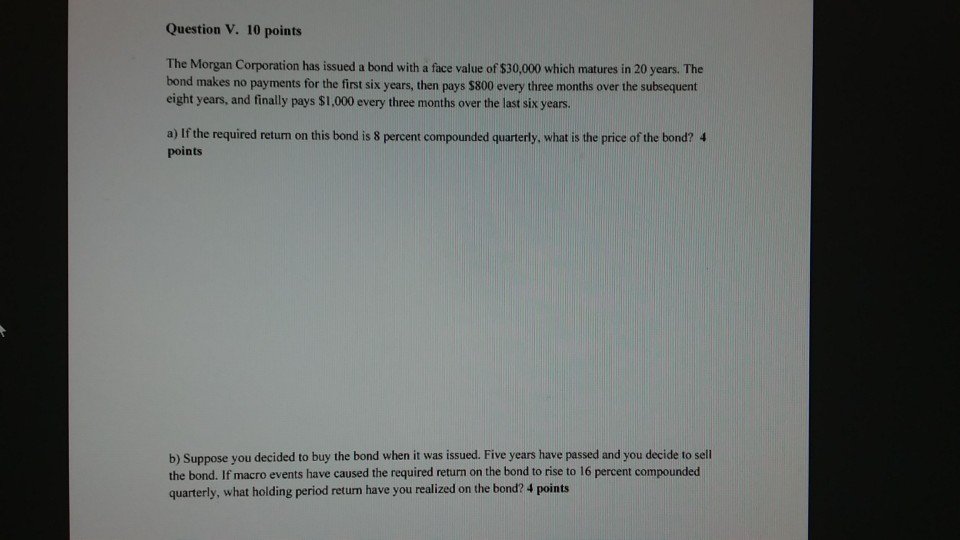

Question V. 10 points The Morgan Corporation has issued a bond with a face value of $30,000 which matures in 20 years. The bond makes

Question V. 10 points The Morgan Corporation has issued a bond with a face value of $30,000 which matures in 20 years. The bond makes no payments for the first six years, then pays $800 every three months over the subsequent eight years, and finally pays $1,000 every three months over the last six years. a) If the required return on this bond is 8 percent compounded quarterly, what is the price of the bond? 4 points b) Suppose you decided to buy the bond when it was issued. Five years have passed and you decide to sell the bond. If macro events have caused the required return on the bond to rise to 16 percent compounded quarterly, what holding period return have you realized on the bond? 4 points

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started