Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider a long/short manager with $200 of assets under management. The fund only has the following two positions: Long $200 of Company Alpha, where

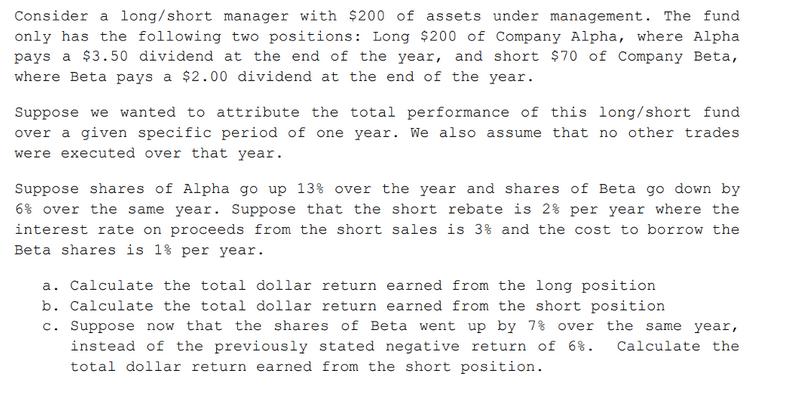

Consider a long/short manager with $200 of assets under management. The fund only has the following two positions: Long $200 of Company Alpha, where Alpha pays a $3.50 dividend at the end of the year, and short $70 of Company Beta, where Beta pays a $2.00 dividend at the end of the year. Suppose we wanted to attribute the total performance of this long/short fund over a given specific period of one year. We also assume that no other trades were executed over that year. Suppose shares of Alpha go up 13% over the year and shares of Beta go down by 6% over the same year. Suppose that the short rebate is 2% per year where the interest rate on proceeds from the short sales is 3% and the cost to borrow the Beta shares is 1% per year. a. Calculate the total dollar return earned from the long position b. Calculate the total dollar return earned from the short position c. Suppose now that the shares of Beta went up by 7% over the same year, instead of the previously stated negative return of 6%. Calculate the total dollar return earned from the short position.

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Part a iTotal dollar Return on long position Price apprecia...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started