Question

Question :- What are the main governance issues in the case, Explain? SINYI CORPORATION: EXPANSION STRATEGY IN CHINA In late 2008, SinYi Group (SinYi), a

Question:-What are the main governance issues in the case, Explain?

SINYI CORPORATION: EXPANSION STRATEGY IN CHINA

In late 2008, SinYi Group (SinYi), a highly successful Taiwanese real estate company, was contemplating its expansion strategy in the mainland China market. In 1999, SinYi had signed a contract with Coldwell Banker (Coldwell) to obtain its master franchise in China. According to the original contract, SinYi ran both its company-owned branches and its franchise stores using the SinYi brand in Chinese and the Coldwell Banker brand in English.2 Although the Chinese real estate market was booming, SinYi's growth was relatively slow, and for this reason, the company decided to review the adequacy of its expansion strategy in China and was instead contemplating a proposed new deal with Coldwell Banker.

Company Background

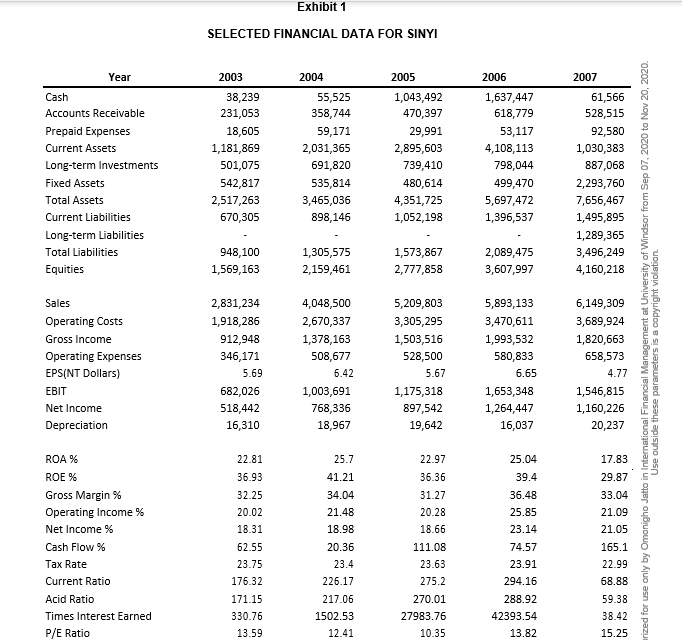

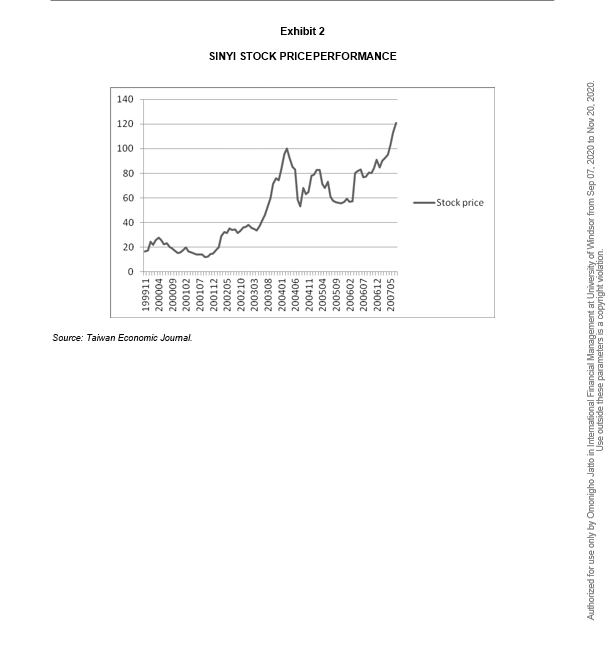

SinYi had formed a Taiwanese real estate company in 1981. Under the leadership of the company president, Mr. Chun-chi Chou, the business grew into the leading real estate agent company in Taiwan. In 1999, the company did an initial public offering (IPO) of its stock in the Taiwan OTC market. Two years later, its shares were listed on the Taiwan Stock Exchange. Until 2008, SinYi was the only publicly traded real estate agency in Taiwan. By 2007, its profits were NT$1,160 million on sales of NT$6,149 million. The net profit margin had been as high as 18.86 per cent. See Exhibit1 for a summary of SinYi's financial history and Exhibit 2 for its stock price performance.

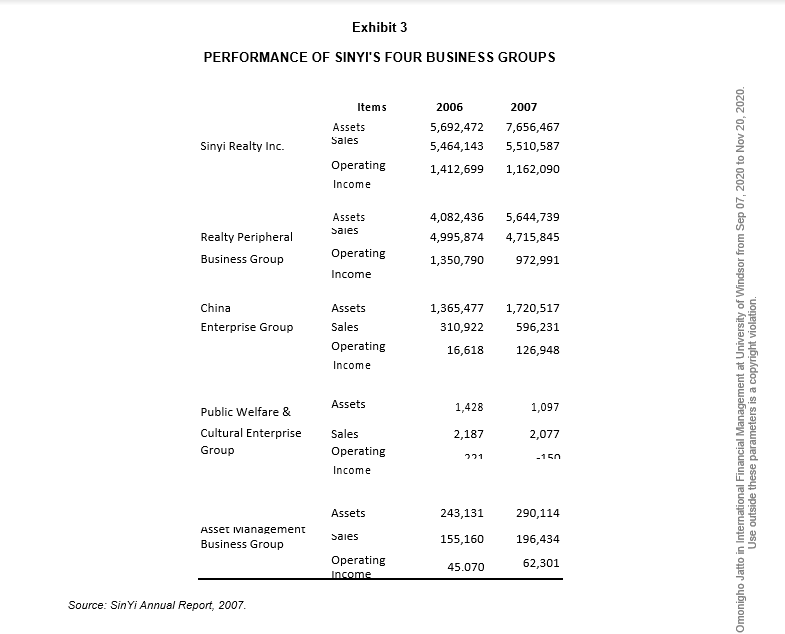

Sinyi had four major groups of business: Realty Peripheral Business Group, Assets Management Group, China Business Group, and the Culture Public Good Group. For 2007, the Realty Business Group represented over 86 per cent of SinYi's total sales, and the China Business Group 11 per cent

The SinYi Philosophy

At the time the company was founded, the real estate market in Taiwan was characterized by fraud and deceit, and fraudulent deals between buyers and sellers were common. From the beginning, Chou had decided to follow an ethical path, as evidenced by the company name, which, in Chinese, means trustworthiness and fair dealing. To ensure that his new approach would be implemented, Chou followed a unique human resources strategy in which he hired persons without experience in the industry (who therefore had not been influenced by its existing bad practices) and thoroughly trained them in the SinYi, client-oriented approach, which included classes on ethics. Moreover the compensation system, in which employees received a large part of their compensation in the form of salary, was designed to avoid having the staff members "push" their product on nave buyers and sellers and to emphasize the importance of teamwork. Finally, the company made a significant effort to ensure that clients were well informed about the real estate market and pushed for home inspections and warrantees by builders. As Chou noted, "The service provided by our people is our product, and therefore our human resources strategies are the key to our success."

SinYi installed a range of management control systems to ensure that the company's philosophy was being implemented. Activities at the branch level were monitored daily, and all transactions were reviewed to ensure that properties were correctly described for the consumer and contracts were reasonable. Customer satisfaction was verified through use of a call centre that contacted both buyers and sellers, and the results of this survey formed the basis for part of the workers' bonus package. On a regular basis, the executive reviewed any cases where there was a dispute between the company and customers. If the company was deemed to be at fault or had used misleading practices, the customer was compensated or the property was repurchased.

Successes and Challenges

Initially, Chou owned all shares in the company, but gradually, shares were made available to employees. Following the IPO, Chou retained a 60 per cent interest in the company. In subsequent years, the company grew and prospered, and the SinYi brand became well known in Taiwan for its fair-dealing practices. In many ways, the company had taken the lead in transforming the conduct of the participants in Taiwan's real-estate community, and other companies began to copy its ethical brand of practices.

However, SinYi's growth was not without its challenges. Chou insisted that promotions would be made from among the existing staff and that all new unit managers should be well trained. As a result, the company could not grow as quickly as some of its competitors, which did not have such high human resource standards and could therefore facilitate their own expansion by hiring experienced managers away from competitors.

ENTERING CHINA

The Mainland China Market in 1993

By 1993, the Taiwan market was becoming more mature and competition was fierce. On the other hand, the market in mainland China was expanding at a very rapid pace, due to the combined influences of the economic boom, the government's preferential policies supporting residential housing, the growing wealth of Chinese consumers, and the development of the transportation infrastructure. In 1993, China's President Mr. Deng Xiaoping had visited southern China and publicly confirmed a new open-door policy that was expected to further stimulate economic growth.

At this time, China's land was owned entirely by the government, so opportunities for foreign real-estate agencies consisted mainly of arranging for rental properties (including retail space) for foreign individuals and companies. The real-estate companies typically arranged for one- to two-year rentals and charged a fee of about 1.5 month's rent, jointly paid by the renter and the property owner. China's real estate market was less mature than those of developed countries. Although there were many real estate companies in existence, they were mostly small firms, many of which operated without official registration. There was no meaningful secondary market for housing except in areas such as Shanghai, but the government was expected to introduce incentives for the resale of houses. Conditions in the market were similar to those that SinYi had experienced in the early years in Taiwan, with inconsistent laws and regulations and widespread corruption.

Initial Entry into China in 1993

In addition to being a rapidly growing market, the Chinese mainland was attractive to SinYi for a variety of reasons. First, the language spoken in China (i.e., Mandarin), was the same as that spoken in Taiwan. Second, China's culture was quite similar to the culture of Taiwan, and third, mainland China was geographically close to Taiwan, and cultural and business exchanges had increased rapidly in recent years.

In 1993, SinYi opened its first company-owned branch in Shanghai in partnership with the Chinese Commercial Bank, which made an investment in the company. Later, however, the government forbade bank investments in real estate companies, and in 1997, this relationship had to be dissolved. By 1999, the number of company-operated real estate branches in Shanghai had gradually increased to 10, and the resale market for individual home sales was opening up due to the fact that the government had released some of its restrictions on home ownership.

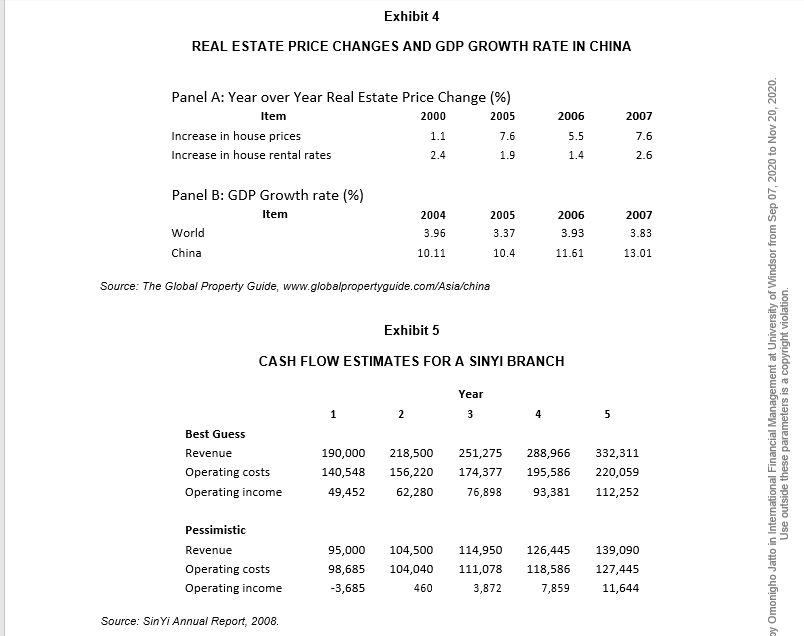

House prices remained quite stable before 2000, but after 2005, they began to grow at a rate of 5 per cent to 7 per cent per year (see Exhibit 4). The growth in prices was very uneven between the urban and rural areas.

The average number of staff at a branch was 10 persons. Initially, SinYi had been able to hire and train capable sales people by offering a stable salary; however, as time went by, people began focusing more on building their wealth, and it became increasingly difficult to retain the types of employees who would operate under SinYi's philosophy.

The Coldwell Opportunity

By 1999, SinYi had decided to re-evaluate its Chinese operations. The company could continue to grow its company-owned branches, a strategy that offered the advantage of allowing carefully control over the implementation of SinYi's philosophy and the establishment of its own brand on the mainland. However, growth in the number of company-operated branches was slow, and employee turnover was much higher than that experienced in Taiwan. This slow growth and the expansion activities of very aggressive competitors meant that SinYi experienced a significant decline in market share.

Faced with these growth challenges, in 1999, SinYi decided to form an alliance with Coldwell Banker. Under this arrangement, Sinyi took on the Coldwell Banker master franchise in China, with a term of 40 years. The cost to Sinyi for this master franchise was NT$105,472,000 paid up front. In addition, SinYi was obliged to pay annually 9 per cent of the revenues collected from franchise stores for the first 10 years and 7 per cent for the remaining life of the contract. All franchised stores would be dual-branded (i.e., bearing both the Coldwell and the SinYi name).

Franchisees were required to pay the franchisor an up-front fee of RMB30,000 to obtain the franchise for a store as well as an annual fee of RMB3,000. Franchisees were to pay all their own costs of setting up and operating the franchise stores.

This new contract enabled SinYi to introduce Coldwell Banker's famous brand and operating resources directly into China's local market. Although Coldwell Banker had not previously established itself in China, it was apparent that Chinese consumers (and especially offshore companies) favoured dealing with international companies with an established reputation, and there was a large market for rentals among foreigners. According to the deal, SinYi was responsible for selling the franchises, marketing the brand, training the franchise owners (but not the salesmen), setting the operating rules, and instigating all communication.

This franchising arrangement was expected to allow the company to grow faster since it freed SinYi from the constraint of internally trained human resources. Furthermore, as a master franchisor, SinYi could decide where the franchises would be located, thus protecting its own standalone operations. Having such a large number of branches offered a variety of economies of scale as well as the opportunity to offer a broader range of services; however, it had the disadvantage of having to share the branding of the franchised units with Coldwell Banker, which meant that SinYi would not be able to follow its usual approach of promotion from within accompanied by rigorous (albeit time-consuming) training.

Renegotiating the Coldwell Deal

By 2007, SinYi had 70 directly owned branches and 90 franchised branches in mainland China in cities such as Shanghai, Beijing, Suzhou, Chongqing, and Hangchow; however, the growth of SinYi in China was still relatively slow compared to that of its competitors, and Chou was considering renegotiating the arrangement with Coldwell Banker.3

On the one hand, management felt that the relatively slow growth of franchised stores and company stores was due to the fact that the same brand was being used for both the 100-per-cent-owned branches and the franchised stores, which made it difficult for customers to distinguish between the two entities. On the other hand, if the Coldwell and SinYi brands were clearly separated, it was felt that customers with different preferences could be attracted to each operation, thus increasing the sales of both.

With the foregoing in mind, SinYi contemplated transferring the Coldwell master franchise to a new company called Coldwell Shanghai (95 per cent owned by SinYi and 5 per cent owned by Coldwell Banker). All franchised stores would use the Coldwell Banker brand, in Chinese and in English. All SinYi's 100-per-cent-owned branches would use only the SinYi brand in Chinese and English. This arrangement was expected to help customers in distinguishing the company-owned branches from the franchised stores. It would also help SinYi to foster its namesake brand. As a result of this new arrangement, SinYi expected to open 100 new franchised stores in the next year and about 200 new stores each year from then on. Hence, the incremental number of stores in the first year was 90 and, in subsequent years, 190.

SinYi's initial investment in Coldwell Shanghai was estimated to be NT$15,995,000 (RMB$6,161,000).4 In addition, the contract for annual payments to Coldwell was modified in that the new contract had an additional requirement that SinYi would have to meet annual "minimum" payment obligations as follows: NT$3,903,000 in 2009, NT$4,198,000 in 2010, NT$5,346,000 in 2011. Thereafter, the minimum payment would be the same as the amount in 2011, but it would be adjusted to meet the consumer price index.5 Thus, SinYi was required to pay the greater of two amounts: (1) a percentage of revenues (9 per cent for the first 10 years and 7 per cent thereafter) or (2) the minimum payment. Further, the annual costs of running the head office of Coldwell Shanghai needed to be factored into the equation.6 From each franchise store, SinYi asked for an initial franchise fee of RMB30,000 and an annual fee of RMB3,000. The average duration of a franchise contract was three to five years.

In making the decision, Chou took note of the profitability of SinYi's 100-per-cent-owned branches. The upfront investment in a new standalone SinYi branch (including facilities, training, initial advertising and so on) was around RMB 310,000. Exhibit 5 provides the subsequent yearly cash flows for a typical 100- per-cent-owned branch.

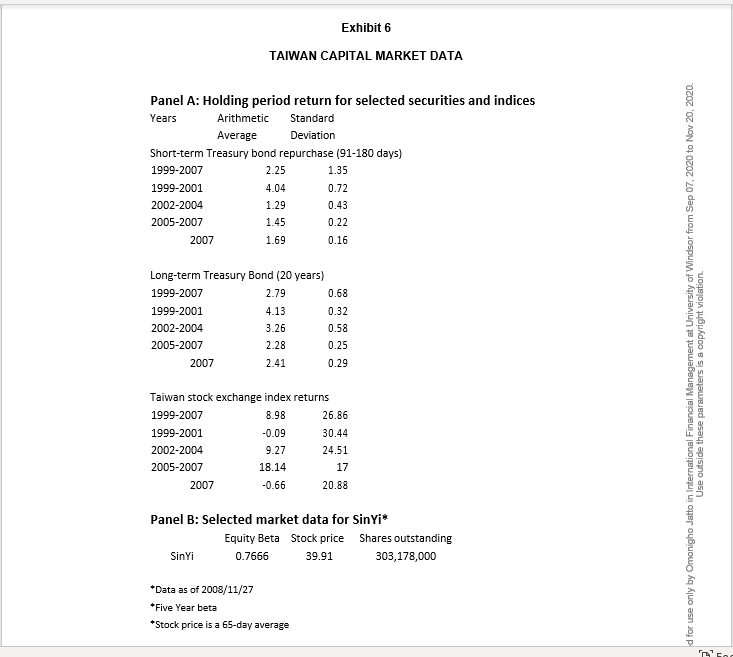

To assist in the analysis, SinYi also obtained certain information about Taiwan's capital market (see Exhibit 6).7 It was expected that the internally generated cash flows would be more than enough to support the company's expansion in China, and no borrowing would be necessary.

Although a public company should engage in strategies that will enhance shareholder value, Chou was also a strong believer that a company should behave in a socially responsible fashion toward its customers, its employees, and towards the public at large, and he wondered whether the franchising model would allow him to pursue those important goals. The franchisee would be an independent businessman, and for this reason, it would be more difficult to impose SinYi's standards on the operations. Moreover, the franchisees were likely to be situated at rather remote locations from Shanghai. It was clear that the franchisees' service levels would be much lower than those in a SinYi branch, and the compensation system would be much more incentive based as well.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started