Question: What markup on variable manufacturing cost did the firm use to establish the selling prices for nail polish in?2009?

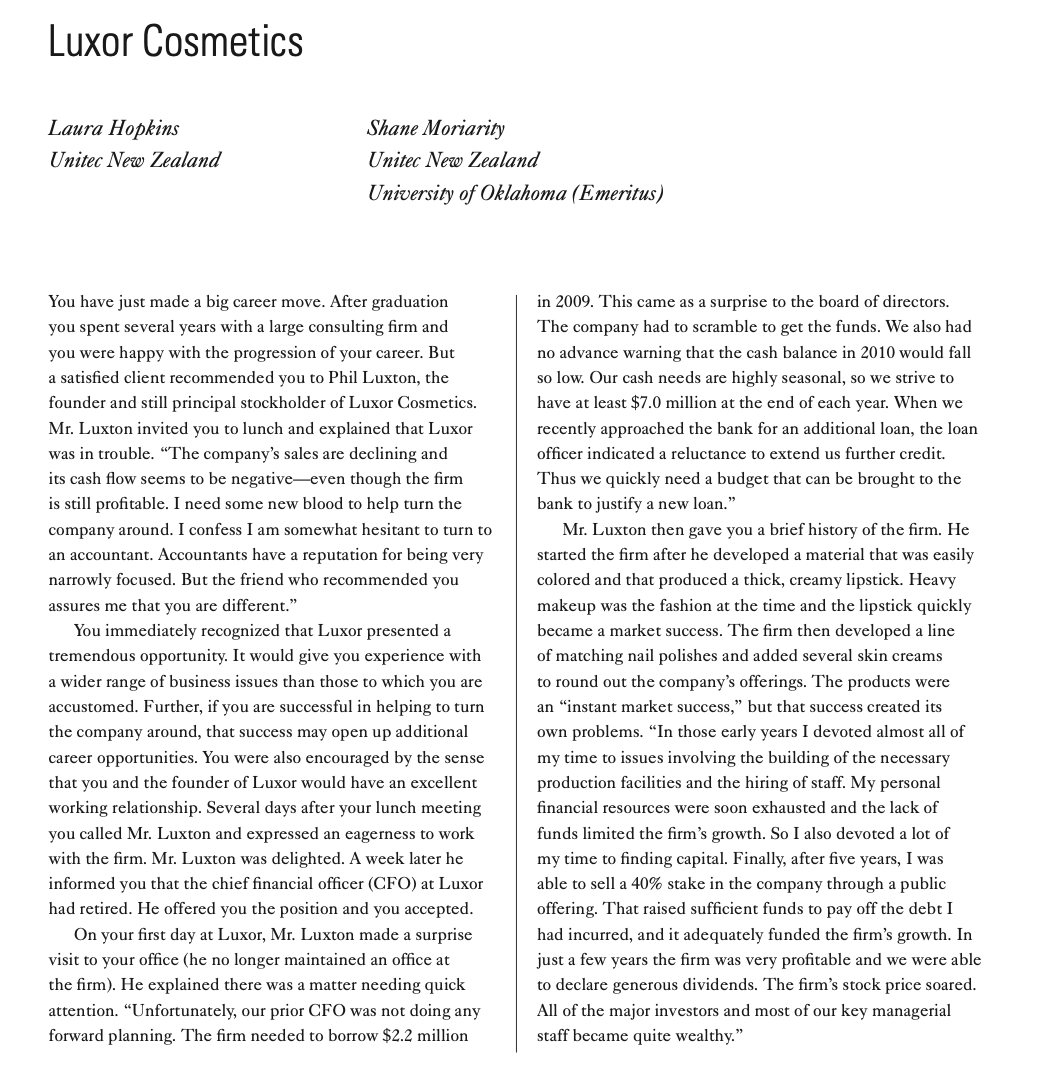

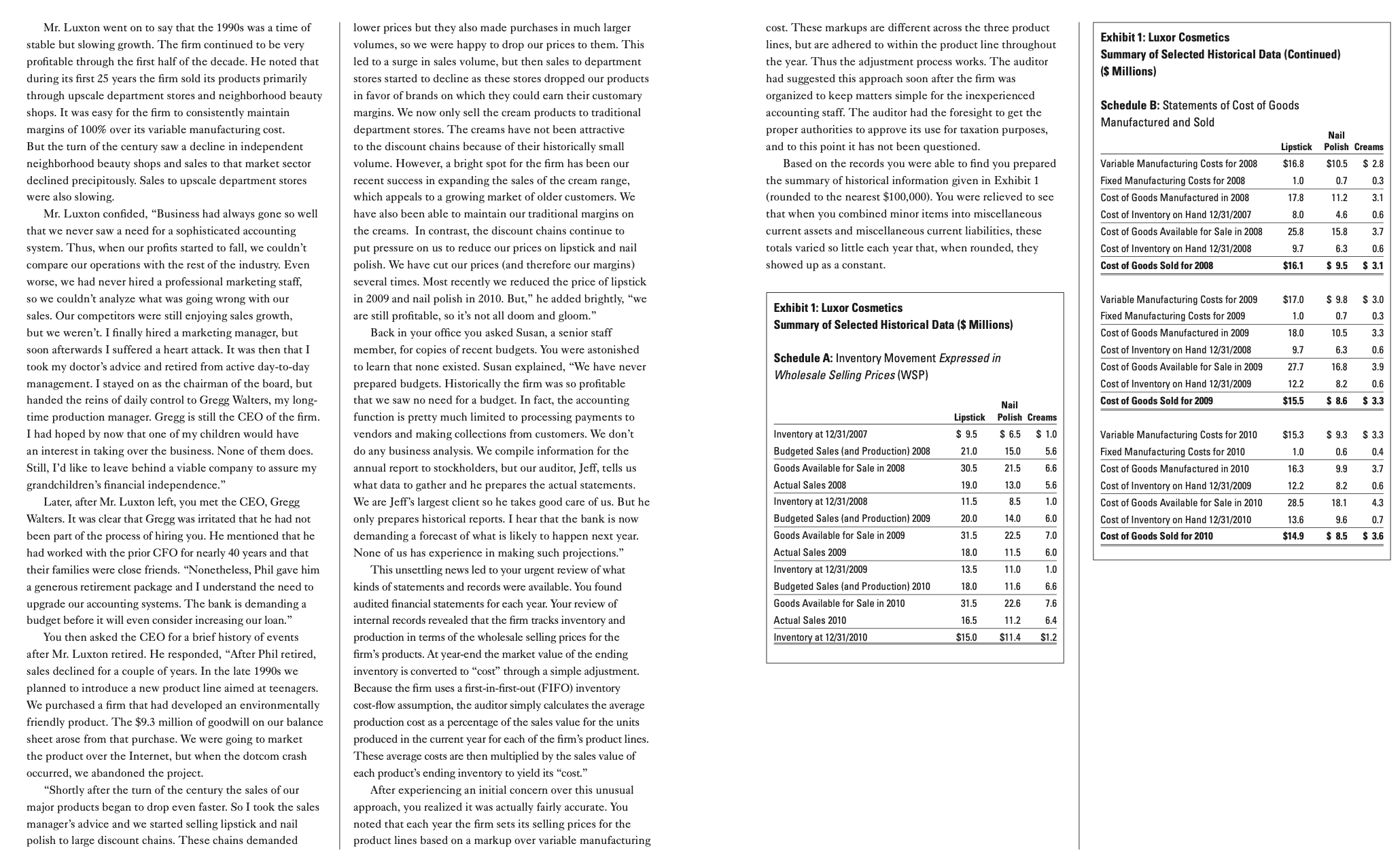

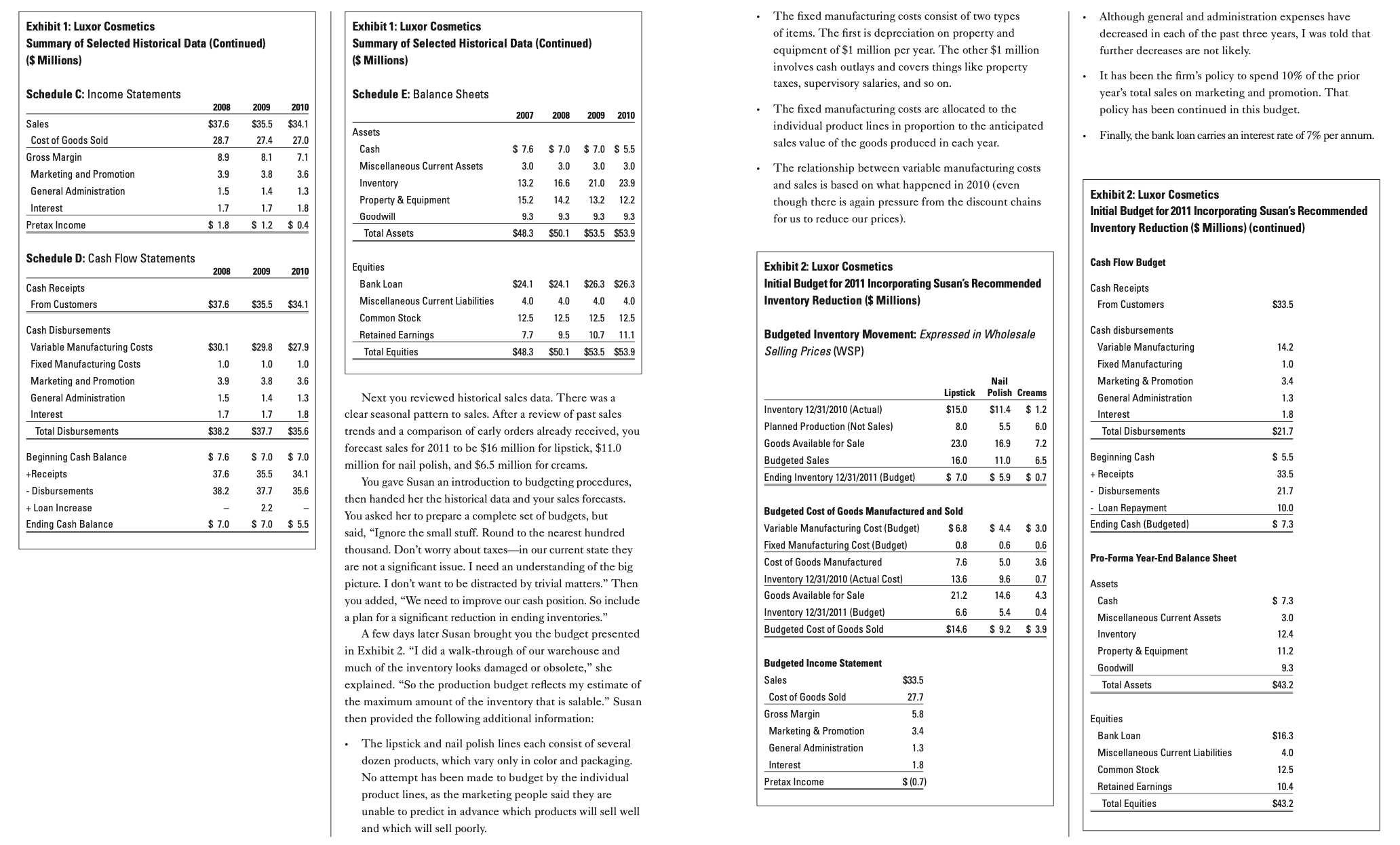

Luxor Cosmetics Laura Hapim Unites New Zeaiand Siam Morian'ty Um'm New Zmiaad Uimfy of GEM/50mg {Emeritm} You have just made a big career move. After graduation you spent several years with a large consulting rm and you were happy with the progression of your career. But a satised client recommended you to Phil Luxton, the founder and still principal stockholder of Luxor Cosmetics. Mr. Luxton invited you to lunch and explained that Luxor was in trouble. \"The company's sales are declining and its cash ow seems to be negativeeven though the rm is still protable. I need some new blood to help turn the company around. I confess I am somewhat hesitant to turn to an accountant. Accountants have a reputation for being very narrowly focused. But the friend who recommended you assures me that you are different." You immediately recognized that Luxor presented a tremendous opportunity. It would give you experience with a wider range of business issues than those to which you are accustomed. Further, if you are successful in helping to turn the company around, that success may open up additional career opportunities. You were also encouraged by the sense that you and the founder of Luxor would have an excellent working relationship. Several days after your lunch meeting you called Mr. Luxton and expressed an eagerness to work with the rm. Mr. Luxton was delighted. A week later he informed you that the chief nancial ofcer (CFO) at Luxor had retired. He offered you the position and you accepted. On your rst day at Luxor, Mr. Luxton made a surprise visit to your ofce (he no longer maintained an o'ice at the rm). He explained there was a matter needing quick attention. \"Unfortunately, our prior CFO was not doing any forward planning. The rm needed to borrow $2.2 million in 2009. This came as a surprise to the board of directors. The company had to scramble to get the funds. We also had no advance warning that the cash balance in 2010 would fall so low. Our cash needs are highly seasonal, so we strive to have at least $7.0 million at the end of each year. When we recently approached the bank for an additional loan, the loan ofcer indicated a reluctance to extend us further credit. Thus we quickly need a budget that can be brought to the bank to justify a new loan." Mr. Luxton then gave you a brief history of the rm. He started the rm after he developed a material that was easily colored and that produced a thick, creamy lipstick. Heavy makeup was the fashion at the time and the lipstick quickly became a market success. The rm then developed a line of matching nail polishes and added several skin creams to round out the company's offerings. The products were an \"instant market success," but that success created its own problems. \"In those early years I devoted almost all of my time to issues involving the building of the necessary production facilities and the hiring of staff. My personal nancial resources were soon exhausted and the lack of funds limited the rm's growth. So I also devoted a lot of my time to nding capital. Finally, after ve years, I was able to sell a 40% stake in the company through a public offering. That raised sufcient funds to pay off the debt I had incurred, and it adequately funded the rm's growth. In just a few years the rm was very protable and we were able to declare generous dividends. The rm's stock price soared. All of the major investors and most of our key managerial staff became quite weal thy." Mr. Luxton went on to say that the 1990s was a time of lower prices but they also made purchases in much larger cost. These markups are different across the three product stable but slowing growth. The firm continued to be very volumes, so we were happy to drop our prices to them. This lines, but are adhered to within the product line throughout Exhibit 1: Luxor Cosmetics profitable through the first half of the decade. He noted that led to a surge in sales volume, but then sales to department the year. Thus the adjustment process works. The auditor Summary of Selected Historical Data (Continued) during its first 25 years the firm sold its products primarily stores started to decline as these stores dropped our products had suggested this approach soon after the firm was ($ Millions) through upscale department stores and neighborhood beauty in favor of brands on which they could earn their customary organized to keep matters simple for the inexperienced shops. It was easy for the firm to consistently maintain margins. We now only sell the cream products to traditional accounting staff. The auditor had the foresight to get the Schedule B: Statements of Cost of Goods margins of 100% over its variable manufacturing cost. department stores. The creams have not been attractive proper authorities to approve its use for taxation purposes, Manufactured and Sold Nail But the turn of the century saw a decline in independent to the discount chains because of their historically small and to this point it has not been questioned. Lipstick Polish Creams neighborhood beauty shops and sales to that market sector volume. However, a bright spot for the firm has been our Based on the records you were able to find you prepared Variable Manufacturing Costs for 2008 $16.8 $10.5 $ 2.8 declined precipitously. Sales to upscale department stores ecent success in expanding the sales of the cream range, the summary of historical information given in Exhibit 1 Fixed Manufacturing Costs for 2008 1.0 0.7 0.3 were also slowing. which appeals to a growing market of older customers. We (rounded to the nearest $100,000). You were relieved to see Cost of Goods Manufactured in 200 7.8 1.2 3.1 Mr. Luxton confided, "Business had always gone so well have also been able to maintain our traditional margins on that when you combined minor items into miscellaneous Cost of Inventory on Hand 12/31/2007 8.0 4.6 0.6 that we never saw a need for a sophisticated accounting the creams. In contrast, the discount chains continue to current assets and miscellaneous current liabilities, these Cost of Goods Available for Sale in 2008 25.8 15.8 3.7 system. Thus, when our profits started to fall, we couldn't put pressure on us to reduce our prices on lipstick and nail totals varied so little each year that, when rounded, they Cost of Inventory on Hand 12/31/2008 9.7 6.3 0.6 compare our operations with the rest of the industry. Even polish. We have cut our prices (and therefore our margins) showed up as a constant. Cost of Goods Sold for 2008 $16.1 $ 9.5 worse, we had never hired a professional marketing staff, several times. Most recently we reduced the price of lipstick so we couldn't analyze what was going wrong with our in 2009 and nail polish in 2010. But," he added brightly, "we Variable Manufacturing Costs for 2009 $17.0 $ 9.8 $ 3.0 sales. Our competitors were still enjoying sales growth, Exhibit 1: Luxor Cosmetics are still profitable, so it's not all doom and gloom." Fixed Manufacturing Costs for 2009 1.0 07 0.3 but we weren't. I finally hired a marketing manager, but Back in your office you asked Susan, a senior staff Summary of Selected Historical Data ($ Millions) Cost of Goods Manufactured in 2009 80 10.5 3.3 soon afterwards I suffered a heart attack. It was then that I member, for copies of recent budgets. You were astonished Schedule A: Inventory Movement Expressed in Cost of Inventory on Hand 12/31/2008 9.7 6.3 0.6 took my doctor's advice and retired from active day-to-day to learn that none existed. Susan explained, "We have never 27.7 16.8 3.9 Wholesale Selling Prices (WSP) Cost of Goods Available for Sale in 2009 management. I stayed on as the chairman of the board, but prepared budgets. Historically the firm was so profitable Cost of Inventory on Hand 12/31/2009 12.2 8.2 0.6 handed the reins of daily control to Gregg Walters, my long- that we saw no need for a budget. In fact, the accounting Nail Cost of Goods Sold for 2009 $15.5 $ 8.6 ime production manager. Gregg is still the CEO of the firm. function is pretty much limited to processing payments to Lipstick Polish Creams I had hoped by now that one of my children would have vendors and making collections from customers. We don't Inventory at 12/31/2007 $ 9.5 $ 6.5 $ 1.0 Variable Manufacturing Costs for 2010 $15.3 $ 3.3 an interest in taking over the business. None of them does. do any business analysis. We compile information for the Budgeted Sales (and Production) 2008 21.0 15.0 5.6 Fixed Manufacturing Costs for 2010 1.0 0.6 0.4 Still, I'd like to leave behind a viable company to assure my annual report to stockholders, but our auditor, Jeff, tells us Goods Available for Sale in 2008 30.5 21.5 6.6 Cost of Goods Manufactured in 2010 6.3 9.9 3.7 grandchildren's financial independence." what data to gather and he prepares the actual statements. Actual Sales 2008 19.0 13.0 5.6 Cost of Inventory on Hand 12/31/2009 12.2 8.2 0.6 Later, after Mr. Luxton left, you met the CEO, Gregg We are Jeff's largest client so he takes good care of us. But he Inventory at 12/31/2008 11.5 8.5 1.0 Cost of Goods Available for Sale in 2010 28.5 18.1 4.3 Walters. It was clear that Gregg was irritated that he had not only prepares historical reports. I hear that the bank is now Budgeted Sales (and Production) 2009 20.0 14.0 6.0 Cost of Inventory on Hand 12/31/2010 13.6 9.6 0.7 been part of the process of hiring you. He mentioned that he demanding a forecast of what is likely to happen next year. Goods Available for Sale in 2009 1.5 2.5 7.0 Cost of Goods Sold for 2010 $14.9 $ 8.5 $ 3.6 had worked with the prior CFO for nearly 40 years and that None of us has experience in making such projections." Actual Sales 2009 18.0 11.5 6.0 their families were close friends. "Nonetheless, Phil gave him This unsettling news led to your urgent review of what Inventory at 12/31/2009 13.5 11.0 1.0 a generous retirement package and I understand the need to kinds of statements and records were available. You found Budgeted Sales (and Production) 2010 18.0 11.6 6.6 upgrade our accounting systems. The bank is demanding a audited financial statements for each year. Your review of Goods Available for Sale in 2010 31.5 22.6 7.6 budget before it will even consider increasing our loan." internal records revealed that the firm tracks inventory and Actual Sales 2010 16.5 11.2 6.4 You then asked the CEO for a brief history of events production in terms of the wholesale selling prices for the Inventory at 12/31/2010 $15.0 $11.4 $1.2 after Mr. Luxton retired. He responded, "After Phil retired, firm's products. At year-end the market value of the ending sales declined for a couple of years. In the late 1990s we inventory is converted to "cost" through a simple adjustment. planned to introduce a new product line aimed at teenagers. Because the firm uses a first-in-first-out (FIFO) inventory We purchased a firm that had developed an environmentally cost-flow assumption, the auditor simply calculates the average friendly product. The $9.3 million of goodwill on our balance production cost as a percentage of the sales value for the units sheet arose from that purchase. We were going to market produced in the current year for each of the firm's product lines. the product over the Internet, but when the dotcom crash These average costs are then multiplied by the sales value of occurred, we abandoned the project. each product's ending inventory to yield its "cost." "Shortly after the turn of the century the sales of our After experiencing an initial concern over this unusual major products began to drop even faster. So I took the sales approach, you realized it was actually fairly accurate. You manager's advice and we started selling lipstick and nail noted that each year the firm sets its selling prices for the polish to large discount chains. These chains demanded product lines based on a markup over variable manufacturingThe fixed manufacturing costs consist of two types Although general and administration expenses have Exhibit 1: Luxor Cosmetics Exhibit 1: Luxor Cosmetics of items. The first is depreciation on property and decreased in each of the past three years, I was told that Summary of Selected Historical Data (Continued) Summary of Selected Historical Data (Continued) equipment of $1 million per year. The other $1 million further decreases are not likely. ($ Millions) ($ Millions) involves cash outlays and covers things like property taxes, supervisory salaries, and so on. . It has been the firm's policy to spend 10% of the prior Schedule C: Income Statements Schedule E: Balance Sheets year's total sales on marketing and promotion. That 2008 2009 2010 2007 2008 2009 2010 The fixed manufacturing costs are allocated to the policy has been continued in this budget. Sales $37.6 $35.5 $34. Assets individual product lines in proportion to the anticipated Cost of Goods Sold 28.7 27.4 27.0 sales value of the goods produced in each year. Finally, the bank loan carries an interest rate of 7% per annum. Cash 6 $7.0 $ 7.0 $ 5.5 Gross Margin 8.9 8.1 7.1 Miscellaneous Current Assets 3.0 3.0 3.0 3.0 Marketing and Promotion 3.9 3.8 The relationship between variable manufacturing costs 3.6 16.6 General Administration 15 Inventory 13.2 21.0 23.9 1.4 1.3 and sales is based on what happened in 2010 (even 5.2 14.2 13.2 12.2 Exhibit 2: Luxor Cosmetics Interest 1.7 Property & Equipment 17 though there is again pressure from the discount chains 1.8 Goodwill 9.3 9.3 9.3 9.3 Initial Budget for 2011 Incorporating Susan's Recommended Pretax Income $ 1.8 $ 1.2 $ 0.4 for us to reduce our prices). Total Assets $48.3 $50.1 $53.5 $53.9 Inventory Reduction ($ Millions) (continued) Schedule D: Cash Flow Statements Cash Flow Budget 2008 2009 2010 Equities Exhibit 2: Luxor Cosmetics Cash Receipts Bank Loan $24.1 $24.1 $26.3 $26.3 Initial Budget for 2011 Incorporating Susan's Recommended Cash Receipts From Customers $37.6 $35.5 $34.1 Miscellaneous Current Liabilities 4.0 4.0 4.0 4. Inventory Reduction ($ Millions) From Customers $33.5 Common Stock 125 125 12.5 12.5 Cash Disbursements Retained Earnings 7.7 9.5 10.7 11.1 Budgeted Inventory Movement: Expressed in Wholesale Cash disbursements Variable Manufacturing Costs $30.1 $29.8 $27.9 Total Equities $48.3 $50.1 $53.5 $53.9 Selling Prices (WSP) Variable Manufacturing 14.2 Fixed Manufacturing Costs 1.0 1.0 1.0 Fixed Manufacturing 1.0 Marketing and Promotion 3.9 3.8 3.6 Nail Marketing & Promotion 3.4 1.5 14 13 Next you reviewed historical sales data. There was a Lipstick Polish Creams General Administration General Administration 1.3 17 Inventory 12/31/2010 (Actual) $15.0 $11.4 $ 1.2 Interest 1.7 1.8 clear seasonal pattern to sales. After a review of past sales Interest 1.8 8.0 5.5 6.0 Total Disbursements $38.2 $37.7 $35.6 trends and a comparison of early orders already received, you Planned Production (Not S Total Disbursements $21.7 forecast sales for 2011 to be $16 million for lipstick, $11.0 Goods Available for Sale 23.0 16.9 7.2 Beginning Cash Balance $ 7.6 $ 7.0 $ 7.0 $ 5.5 million for nail polish, and $6.5 million for creams. Budgeted Sales 16.0 11.0 6.5 Beginning Cash +Receipts 37.6 35.5 34.1 You gave Susan an introduction to budgeting procedures, Ending Inventory 12/31/2011 (Budget) $ 7.0 $ 5.9 $ 0.7 + Receipts 33.5 Disbursements 38.2 37.7 35.6 - Disbursements 21.7 Loan Increase 2.2 then handed her the historical data and your sales forecasts. Budgeted Cost of Goods Manufactured and Sold -Loan Repayment 10.0 Ending Cash Balance $ 7.0 $ 7.0 $ 5.5 You asked her to prepare a complete set of budgets, but Variable Manufacturing Cost (Budget) $ 6.8 $ 4.4 $ 3.0 Ending Cash (Budgeted) $ 7.3 said, "Ignore the small stuff. Round to the nearest hundred thousand. Don't worry about taxes-in our current state they Fixed Manufacturing Cost (Budget) 0.8 0.6 0. Cost of Goods Manufactured 7.6 50 3.6 Pro-Forma Year-End Balance Sheet are not a significant issue. I need an understanding of the big Inventory 12/31/2010 (Actual Cost) 13.6 3.6 0.7 picture. I don't want to be distracted by trivial matters." Then Assets you added, "We need to improve our cash position. So include Goods Available for Sale 21.2 14.6 4.3 Cash $ 7.3 6.6 a plan for a significant reduction in ending inventories." Inventory 12/31/2011 (Budget) 5.4 0.4 Miscellaneous Current Assets 3.0 A few days later Susan brought you the budget presented Budgeted Cost of Goods Sol $14.6 $ 9.2 $ 3.9 Inventory 12.4 in Exhibit 2. "I did a walk-through of our warehouse and Property & Equipment 11.2 much of the inventory looks damaged or obsolete," she Budgeted Income Statement Goodwill 9.3 explained. "So the production budget reflects my estimate of Sales $33.5 Total Assets $43.2 the maximum amount of the inventory that is salable." Susan Cost of Goods Sold 27.7 Gross Margin 5.8 then provided the following additional information: Equities Marketing & Promotion 3.4 Bank Loan $16.3 The lipstick and nail polish lines each consist of several General Administration 1.3 Miscellaneous Current Liabilities 4.0 dozen products, which vary only in color and packaging. Interest 1.8 Common Stock 12.5 No attempt has been made to budget by the individual Pretax Income $ (0.7 Retained Earnings 10.4 product lines, as the marketing people said they are Total Equities $43.2 unable to predict in advance which products will sell well and which will sell poorly