Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What was the total fair value of all Restricted stock awards (RSA) and Restricted stock unit (RSU) grants made during fiscal 2020? On May 5,

What was the total fair value of all Restricted stock awards (RSA) and Restricted stock unit (RSU) grants made during fiscal 2020?

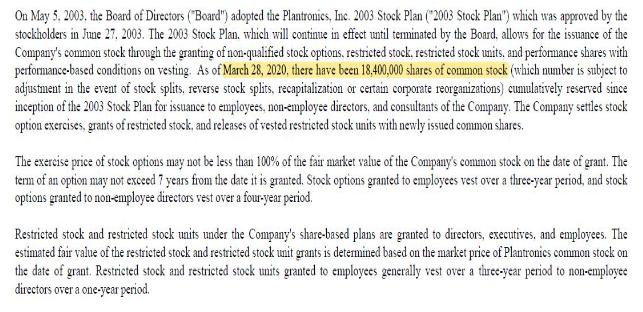

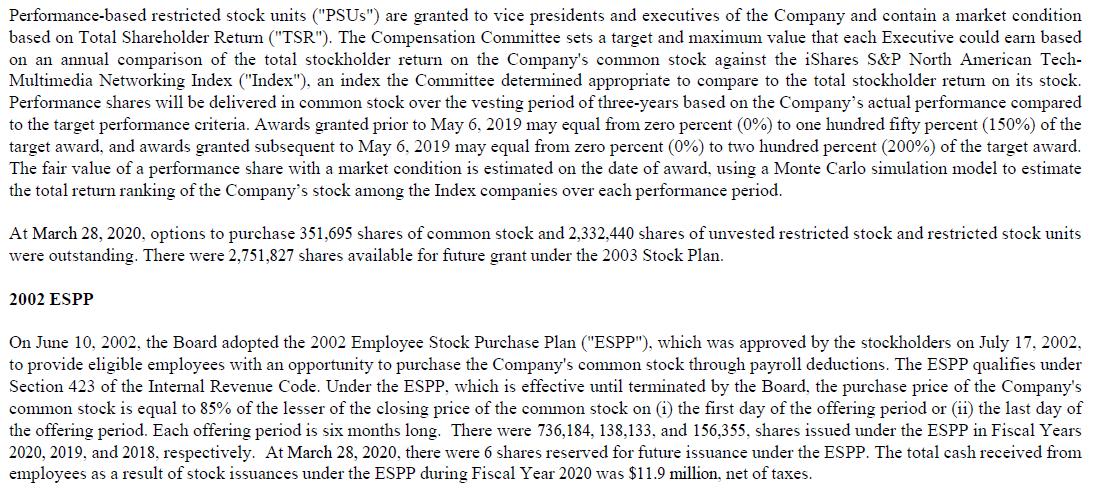

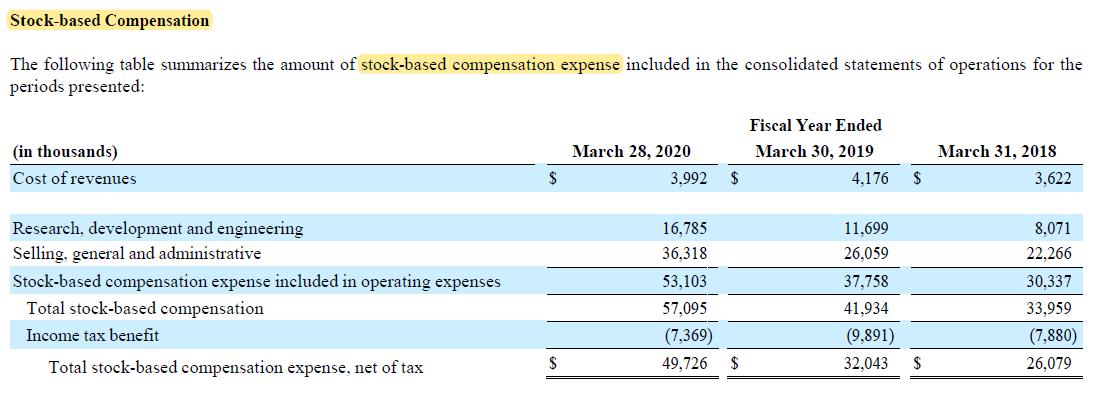

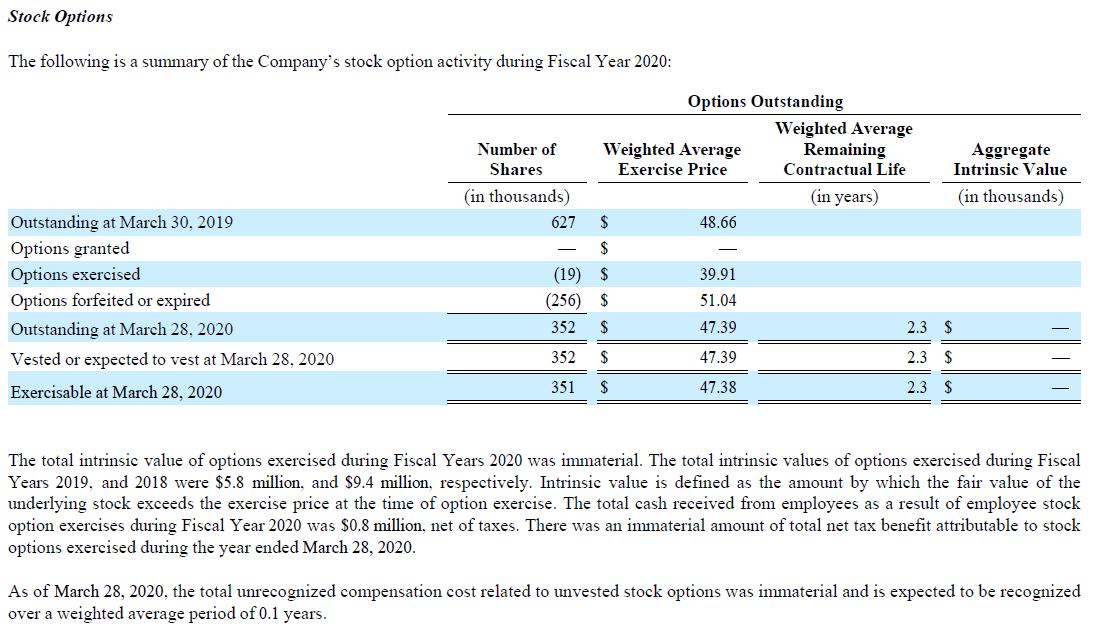

On May 5, 2003, the Board of Directors ("Board") adopted the Plantronics, Inc. 2003 Stock Plan ("2003 Stock Plan") which was approved by the stockholders in June 27. 2003. The 2003 Stock Plan, which will continue in effect until terminated by the Board. allows for the issuance of the Company's common stock through the granting of non-qualified stock options, restricted stock. restricted stock units, and performance shares with performance-based conditions on vesting. As of March 28, 2020, there have been 18,400,000 shares of common stock (which number is subject to adjustment in the event of stock splits, reverse stock splits, recapitalization or certain corporate reorganizations) cumulatively reserved since inception of the 2003 Stock Plan for issuance to employees, non-employee directors, and consultants of the Company. The Company settles stock option exercises, grants of restricted stock, and releases of vested restricted stock units with newly issued common shares. The exercise price of stock options may not be less than 100% of the fair market value of the Company's common stock on the date of grant. The term of an option may not exceed 7 years from the date it is granted. Stock options granted to employees vest over a three-year period, and stock options granted to non-employee directors vest over a four-year period. Restricted stock and restricted stock units under the Company's share-based plans are granted to directors, executives, and employees. The estimated fair value of the restricted stock and restricted stock unit grants is determined based on the market price of Plantronics common stock on the date of grant. Restricted stock and restricted stock units granted to employees generally vest over a three-year period to non-employee directors over a one-year period.

Step by Step Solution

★★★★★

3.58 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

The total fair value of restricted stock awards RS As and restricted stoc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started