Answered step by step

Verified Expert Solution

Question

1 Approved Answer

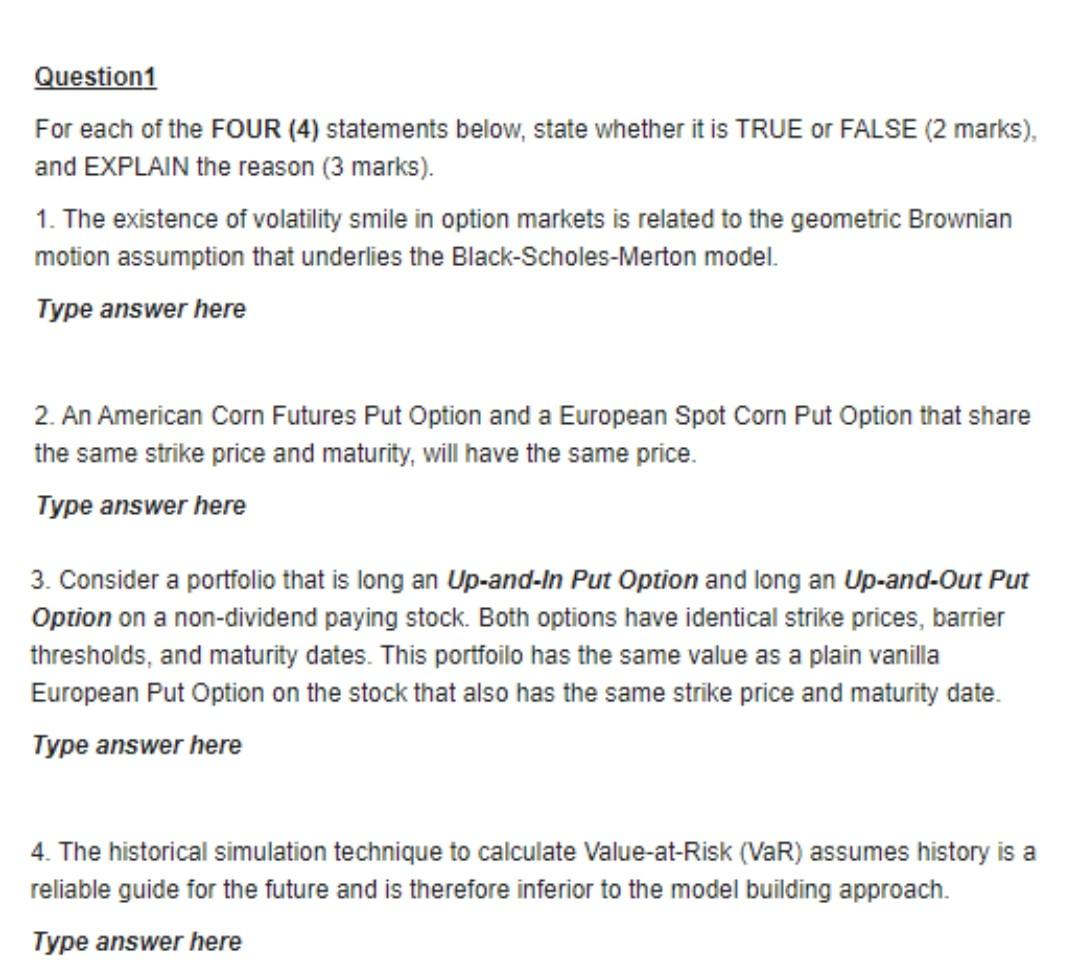

Question1 For each of the FOUR (4) statements below, state whether it is TRUE or FALSE (2 marks), and EXPLAIN the reason (3 marks). 1.

Question1 For each of the FOUR (4) statements below, state whether it is TRUE or FALSE (2 marks), and EXPLAIN the reason (3 marks). 1. The existence of volatility smile in option markets is related to the geometric Brownian motion assumption that underlies the Black-Scholes-Merton model. Type answer here 2. An American Corn Futures Put Option and a European Spot Corn Put Option that share the same strike price and maturity, will have the same price. Type answer here 3. Consider a portfolio that is long an Up-and-In Put Option and long an Up-and-Out Put Option on a non-dividend paying stock. Both options have identical strike prices, barrier thresholds, and maturity dates. This portfoilo has the same value as a plain vanilla European Put Option on the stock that also has the same strike price and maturity date. Type answer here 4. The historical simulation technique to calculate Value-at-Risk (VaR) assumes history is a reliable guide for the future and is therefore inferior to the model building approach. Type answer here

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started