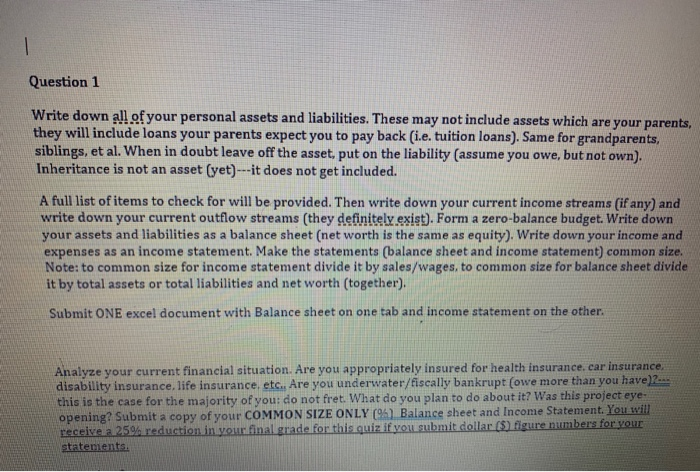

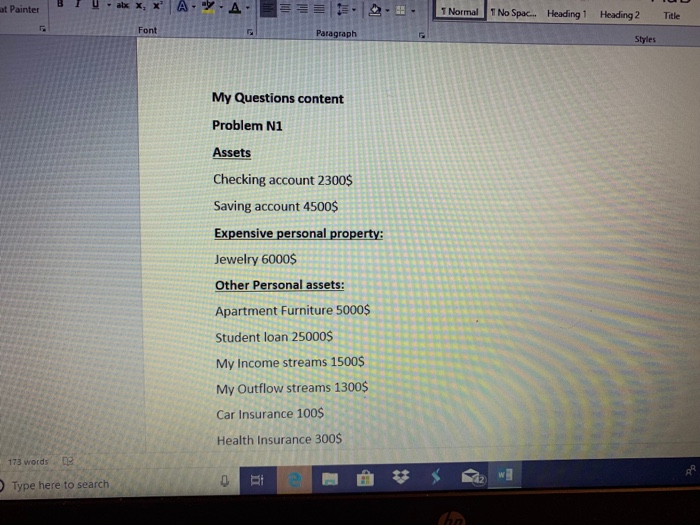

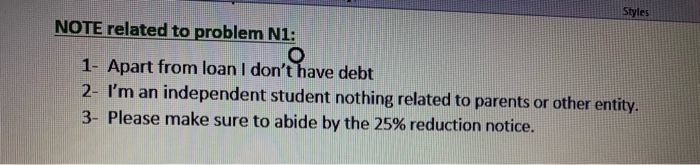

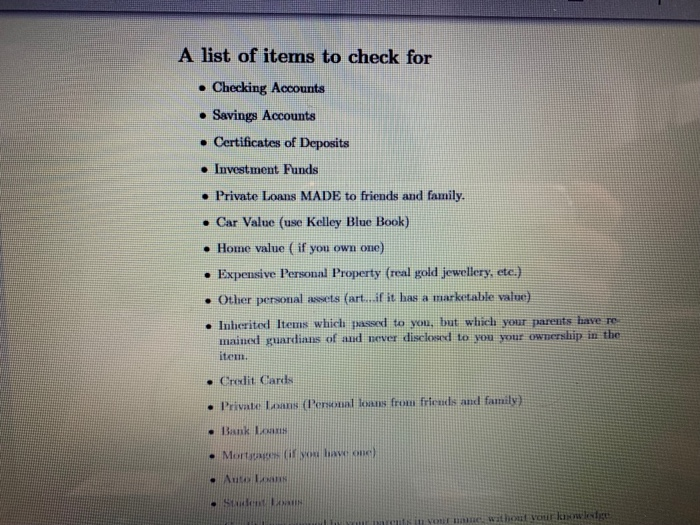

Question1 Write down all of your personal assets and liabilities. These may not include assets which are your parents they will include loans your parents expect you to pay back (i.e. tuition loans). Same for grandparents, siblings, et al. When in doubt leave off the asset put on the liability (assume you owe, but not own). Inheritance is not an asset (yet)--it does not get included. A full list of items to check for will be provided. Then write down your current income streams (if any) and write down your current outflow streams (they definitelz exist). Form a zero-balance budget. Write down your assets and liabilities as a balance sheet (net worth is the same as equity). Write down your income and expenses as an income statement. Make the statements (balance sheet and income statement) common size Note: to common size for income statement divide it by sales/wages, to common size for balance sheet divide it by total assets or total liabilities and net worth (together). Submit ONE excel document with Balance sheet on one tab and income statement on the other Analyze your current financial situation. Are you appropriately insured for health insurance. car insurance disability insurance, life insurance, etc" Are you underwater/ fiscally bankrupt (owe more than you have) this is the case for the majority of you: do not fret. What do you plan to do about it? Was this project eye- opening? Submit a copy of your cOMMON SIZE ONLY (%) Balance sheet and Income Statement. You wil receivea 25% reduction in your final grade for this guiz if you subrnit dollar rs) ngure nunubers for your B | r u , | A . . | , atx x, x . 1 LNermall 1 No Spac.. at Painter Heading 1 . Heading 2 Title Font Patagraph Styles My Questions content Problem N1 Assets Checking account 2300S Saving account 4500$ Expensive personal property: Jewelry 600os Other Personal assets: Apartment Furniture 5000s Student loan 25000S My Income streams 15009 My Outflow streams 1300$ Car Insurance 100$ Health Insurance 300S 173 words 2 w ) Type here to search Styles NOTE related to problem N1: 1- Apart from loan I don't have debt 2- I'm an independent student nothing related to parents or other entity 3- Please make sure to abide by the 25% reduction notice. A list of items to check for e Checking Accounts e Savings Accounts . Certificates of Deposits Investment Funds . Private Loans MADE to friends and family . Car Value (use Kelley Blue Book) e Home value (if you own one) . Expensive Persoual Property (real gold jewellery, ete.) . Other personal assets (art if it has a marketable value) . Inherited Items which passed to you, but which your parents have re mained xuardinus of aud never discloerd to you your ownership in the item. - Credit Cards - Private Laans (Teneunl kaus frou friuds and family) . Bank Loams Auta Loans uculs il your ne without your ki