Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION2 Over the last few years, the Bank of Ghana (BOG) has cracked the whip at the banking industry in a bid to restore sanity

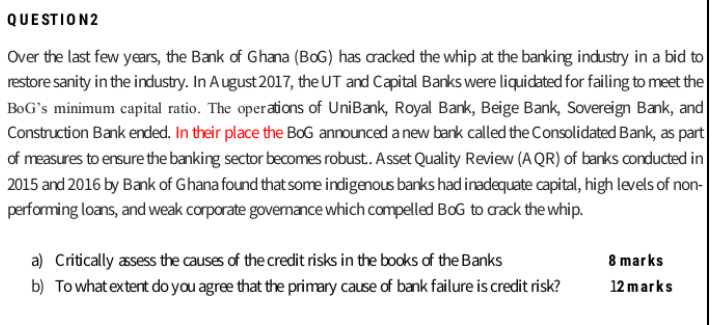

QUESTION2 Over the last few years, the Bank of Ghana (BOG) has cracked the whip at the banking industry in a bid to restore sanity in the industry. In August 2017, the UT and Capital Banks were liquidated for failing to meet the BoG's minimum capital ratio. The operations of UniBank, Royal Bank, Beige Bank, Sovereign Bank, and Construction Bank ended. In their place the Bog announced a new bank called the Consolidated Bank, as part of measures to ensure the banking sector becomes robust. Asset Quality Review (AQR) of banks conducted in 2015 and 2016 by Bank of Ghana found that some indigenous banks had inadequate capital, high levels of non- performing loans, and weak corporate governance which compelled BoG to crack the whip. a) Critically assess the causes of the credit risks in the books of the Banks b) To what extent do you agree that the primary cause of bank failure is credit risk? 8 marks 12 marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started