Answered step by step

Verified Expert Solution

Question

1 Approved Answer

question2.41pls Matehjol T ACCOUNTING COST TERMS AND CONCEPTS P2.40 Interpreting the schedule of cost of goods manured i Refer to the schedule of cost of

question2.41pls

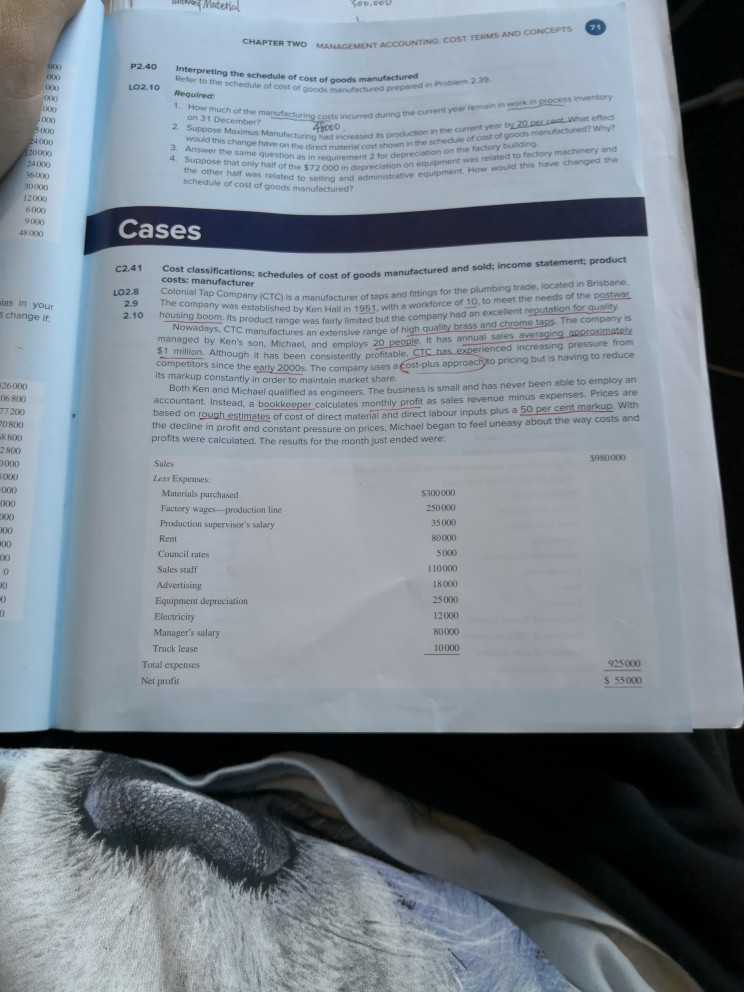

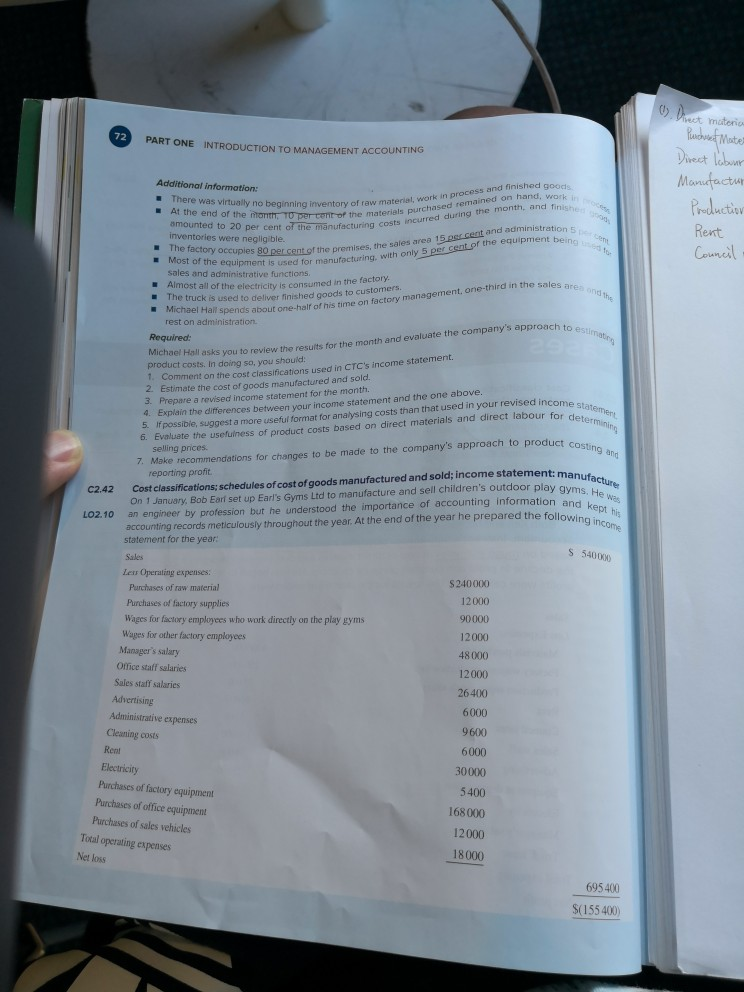

Matehjol T ACCOUNTING COST TERMS AND CONCEPTS P2.40 Interpreting the schedule of cost of goods manured i Refer to the schedule of cost of goods LO2.10 menufactured prepared in Problem 29 1. How much of the on 31 December? cogts incurred during the current year temain in work in process inventory Suppose that ane question as rcost shown in the schedule of cost of goods manufactured? why? the other half was related to selling 72 000 in depreciation on equipment was related to factory machinery and and administrative equipment How would this have changed the Answer changehave on trig hesd ncreased ts production in the curent year by 20.oscent What effect 4. Suppose that only half of the requirement 2 for depreciation on the factory building in depreciation schedule hai was related schedule of cost of goods 12000 Cases 48000 Cost classifications: schedules of cost of goods costs: manufacturer 41 manufactured and sold; income CTO is a manufacturer of taps and fittings for the plumbing trade, located in Brisbane established by Ken Hallin 1951, with a workforce of 10, to meet the needs of the postwar LO2.8 Colonial Ta las in your l change if The company was es an extensive range of high quality brass and chrome taps The company is enced increasing pressure from but is having to reduce uct range was fairly limited but the company had an excellent reputation for quality Nowadays, CTC managed by Ken's son, Michael, and employs 20 people, $1 million. Alth ough it has been consistently profitable compeitors since the eary 2000s. The company uses a Eost plus approacito pricing its markup constantly in order to maintain market share 8oh ken onistantly ar 2000 stenty proftable. Cas n qualified as engineers. The business is small and has never been able to employ an monthly profit as sales revenue minus expenses. Prices are 26000 06800 77200 0800 8 800 2800 Both Ken and Michael engineers. accountant. Instead, a bookkeeper calculates of cost of direct material and direct labour inputs plus a 50 per cent markup. With constant pressure on prices, Michael began to feel uneasy about the way costs and the decline in profit and profits were calculated. The results for the month just ended were Sales Les Expenses: Materials purchased Factory wages-production line Production supervisor's salary 35000 Council rates Sales staff Advertis Equipment depreciation 5000 1 10000 18000 25000 12000 80000 10000 0 Manager's salary Truck lease 925000 Total expenses Net profit S 55000 AT ONE INTRODUCTION TO MANAGEMENT ACCOUNTING hect lobuwr Maudactus Rent Additional in formotion: work in process and finisheda remae month, and finishe nMonth, TO per cent-of the materials purchased amounted to 20 per cent of the mnufacturing costs incurred during inventories were negligible. The factory occupies Council sales and administrofectuing, with onty h t all of the electricity is consumed in the factory. are - The truck is used to deliver finished goods to spends about one-half of his time on factory management, one-third in the sales rest on administration Required Hall asks you to review the results for the month and evaluate the company's approach to product costs. In doing so, you shouid: 1. Comment 2 Estimate the cost of goods manufactured and sold 3. Prepare a revised income statement for the month. on the cost classifications used in CTC's income statement. gest a more useful format for analysing costs than that used in your revised inco ss of product costs based on direct materials and direct labo me the differences between your income statement and the one above selling prices. 7. Make recommendations for changes to be made to the company's approach to product cost C242 Cost classifications; schedules of cost of goods manufactured and sold; income statement:m Lo2.10 an engineer by profession but he understood the importance of accounting information and reporting profit gy pt and kers On 1 January, Bob Eorf set up Earl's Gyms Ltd to manufacture and sell children's outdoor play g accounting records meticulously throughout the year. At the end of the year he prepared the followinh statement for the year Sales Letr Operating expenses. S 5400%0 S240000 12000 90000 12000 48 000 12000 26400 6000 9600 6000 30000 5400 168000 12000 18000 Purchases of raw material Purchases of factory supplies Wages for factoxy employees who work directly on the play gyms Wages for other factory employees Manager's salary Office staff salaries Administrative ex Cleaning costs Electricity Purchases of factory equipment Purchases of office equipment Purchases of sales vehicles operating expenses Net loss 695400 $(155 400)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started