Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question5 A B C D E Question6 A B C D E Question7 A B C D E Question8 A B C D E Question9

Question5

A

B

C

D

E

Question6

A

B

C

D

E

Question7

A

B

C

D

E

Question8

A

B

C

D

E

Question9

A

B

C

D

E

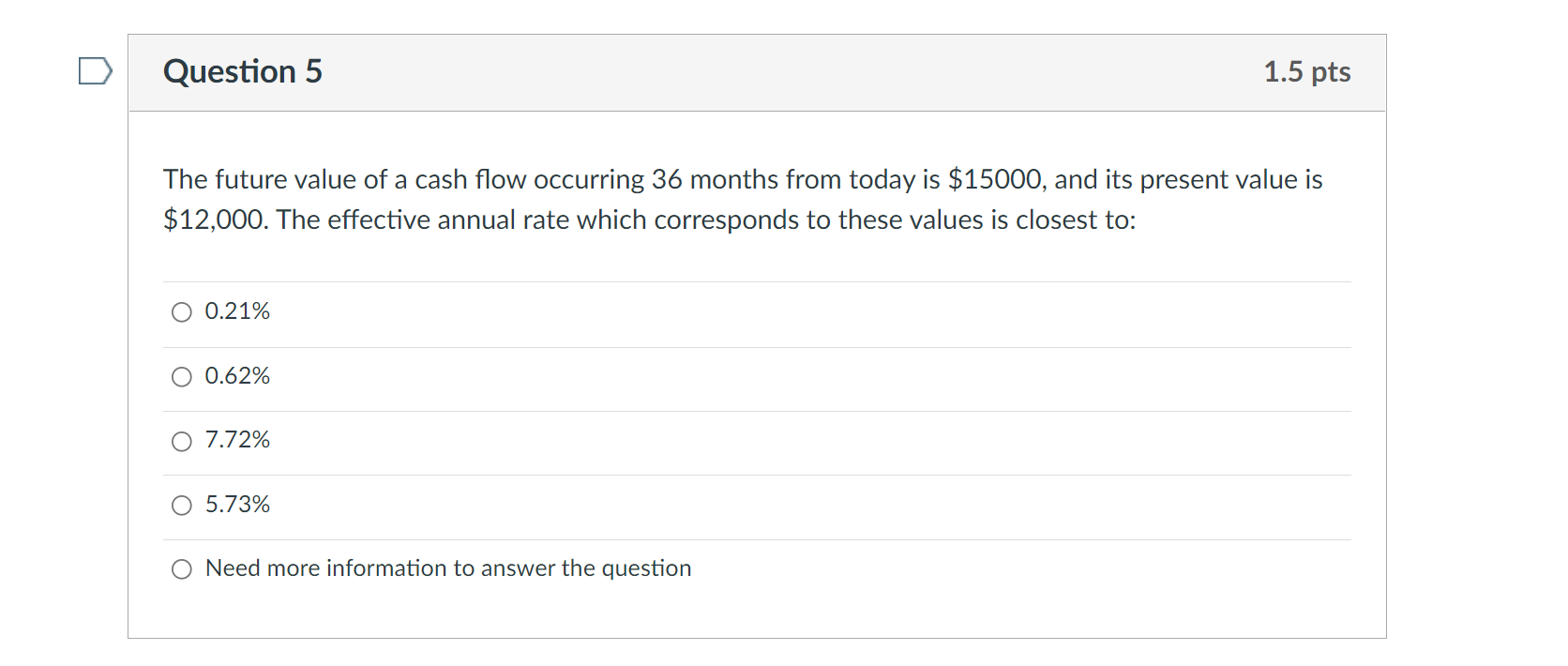

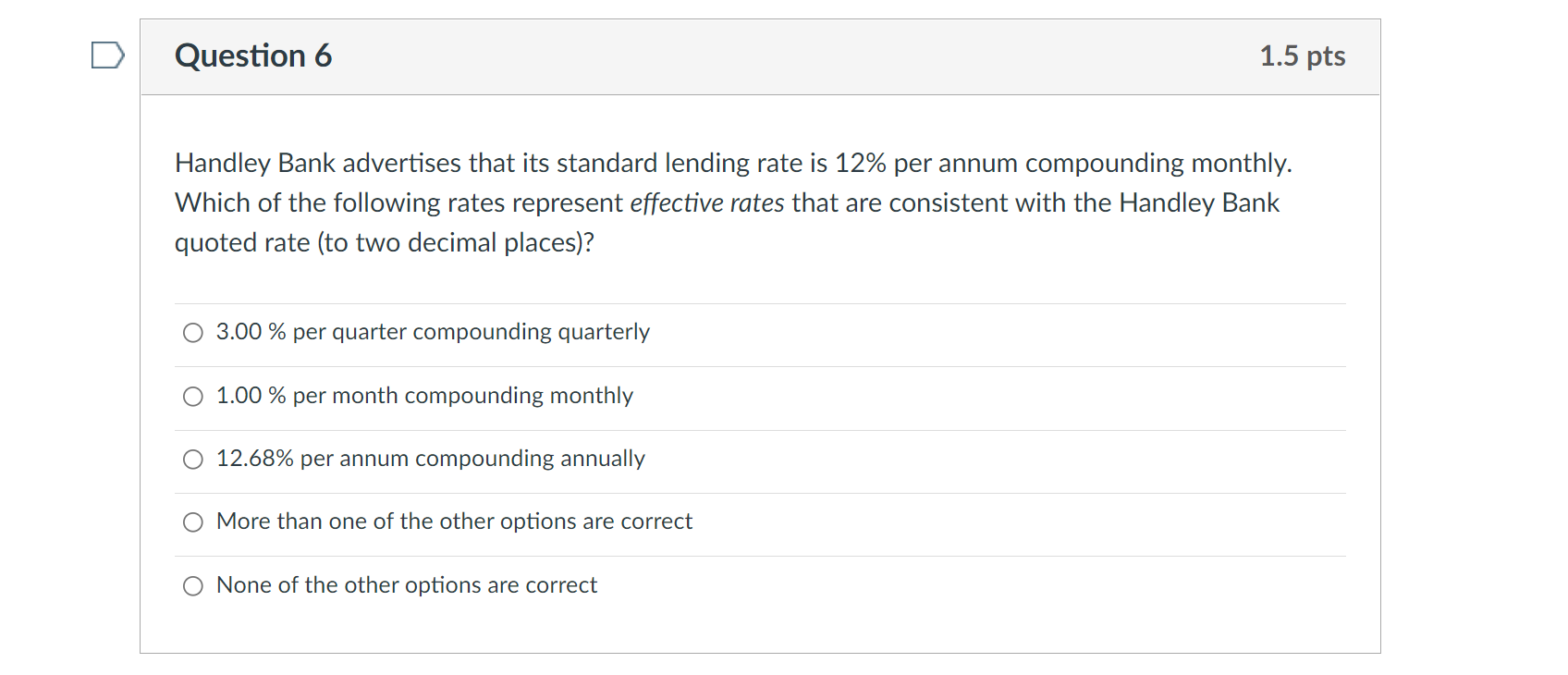

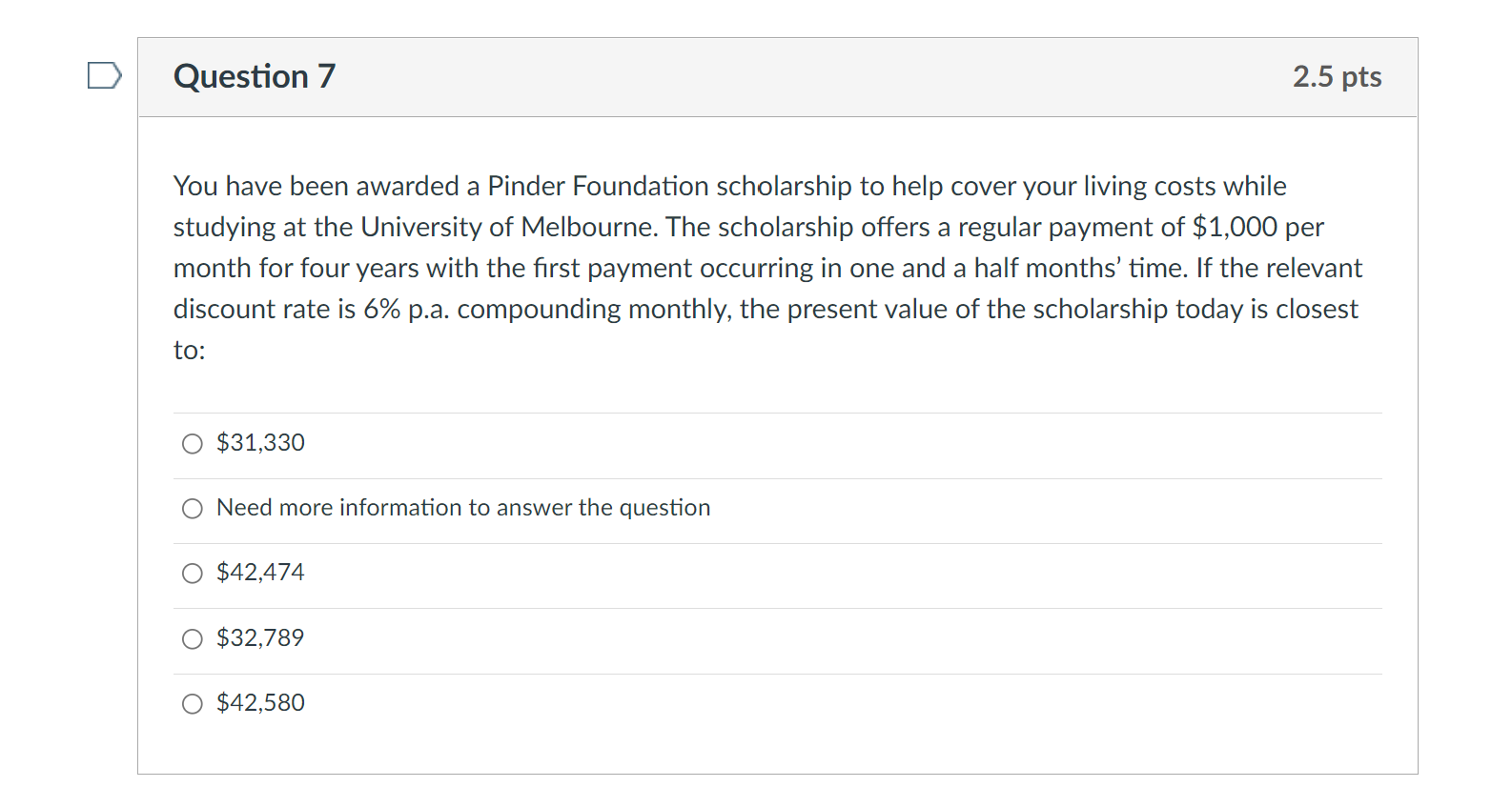

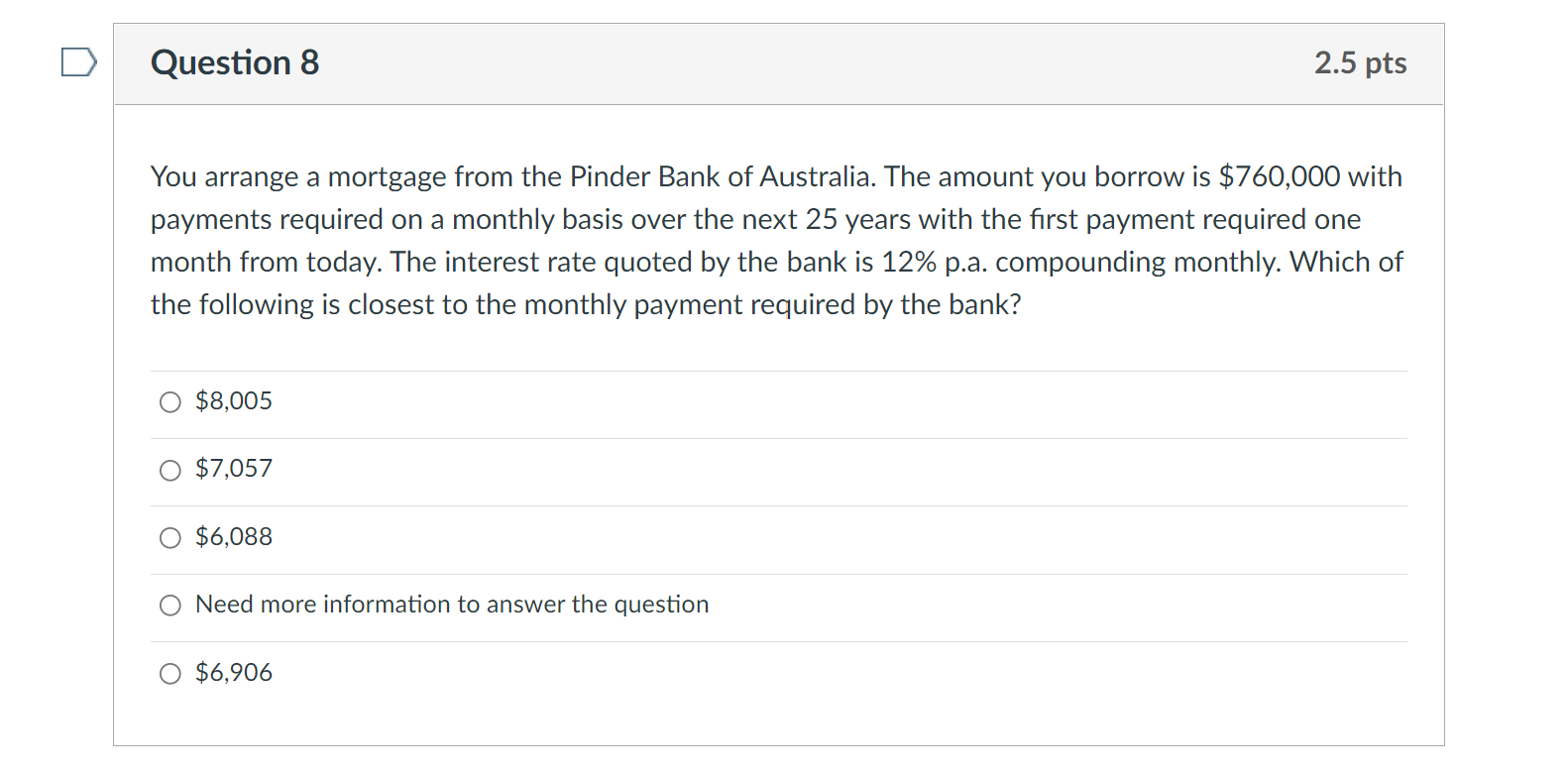

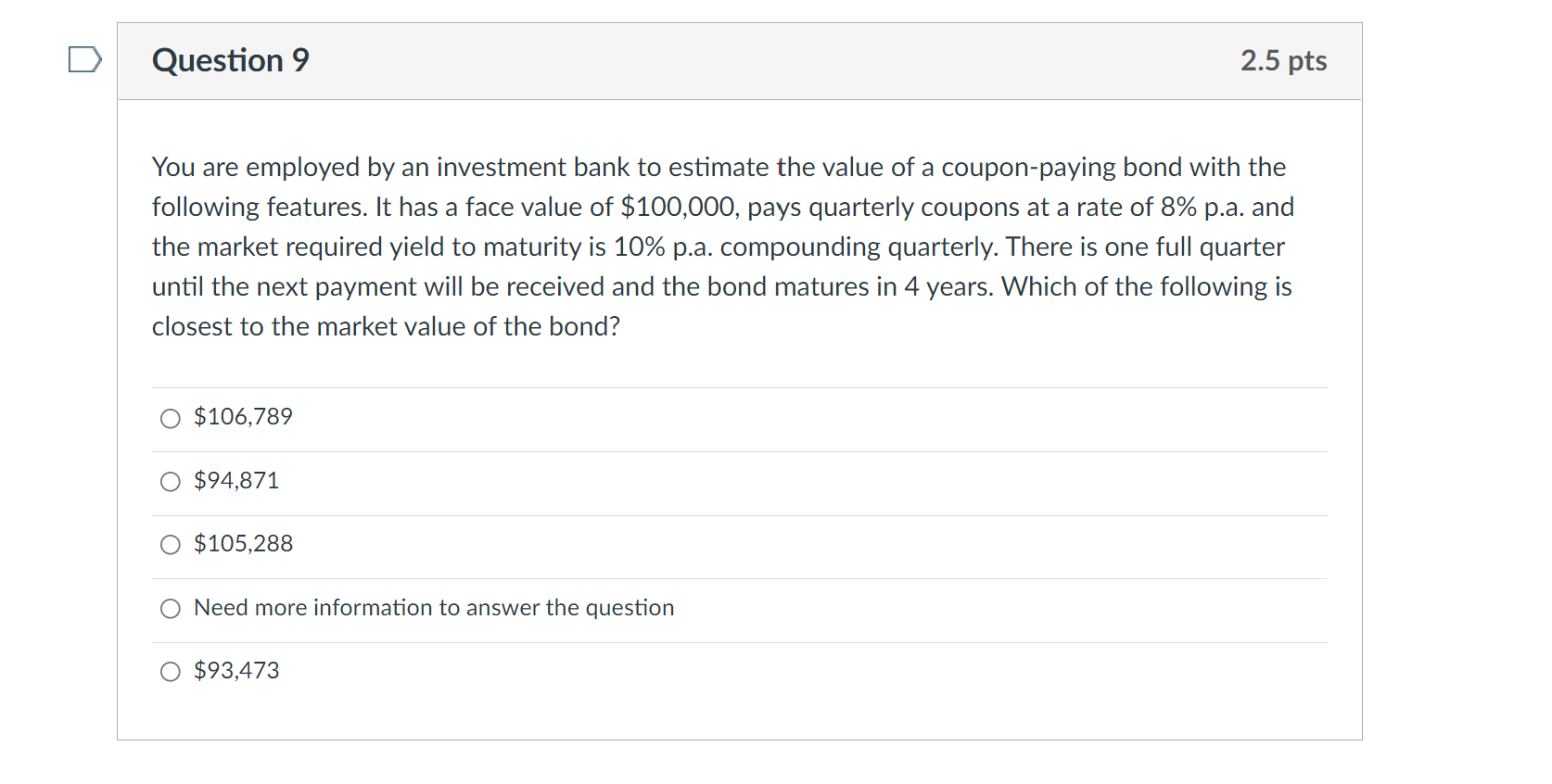

Question 5 1.5 pts The future value of a cash flow occurring 36 months from today is $15000, and its present value is $12,000. The effective annual rate which corresponds to these values is closest to: 0.21% 0.62% 7.72% 5.73% Need more information to answer the question Question 6 1.5 pts Handley Bank advertises that its standard lending rate is 12% per annum compounding monthly. Which of the following rates represent effective rates that are consistent with the Handley Bank quoted rate (to two decimal places)? 3.00 % per quarter compounding quarterly 1.00 % per month compounding monthly 12.68% per annum compounding annually More than one of the other options are correct None of the other options are correct Question 7 2.5 pts You have been awarded a Pinder Foundation scholarship to help cover your living costs while studying at the University of Melbourne. The scholarship offers a regular payment of $1,000 per month for four years with the first payment occurring in one and a half months' time. If the relevant discount rate is 6% p.a. compounding monthly, the present value of the scholarship today is closest to: O $31,330 Need more information to answer the question $42,474 $32,789 O $42,580 Question 8 2.5 pts You arrange a mortgage from the Pinder Bank of Australia. The amount you borrow is $760,000 with payments required on a monthly basis over the next 25 years with the first payment required one month from today. The interest rate quoted by the bank is 12% p.a. compounding monthly. Which of the following is closest to the monthly payment required by the bank? $8,005 O $7,057 $6,088 Need more information to answer the question O $6,906 Question 9 2.5 pts You are employed by an investment bank to estimate the value of a coupon-paying bond with the following features. It has a face value of $100,000, pays quarterly coupons at a rate of 8% p.a. and the market required yield to maturity is 10% p.a. compounding quarterly. There is one full quarter until the next payment will be received and the bond matures in 4 years. Which of the following is closest to the market value of the bond? $106,789 $94,871 $105,288 Need more information to answer the question $93,473Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started