Answered step by step

Verified Expert Solution

Question

1 Approved Answer

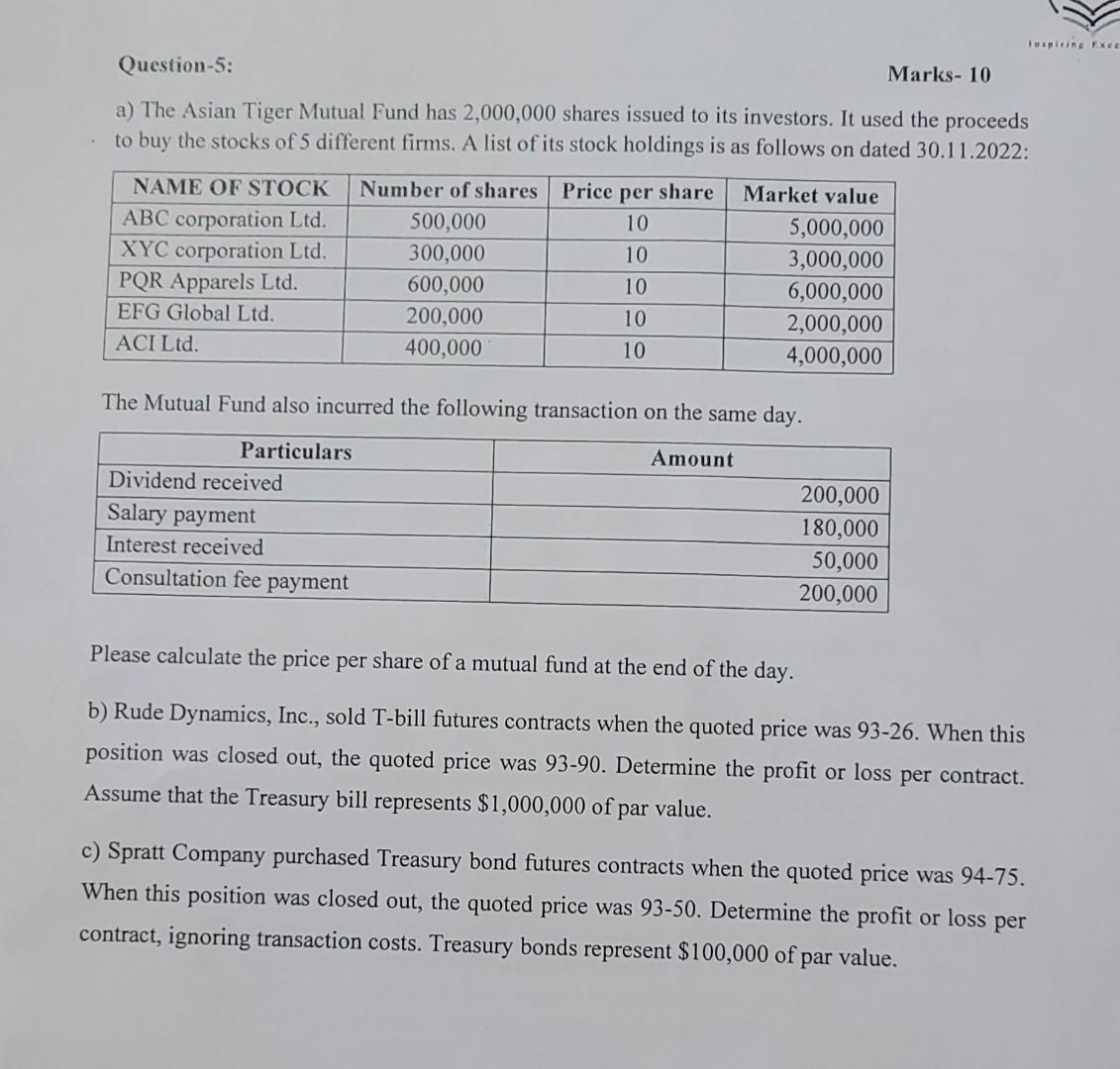

Question-5: Marks- 10 a) The Asian Tiger Mutual Fund has 2,000,000 shares issued to its investors. It used the proceeds to buy the stocks

Question-5: Marks- 10 a) The Asian Tiger Mutual Fund has 2,000,000 shares issued to its investors. It used the proceeds to buy the stocks of 5 different firms. A list of its stock holdings is as follows on dated 30.11.2022: Price NAME OF STOCK ABC corporation Ltd. XYC corporation Ltd. PQR Apparels Ltd. EFG Global Ltd. ACI Ltd. Number of shares 500,000 300,000 600,000 200,000 400,000 Dividend received Salary payment Interest received Consultation fee payment per 10 10 10 10 10 share Market value 5,000,000 3,000,000 6,000,000 2,000,000 4,000,000 The Mutual Fund also incurred the following transaction on the same day. Particulars Amount 200,000 180,000 50,000 200,000 Please calculate the price per share of a mutual fund at the end of the day. b) Rude Dynamics, Inc., sold T-bill futures contracts when the quoted price was 93-26. When this position was closed out, the quoted price was 93-90. Determine the profit or loss per contract. Assume that the Treasury bill represents $1,000,000 of par value. Inspiring Exce c) Spratt Company purchased Treasury bond futures contracts when the quoted price was 94-75. When this position was closed out, the quoted price was 93-50. Determine the profit or loss per contract, ignoring transaction costs. Treasury bonds represent $100,000 of par value.

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a Price per share of the mutual fund at the end of the day M...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started