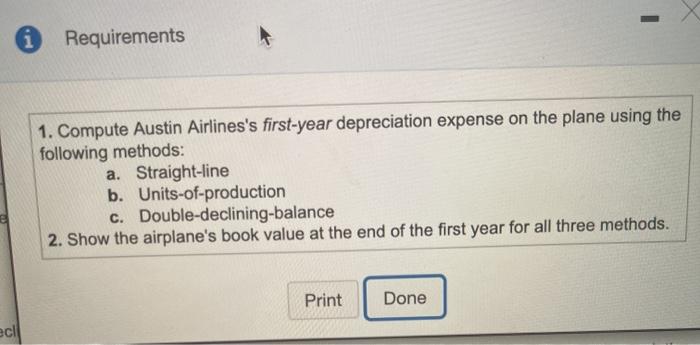

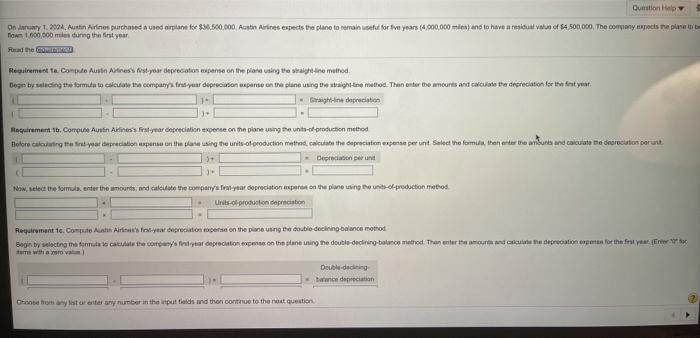

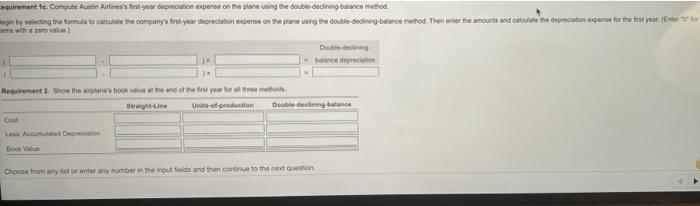

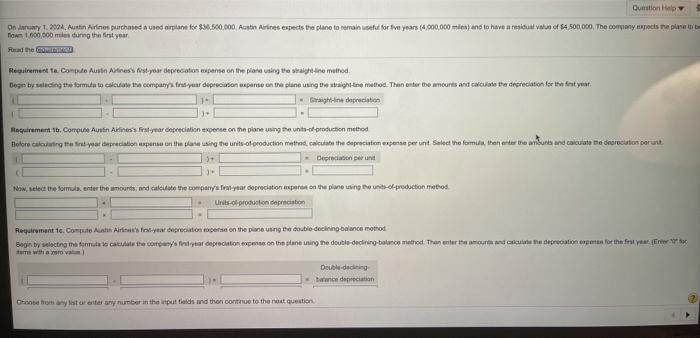

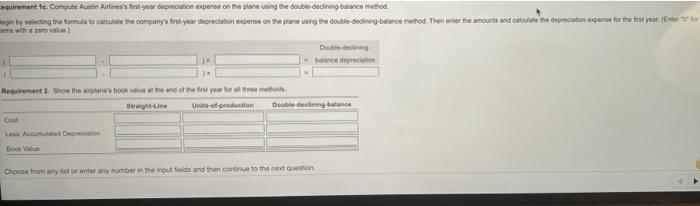

Questione On nyt.2024. Austin Airlines purchased and simple tee $26.500.000 Austin Arines espects the plane to permain use for five years (4,000,000 in and to have a resident value of 54,500,000. The company expects the plane to be Town 1.600.000 miles during the first year Read the CB Requirement to computo Austin Autress star depreciation expense on the plane using the straine muhed. Begies by cing the formula to close the company frusyuar depression expanse on the plane using the right method. Then enter the amounts and calculate the depreciation for the first yeat. Requirement 16. Compute Auvin Aisyear depreciation expense on the plane using the units of production method Beforo condutor e tratar depreciation penso en the para using the units of production methods, calculate the depreciation expense per unt Select the family, then we te burks and calculate e drevocation perunt Depreciation peut Now, select the formulenter the mounts, and cut the company year depreciation expert on the plane using the production metros Units-oproduction precision Requirement te. Come Ash Airworpreciation expense on the plane using the coloring balance method Begin by selecting the food to the company depreciation expens on the plane using the double declining method. Then enter the amount and a deprecationerpens for the first year with Dedeng ce derection Choose from your enter any number in the input finds and then continue to the next question equirement 1. Compote Austin Airlines Pratya depreciation expense on the plane using the double declining balance method legaty na forma to call the company's first year depreciation expense on the plane using the double declining balance method. Then enter the wounts and cautaro he depreciation expense tre first you (Enter Wis valus) Double Requirement show the OR end of the rewood BrightLine Uns-of-production Double declining balance Law Accu Detroit Choose from any to enter any number the input beide and then come to the next stion Questione On nyt.2024. Austin Airlines purchased and simple tee $26.500.000 Austin Arines espects the plane to permain use for five years (4,000,000 in and to have a resident value of 54,500,000. The company expects the plane to be Town 1.600.000 miles during the first year Read the CB Requirement to computo Austin Autress star depreciation expense on the plane using the straine muhed. Begies by cing the formula to close the company frusyuar depression expanse on the plane using the right method. Then enter the amounts and calculate the depreciation for the first yeat. Requirement 16. Compute Auvin Aisyear depreciation expense on the plane using the units of production method Beforo condutor e tratar depreciation penso en the para using the units of production methods, calculate the depreciation expense per unt Select the family, then we te burks and calculate e drevocation perunt Depreciation peut Now, select the formulenter the mounts, and cut the company year depreciation expert on the plane using the production metros Units-oproduction precision Requirement te. Come Ash Airworpreciation expense on the plane using the coloring balance method Begin by selecting the food to the company depreciation expens on the plane using the double declining method. Then enter the amount and a deprecationerpens for the first year with Dedeng ce derection Choose from your enter any number in the input finds and then continue to the next question equirement 1. Compote Austin Airlines Pratya depreciation expense on the plane using the double declining balance method legaty na forma to call the company's first year depreciation expense on the plane using the double declining balance method. Then enter the wounts and cautaro he depreciation expense tre first you (Enter Wis valus) Double Requirement show the OR end of the rewood BrightLine Uns-of-production Double declining balance Law Accu Detroit Choose from any to enter any number the input beide and then come to the next stion