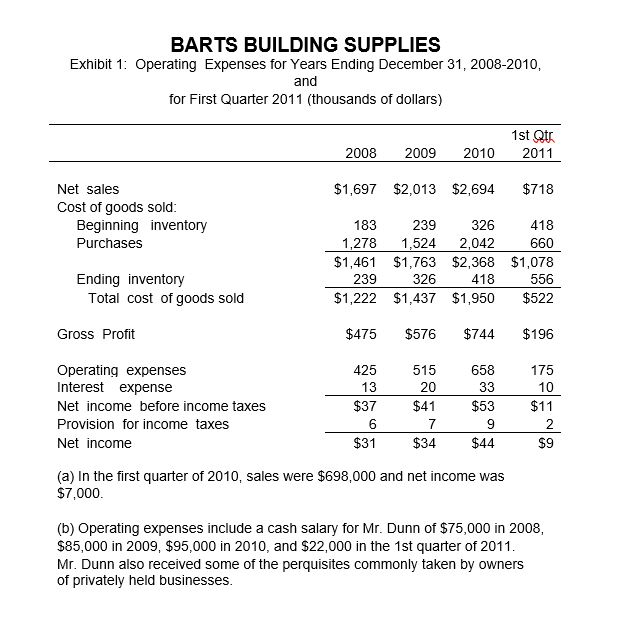

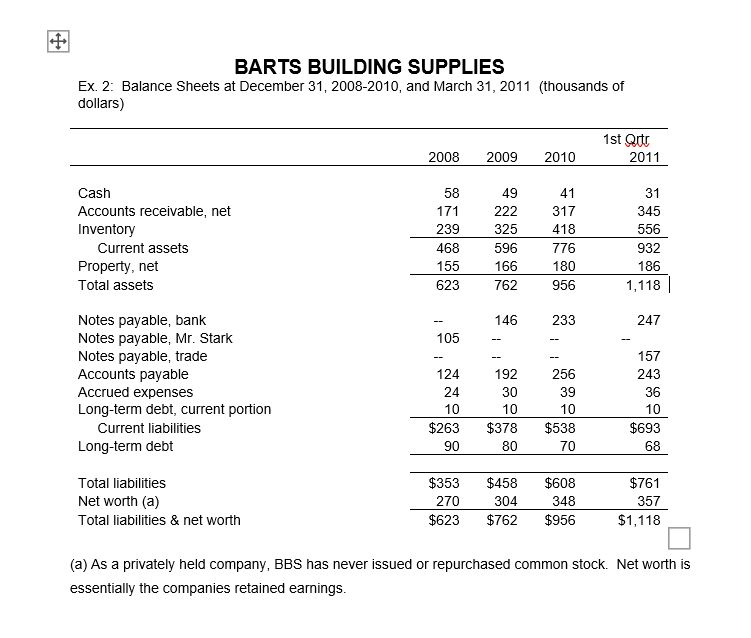

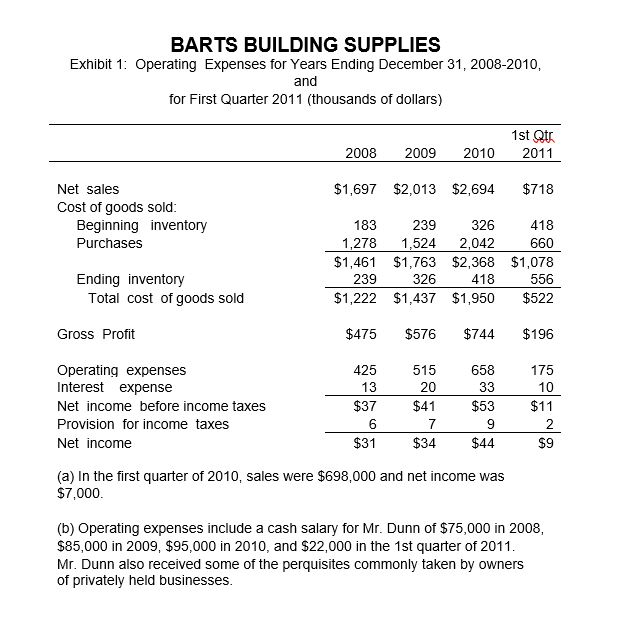

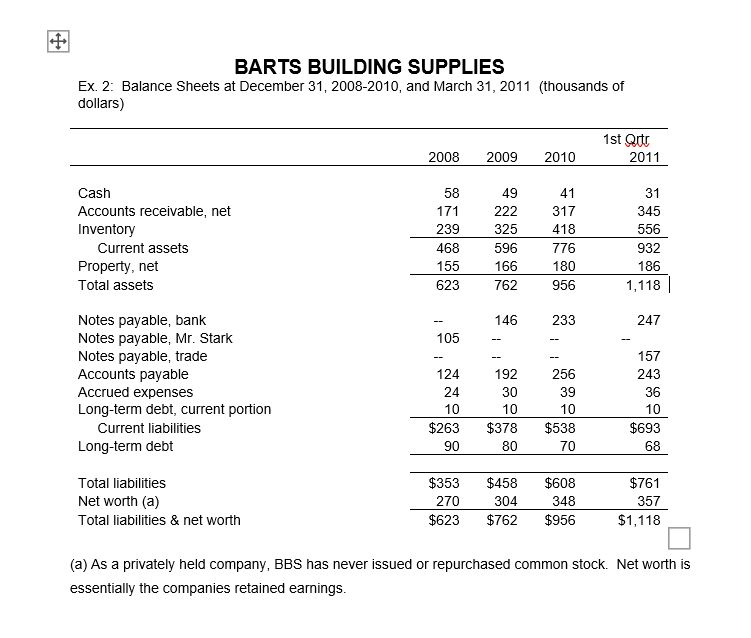

Questions 1. From 2008 to 2010, examine the changes in every balance sheet item (plus net income). How much did each item change by and was this a source or a use of cash from BBS perspective? 2. Is BBS financially "healthy"? Hint: Calculate the financial in years 2008, 2009, and 2010 and say something about how the company is performing and whether certain ratios are getting better or worse. Focus on these ratios: debt to assets, current ratio, ROA, PM, and the turnover ratios (inventory, AP, and AR). BARTS BUILDING SUPPLIES Exhibit 1: Operating Expenses for Years Ending December 31, 2008-2010, and for First Quarter 2011 (thousands of dollars) 2008 2009 2010 1st Qtr 2011 $1,697 $2,013 $2,694 $718 Net sales Cost of goods sold: Beginning inventory Purchases 183 1,278 $1,461 239 $1,222 239 1,524 $1,763 326 $1,437 326 2,042 $2,368 418 $1,950 418 660 $1,078 556 Ending inventory Total cost of goods sold $522 Gross Profit Operating expenses Interest expense Net income before income taxes Provision for income taxes Net income $475 425 13 $37 $576 515 20 $41 $744 658 33 $53 $196 175 10 $11 7 67 9 $31 $34 $44 $9 (a) In the first quarter of 2010, sales were $698,000 and net income was $7,000. (b) Operating expenses include a cash salary for Mr. Dunn of $75,000 in 2008, $85,000 in 2009, $95,000 in 2010, and $22,000 in the 1st quarter of 2011. Mr. Dunn also received some of the perquisites commonly taken by owners of privately held businesses. BARTS BUILDING SUPPLIES Ex. 2: Balance Sheets at December 31, 2008-2010, and March 31, 2011 (thousands of dollars) 2008 2009 2010 1st Qitr 2011 49 Cash Accounts receivable, net Inventory Current assets Property, net Total assets 58 171 239 468 155 623 222 325 596 166 41 317 418 776 180 956 31 345 556 932 186 1,118 762 146 233 247 105 124 Notes payable, bank Notes payable, Mr. Stark Notes payable, trade Accounts payable Accrued expenses Long-term debt, current portion Current liabilities Long-term debt 256 39 192 24 1010 $263 $378 90 80 157 243 36 10 $693 68 10 $538 70 Total liabilities Net worth (a) Total liabilities & net worth $353 270 $623 $458 304 $762 $608 348 $956 $761 357 $1,118 (a) As a privately held company, BBS has never issued or repurchased common stock. Net worth is essentially the companies retained earnings