Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Questions 1 . In the accompanying spreadsheet, HW 2 data.xlsx , continuously - compounded Treasury zero - coupon yields for maturities 0 . 5 to

Questions

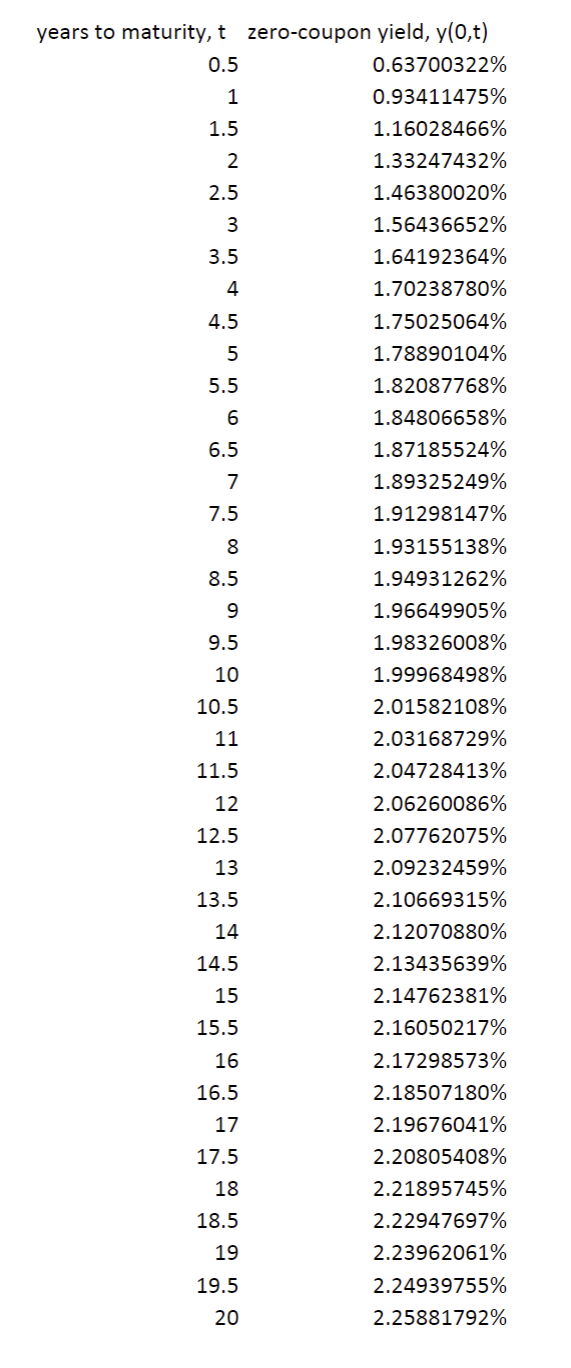

In the accompanying spreadsheet, HW data.xlsx continuouslycompounded Treasury zerocoupon

yields for maturities to years are provided. Plot the spot curve.

Calculate zerocoupon bond prices, Pt for every maturity. Plot the discount function.

Calculate noarbitrage month zerocoupon bond forward prices FOtt

Calculate noarbitrage month forward rates, ftt and plot the forward curve in the same

plot as the spot curve. Is the forward curve above or below the spot curve? Explain why.

Calculate semiannuallycompounded par rates for every maturity. Find the continuouslycompounded

par rates and plot the par curve in the same plot as the spot and forward curves.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started