Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Questions 1.) Jamie Lee is trying to decide whether to use Form 1040EZ and Form 1040A to file her federal income tax return. Using the

Questions

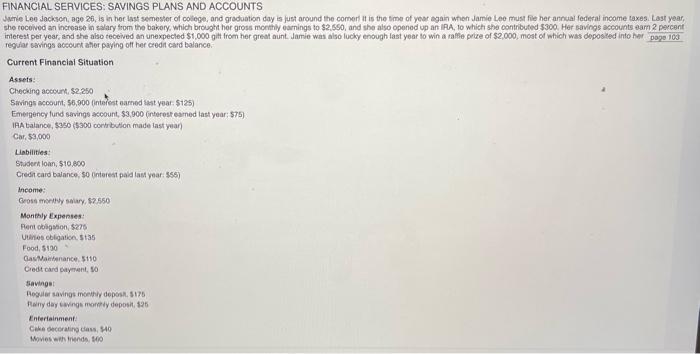

1.) Jamie Lee is trying to decide whether to use Form 1040EZ and Form 1040A to file her federal income tax return. Using the Financial Literacy in Practice feature in this chapter, choose the most appropriate federal tax filing form for Jamie to use and describe your reasoning for making this choice.

2.)What impact on Jamie Lees income will the gift of $1,000 from her great aunt have on her adjusted gross income? Will there be an impact on the adjusted gross income with her $2,000 raffle prize winnings? Explain your answer.

3.)Using Exhibit 31 as a guide, calculate Jamie Lees adjusted gross income amount by completing the table below:

Gross income

() Adjustments to income

= Adjusted gross income

4.)What would Jamie Lees filing status be considered?

5.) Jamie Lee has a marginal tax rate of 15 percent and an average tax rate of 11 percent. Explain why there is a difference between the two rates.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started