Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Questions 1 to 20 Is the Income Statement a flow or a static statement? Do Income Statement numbers get bigger, smaller, or neither - as

Questions 1 to 20

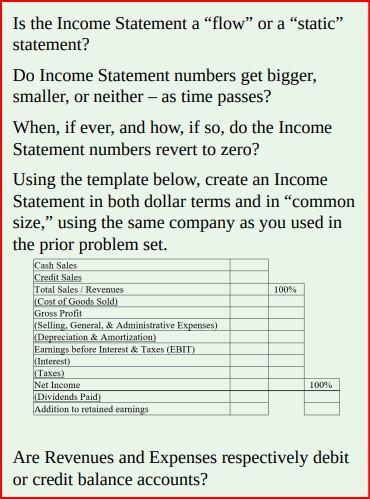

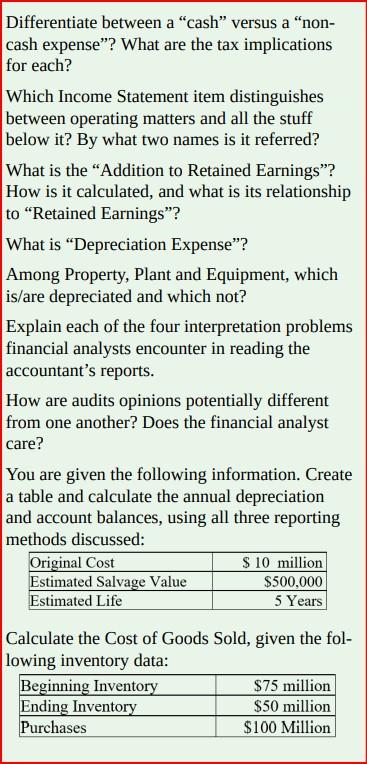

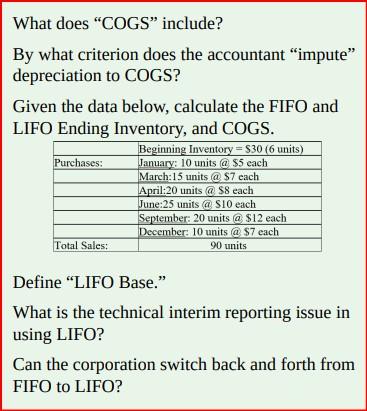

Is the Income Statement a "flow" or a "static" statement? Do Income Statement numbers get bigger, smaller, or neither - as time passes? When, if ever, and how, if so, do the Income Statement numbers revert to zero? Using the template below, create an Income Statement in both dollar terms and in "common size," using the same company as you used in the prior problem set. Are Revenues and Expenses respectively debit or credit balance accounts? Differentiate between a "cash" versus a "noncash expense"? What are the tax implications for each? Which Income Statement item distinguishes between operating matters and all the stuff below it? By what two names is it referred? What is the "Addition to Retained Earnings"? How is it calculated, and what is its relationship to "Retained Earnings"? What is "Depreciation Expense"? Among Property, Plant and Equipment, which is/are depreciated and which not? Explain each of the four interpretation problems financial analysts encounter in reading the accountant's reports. How are audits opinions potentially different from one another? Does the financial analyst care? You are given the following information. Create a table and calculate the annual depreciation and account balances, using all three reporting methods discussed: Calculate the Cost of Goods Sold, given the following inventory data: What does "COGS" include? By what criterion does the accountant "impute" depreciation to COGS? Given the data below, calculate the FIFO and LIFO Ending Inventory, and COGS. Define "LIFO Base." What is the technical interim reporting issue in using LIFO? Can the corporation switch back and forth from FIFO to LIFO? Is the Income Statement a "flow" or a "static" statement? Do Income Statement numbers get bigger, smaller, or neither - as time passes? When, if ever, and how, if so, do the Income Statement numbers revert to zero? Using the template below, create an Income Statement in both dollar terms and in "common size," using the same company as you used in the prior problem set. Are Revenues and Expenses respectively debit or credit balance accounts? Differentiate between a "cash" versus a "noncash expense"? What are the tax implications for each? Which Income Statement item distinguishes between operating matters and all the stuff below it? By what two names is it referred? What is the "Addition to Retained Earnings"? How is it calculated, and what is its relationship to "Retained Earnings"? What is "Depreciation Expense"? Among Property, Plant and Equipment, which is/are depreciated and which not? Explain each of the four interpretation problems financial analysts encounter in reading the accountant's reports. How are audits opinions potentially different from one another? Does the financial analyst care? You are given the following information. Create a table and calculate the annual depreciation and account balances, using all three reporting methods discussed: Calculate the Cost of Goods Sold, given the following inventory data: What does "COGS" include? By what criterion does the accountant "impute" depreciation to COGS? Given the data below, calculate the FIFO and LIFO Ending Inventory, and COGS. Define "LIFO Base." What is the technical interim reporting issue in using LIFO? Can the corporation switch back and forth from FIFO to LIFOStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started