Answered step by step

Verified Expert Solution

Question

1 Approved Answer

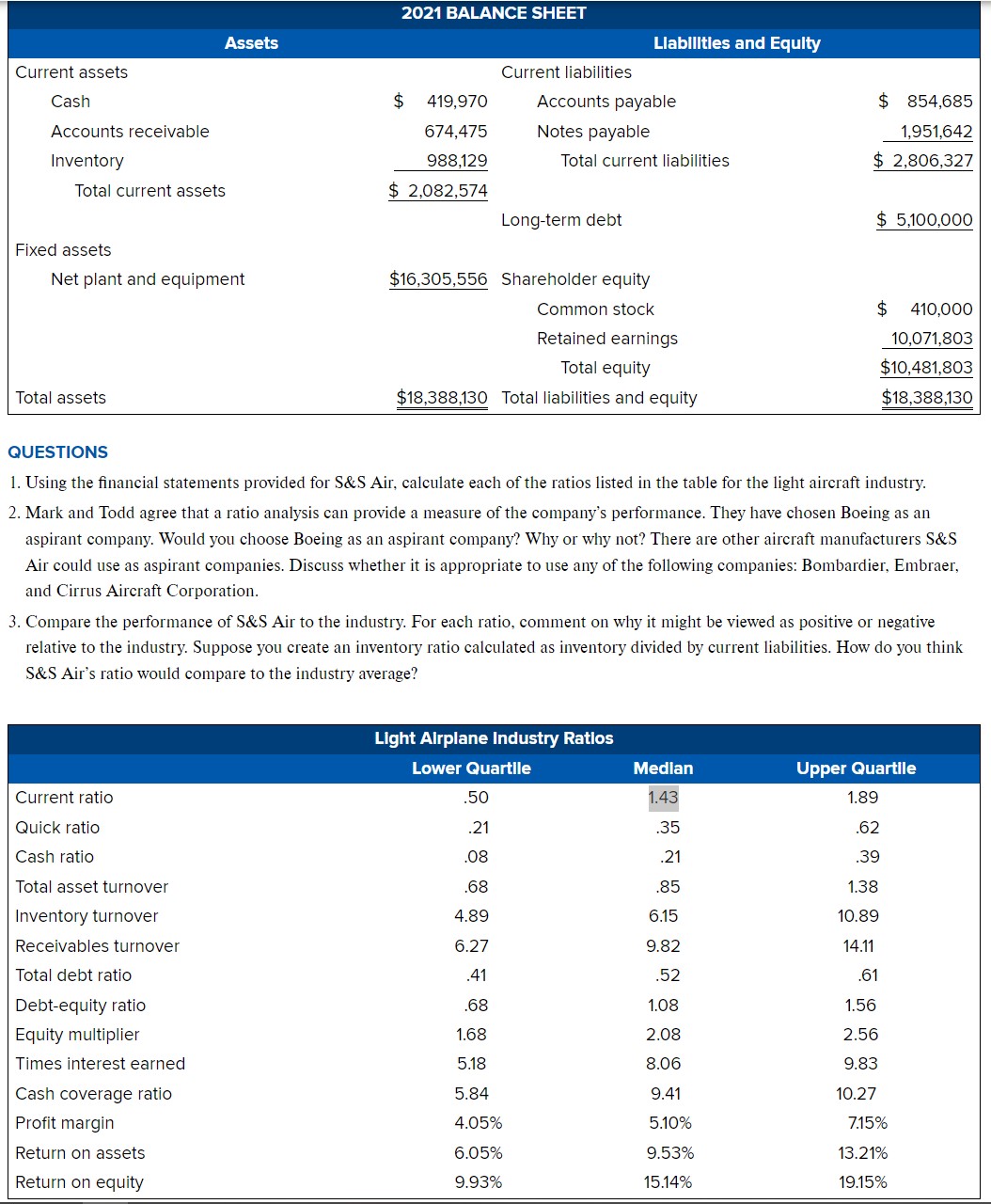

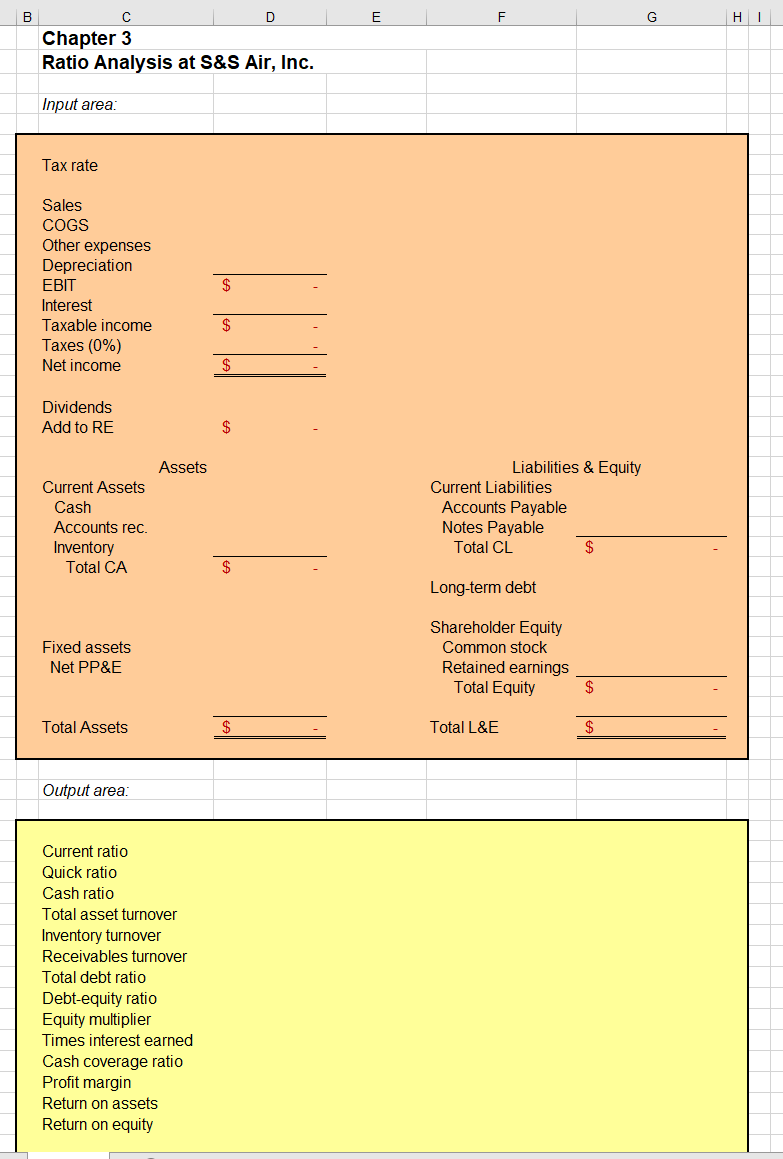

QUESTIONS 1. Using the financial statements provided for S&S Air, calculate each of the ratios listed in the table for the light aircraft industry. 2.

QUESTIONS 1. Using the financial statements provided for S\&S Air, calculate each of the ratios listed in the table for the light aircraft industry. 2. Mark and Todd agree that a ratio analysis can provide a measure of the company's performance. They have chosen Boeing as an aspirant company. Would you choose Boeing as an aspirant company? Why or why not? There are other aircraft manufacturers S\&S Air could use as aspirant companies. Discuss whether it is appropriate to use any of the following companies: Bombardier, Embraer, and Cirrus Aircraft Corporation. 3. Compare the performance of S\&S Air to the industry. For each ratio, comment on why it might be viewed as positive or negative relative to the industry. Suppose you create an inventory ratio calculated as inventory divided by current liabilities. How do you think S\&S Air's ratio would compare to the industry average? QUESTIONS 1. Using the financial statements provided for S\&S Air, calculate each of the ratios listed in the table for the light aircraft industry. 2. Mark and Todd agree that a ratio analysis can provide a measure of the company's performance. They have chosen Boeing as an aspirant company. Would you choose Boeing as an aspirant company? Why or why not? There are other aircraft manufacturers S\&S Air could use as aspirant companies. Discuss whether it is appropriate to use any of the following companies: Bombardier, Embraer, and Cirrus Aircraft Corporation. 3. Compare the performance of S\&S Air to the industry. For each ratio, comment on why it might be viewed as positive or negative relative to the industry. Suppose you create an inventory ratio calculated as inventory divided by current liabilities. How do you think S\&S Air's ratio would compare to the industry average

QUESTIONS 1. Using the financial statements provided for S\&S Air, calculate each of the ratios listed in the table for the light aircraft industry. 2. Mark and Todd agree that a ratio analysis can provide a measure of the company's performance. They have chosen Boeing as an aspirant company. Would you choose Boeing as an aspirant company? Why or why not? There are other aircraft manufacturers S\&S Air could use as aspirant companies. Discuss whether it is appropriate to use any of the following companies: Bombardier, Embraer, and Cirrus Aircraft Corporation. 3. Compare the performance of S\&S Air to the industry. For each ratio, comment on why it might be viewed as positive or negative relative to the industry. Suppose you create an inventory ratio calculated as inventory divided by current liabilities. How do you think S\&S Air's ratio would compare to the industry average? QUESTIONS 1. Using the financial statements provided for S\&S Air, calculate each of the ratios listed in the table for the light aircraft industry. 2. Mark and Todd agree that a ratio analysis can provide a measure of the company's performance. They have chosen Boeing as an aspirant company. Would you choose Boeing as an aspirant company? Why or why not? There are other aircraft manufacturers S\&S Air could use as aspirant companies. Discuss whether it is appropriate to use any of the following companies: Bombardier, Embraer, and Cirrus Aircraft Corporation. 3. Compare the performance of S\&S Air to the industry. For each ratio, comment on why it might be viewed as positive or negative relative to the industry. Suppose you create an inventory ratio calculated as inventory divided by current liabilities. How do you think S\&S Air's ratio would compare to the industry average Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started