Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Questions 11 through 15 please. Thanks! 11. Cory took and passed the Special Enrollment Exam last year. He has kept up with his continuing education

Questions 11 through 15 please. Thanks!

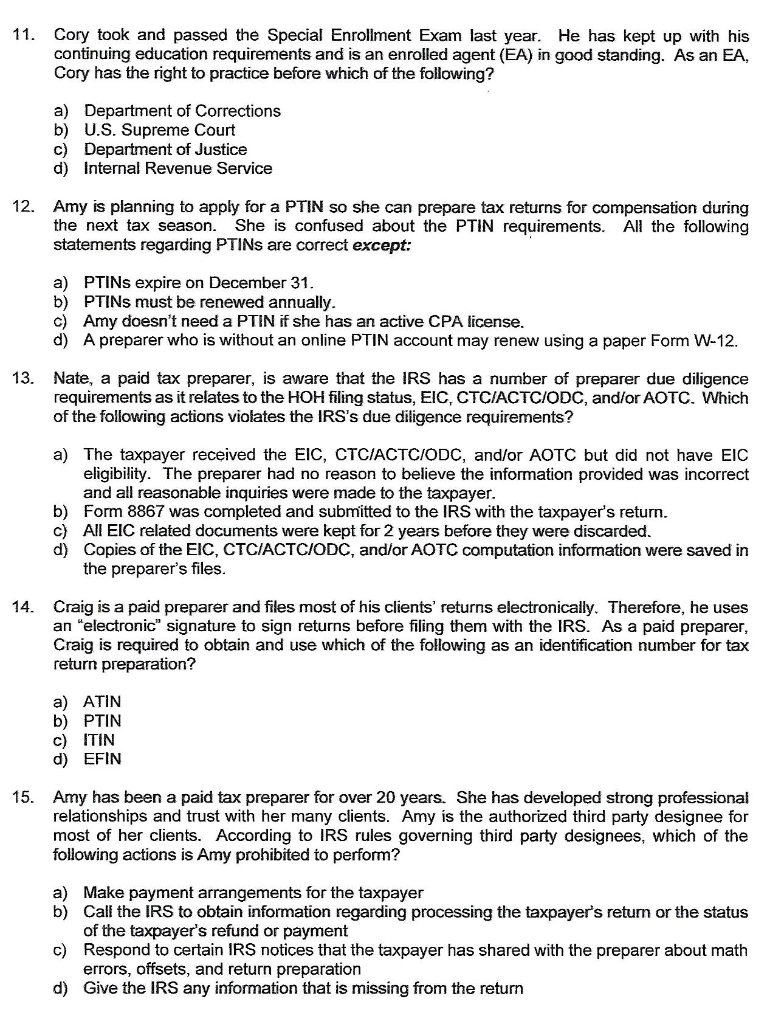

11. Cory took and passed the Special Enrollment Exam last year. He has kept up with his continuing education requirements and is an enrolled agent (EA) in good standing. As an EA, Cory has the right to practice before which of the following? a) Department of Corrections b) U.S. Supreme Court c) Department of Justice d) Internal Revenue Service 12. Amy is planning to apply for a PTIN so she can prepare tax returns for compensation during the next tax season. She is confused about the PTIN requirements. All the following statements regarding PTINs are correct except: a) PTINs expire on December 31. b) PTINs must be renewed annually. c) Amy doesn't need a PTIN if she has an active CPA license. d) A preparer who is without an online PTIN account may renew using a paper Form W-12. 13. Nate, a paid tax preparer, is aware that the IRS has a number of preparer due diligence requirements as it relates to the HOH filing status, EIC, CTC/ACTC/ODC, and/or AOTC. Which of the following actions violates the IRS's due diligence requirements? a) The taxpayer received the EIC, CTC/ACTC/ODC, and/or AOTC but did not have EIC eligibility. The preparer had no reason to believe the information provided was incorrect and all reasonable inquiries were made to the taxpayer. b) Form 8867 was completed and submitted to the IRS with the taxpayer's return. c) All EIC related documents were kept for 2 years before they were discarded. d) Copies of the EIC, CTCIACTC/ODC, and/or AOTC computation information were saved in the preparer's files. 14. Craig is a paid preparer and files most of his clients' returns electronically. Therefore, he uses an "electronic" signature to sign returns before filing them with the IRS. As a paid preparer, Craig is required to obtain and use which of the following as an identification number for tax return preparation? a) ATIN b) PTIN c) ITIN d) EFIN 15. Amy has been a paid tax preparer for over 20 years. She has developed strong professional relationships and trust with her many clients. Amy is the authorized third party designee for most of her clients. According to IRS rules governing third party designees, which of the following actions is Amy prohibited to perform? a) Make payment arrangements for the taxpayer b) Call the IRS to obtain information regarding processing the taxpayer's return or the status of the taxpayer's refund or payment c) Respond to certain IR$ notices that the taxpayer has shared with the preparer about math errors, offsets, and return preparation d) Give the IRS any information that is missing from the return

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started