Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Questions 1,3,5,7,9,11,13 $1,000 Tace va 2. If there is a decline in interest rates, which , bonds? Why? Which type of bond has the greater

Questions 1,3,5,7,9,11,13

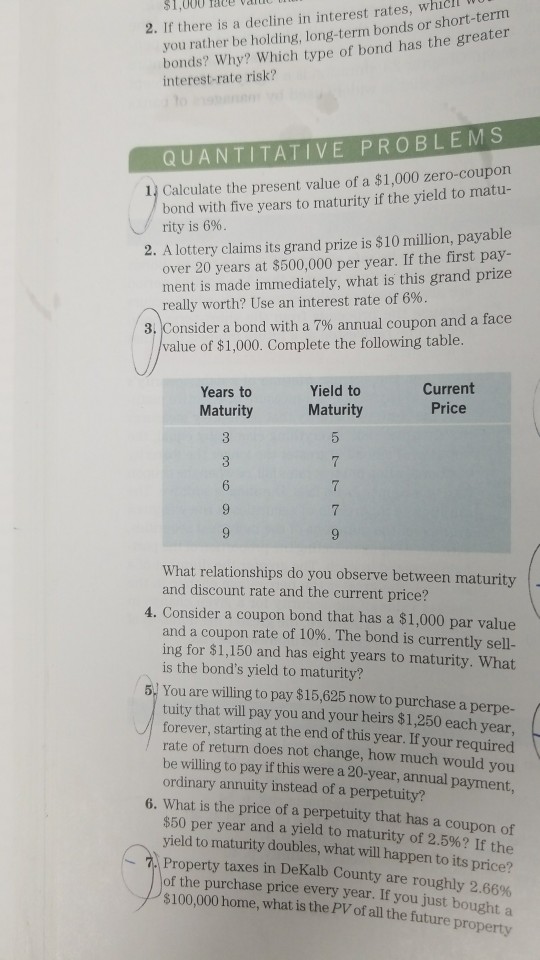

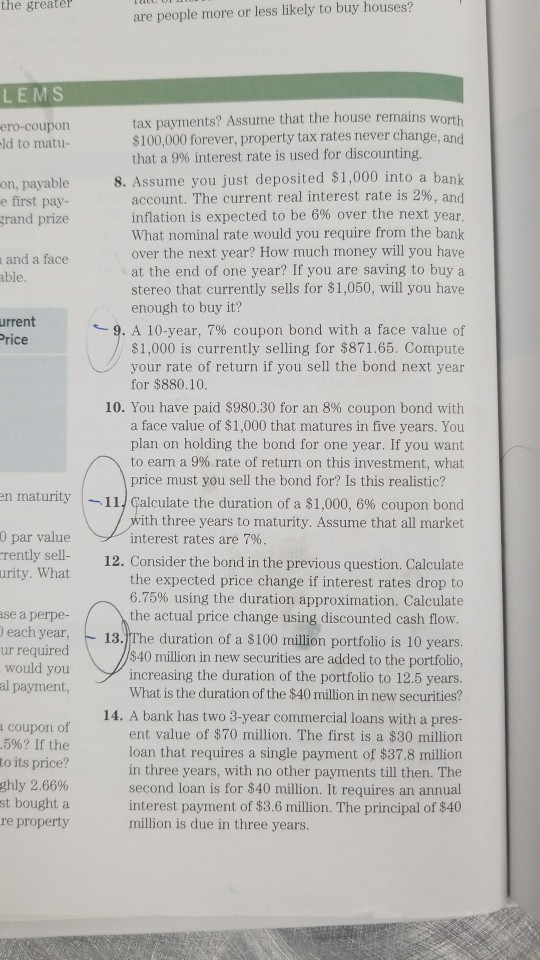

$1,000 Tace va 2. If there is a decline in interest rates, which , bonds? Why? Which type of bond has the greater interest-rate risk? you rather be holding, long-term bonds or short-term QUANTITATIVE PROBLEMS alculate the present value of a $1,000 zero-coupon bond with five years to maturity if the yield to matu- rity is 696 2. A lottery claims its grand prize is $10 million, payable over 20 years at $500,000 per year. If the first pay- ment is made immediately, what is this grand prize really worth? Use an interest rate of 6%. Consider a bond with a 7% annual coupon and a face value of $1,000. Complete the following table. Years toYield to Maturity Maturity Current Price What relationships do you observe between maturity and discount rate and the current price? 4. Consider a coupon bond that has a $1,000 par value and a coupon rate of 10%. The bond is currently sell- ing for $1,150 and has eight years to maturity. What is the bond's yield to maturity? 5! You are willing to pay $15,625 now to purchase a perpe- tuity that will pay you and your heirs $1,250 each year forever, starting at the end of this year. If your required rate of return does not change, how much would you be willing to pay if this were a 20-year, annual payment, ordinary annuity instead of a perpetuity? 6. What is the price of a perpetuity that has a coupon of $50 per year and a yield to maturity of 2.5%? If the yield to maturity doubles, what will happen to its price? Property taxes in DeKalb County are roughly 2.66% of the purchase price every year. If you just bought a $100,000 home, what is the PV of all the future propertyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started