Answered step by step

Verified Expert Solution

Question

1 Approved Answer

questions 1-4 please 1. Why do callable bonds usually pay a higher coupon rate than noncallable bonds? A. To compensate investors for their extra tax

questions 1-4 please

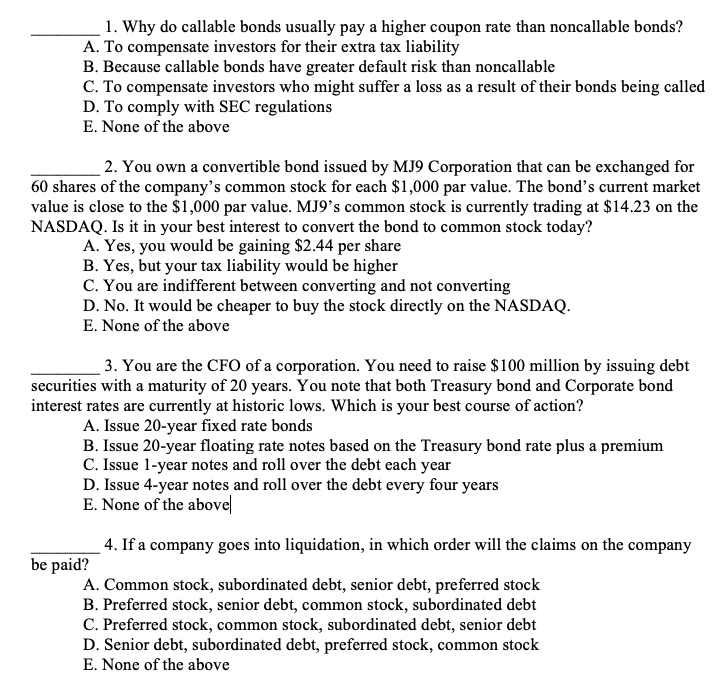

1. Why do callable bonds usually pay a higher coupon rate than noncallable bonds? A. To compensate investors for their extra tax liability B. Because callable bonds have greater default risk than noncallable C. To compensate investors who might suffer a loss as a result of their bonds being called D. To comply with SEC regulations E. None of the above 2. You own a convertible bond issued by MJ9 Corporation that can be exchanged for 60 shares of the company's common stock for each $1,000 par value. The bond's current market value is close to the $1,000 par value. MJO's common stock is currently trading at $14.23 on the NASDAQ. Is it in your best interest to convert the bond to common stock today? A. Yes, you would be gaining $2.44 per share B. Yes, but your tax liability would be higher C. You are indifferent between converting and not converting D. No. It would be cheaper to buy the stock directly on the NASDAQ. E. None of the above 3. You are the CFO of a corporation. You need to raise $ 100 million by issuing debt securities with a maturity of 20 years. You note that both Treasury bond and Corporate bond interest rates are currently at historic lows. Which is your best course of action? A. Issue 20-year fixed rate bonds B. Issue 20-year floating rate notes based on the Treasury bond rate plus a premium C. Issue 1-year notes and roll over the debt each year D. Issue 4-year notes and roll over the debt every four years E. None of the above 4. If a company goes into liquidation, in which order will the claims on the company be paid? A. Common stock, subordinated debt, senior debt, preferred stock B. Preferred stock, senior debt, common stock, subordinated debt C. Preferred stock, common stock, subordinated debt, senior debt D. Senior debt, subordinated debt, preferred stock, common stock E. None of the aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started