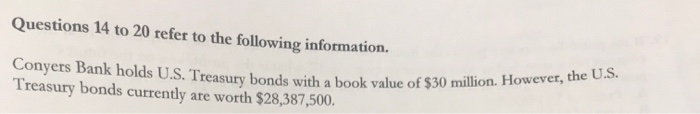

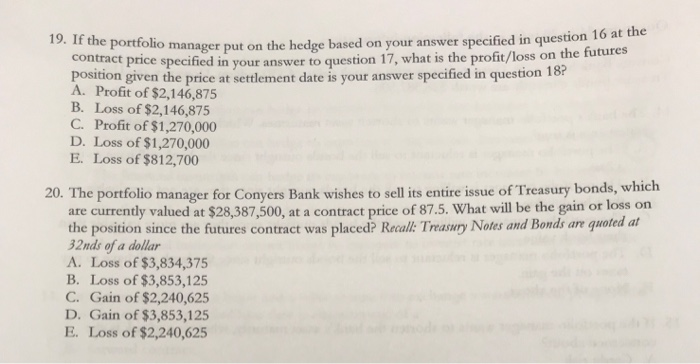

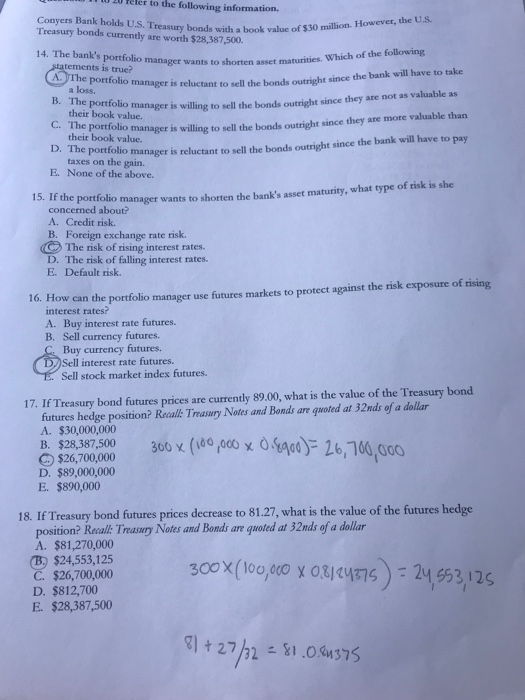

Questions 14 to 20 refer to the following information. Conyers Bank holds U.S. Treasury bonds with a book value of $30 milion. Howeret Treasury bonds currently are worth $28,387,500. .S 19. If the portfolio manager put on the hedge based on your answer specified in question 1 contract price speci position given the price at settlement date is your answer specified in question 18? in your answer to question 17, what is the profit/loss on the futures A. Profit of $2,146,875 B. Loss of $2,146,875 C. Profit of $1,270,000 D. Loss of $1,270,000 E. Loss of $812,700 20. The portfolio manager for Conyers Bank wishes to sell its entire issue of Treasury bonds, which 7 are currently valued at $28,387,500, at a contract price of 87.5. What will be the gain or loss on the position since the futures contract was placed? Recal: Treasuy Notes and Bonds are quoted at 2nds of a dollar A. Loss of $3,834,375 B. Loss of $3,853,125 C. Gain of $2,240,625 D. Gain of $3,853,125 E. Loss of $2,240,625 ieler to the following information. Conyers Bank holds U.S. Treasury bonds with a book value of $30 malin Treasury bonds currently are worth $28,387,500. 14. The bank's portfolio mana ger wants to shorten asset maturities. Which of the following tements is true? A. e portfolio manager is reluctant a loss. to sell the bonds outright since the bank will have to take manager is willing to sell the bonds outright since they are not as valuable as manager is willing to sell the bonds outright since they are more valuable than o manager is reluctant to sell the bonds outright since the bank will have to pay B. The portfolio their book value. their book value. taxes on the gain. C. The portfolio D. The portfol E. None of the above. potfolio manager wants to shorten the bank's asset maturity, what type of risk is she concerned about? A. Credit risk. B. Foreign exchange rate risk. The risk of rising interest rat D. The risk of falling interest rates. E. Default risk. 16. How can the portfolio manager use futures markets to protect against the risk exposure of rising interest rates? A. Buy interest rate futures. B. Sell currency futures. Buy currency futures Sell interest rate futures. Sell stock market index futures. 17. If Treasury bond futures prices are currently 89.00, what is the value of the Treasury bond futures hedge position? Recall: Treasury Notes and Bonds are quoted at 32nds of a dollar A. $30,000,000 ,00,000 x .hago)" 26,760,000 $28,387,500 B, 300 x ( $26,700,000 D. $89,000,000 E. $890,000 18. If Treasury bond futures prices decrease to 81.27, what is the value of the futures hedge position? Recall: Treasury Notes and Bonds are quoted at 32nds of a dollar A. $81,270,000 B.) $24,553,125 C. $26,700,000 D. $812,700 E. $28,387,500 Questions 14 to 20 refer to the following information. Conyers Bank holds U.S. Treasury bonds with a book value of $30 milion. Howeret Treasury bonds currently are worth $28,387,500. .S 19. If the portfolio manager put on the hedge based on your answer specified in question 1 contract price speci position given the price at settlement date is your answer specified in question 18? in your answer to question 17, what is the profit/loss on the futures A. Profit of $2,146,875 B. Loss of $2,146,875 C. Profit of $1,270,000 D. Loss of $1,270,000 E. Loss of $812,700 20. The portfolio manager for Conyers Bank wishes to sell its entire issue of Treasury bonds, which 7 are currently valued at $28,387,500, at a contract price of 87.5. What will be the gain or loss on the position since the futures contract was placed? Recal: Treasuy Notes and Bonds are quoted at 2nds of a dollar A. Loss of $3,834,375 B. Loss of $3,853,125 C. Gain of $2,240,625 D. Gain of $3,853,125 E. Loss of $2,240,625 ieler to the following information. Conyers Bank holds U.S. Treasury bonds with a book value of $30 malin Treasury bonds currently are worth $28,387,500. 14. The bank's portfolio mana ger wants to shorten asset maturities. Which of the following tements is true? A. e portfolio manager is reluctant a loss. to sell the bonds outright since the bank will have to take manager is willing to sell the bonds outright since they are not as valuable as manager is willing to sell the bonds outright since they are more valuable than o manager is reluctant to sell the bonds outright since the bank will have to pay B. The portfolio their book value. their book value. taxes on the gain. C. The portfolio D. The portfol E. None of the above. potfolio manager wants to shorten the bank's asset maturity, what type of risk is she concerned about? A. Credit risk. B. Foreign exchange rate risk. The risk of rising interest rat D. The risk of falling interest rates. E. Default risk. 16. How can the portfolio manager use futures markets to protect against the risk exposure of rising interest rates? A. Buy interest rate futures. B. Sell currency futures. Buy currency futures Sell interest rate futures. Sell stock market index futures. 17. If Treasury bond futures prices are currently 89.00, what is the value of the Treasury bond futures hedge position? Recall: Treasury Notes and Bonds are quoted at 32nds of a dollar A. $30,000,000 ,00,000 x .hago)" 26,760,000 $28,387,500 B, 300 x ( $26,700,000 D. $89,000,000 E. $890,000 18. If Treasury bond futures prices decrease to 81.27, what is the value of the futures hedge position? Recall: Treasury Notes and Bonds are quoted at 32nds of a dollar A. $81,270,000 B.) $24,553,125 C. $26,700,000 D. $812,700 E. $28,387,500