Answered step by step

Verified Expert Solution

Question

1 Approved Answer

questions 17-20 please 17. Which of the following valuation measures is often used to compare firms that have no earnings? A. Price-to-book ratio B. P/E

questions 17-20 please

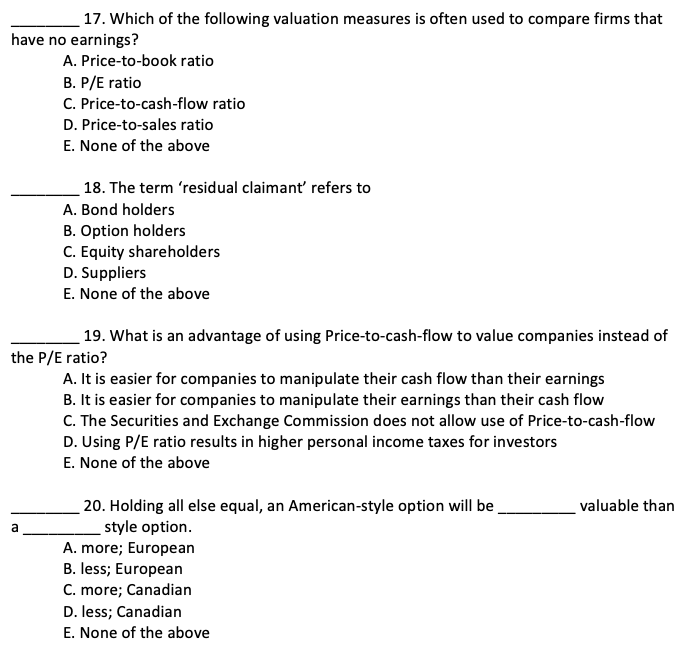

17. Which of the following valuation measures is often used to compare firms that have no earnings? A. Price-to-book ratio B. P/E ratio C. Price-to-cash-flow ratio D. Price-to-sales ratio E. None of the above 18. The term 'residual claimant' refers to A. Bond holders B. Option holders C. Equity shareholders D. Suppliers E. None of the above 19. What is an advantage of using Price-to-cash-flow to value companies instead of the P/E ratio? A. It is easier for companies to manipulate their cash flow than their earnings B. It is easier for companies to manipulate their earnings than their cash flow C. The Securities and Exchange Commission does not allow use of Price-to-cash-flow D. Using P/E ratio results in higher personal income taxes for investors E. None of the above valuable than a 20. Holding all else equal, an American-style option will be style option. A. more; European B. less; European C. more; Canadian D. less; Canadian E. None of the aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started