Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Questions 2, 4, 5, 11 need to be done. All homework must be done as a Microsoft Excel file You must show your work on

Questions 2, 4, 5, 11 need to be done.

All homework must be done as a Microsoft Excel file

You must show your work on the homework problems, using equations, functions, cell references, etc. in Excel instead of just values.

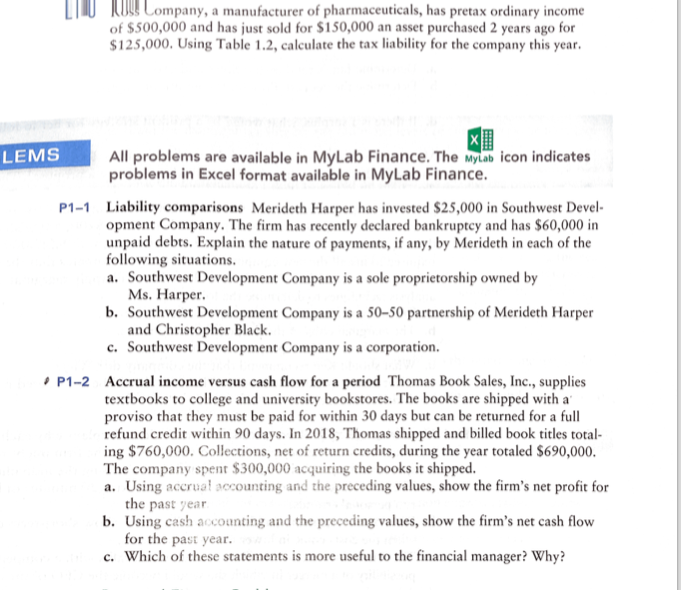

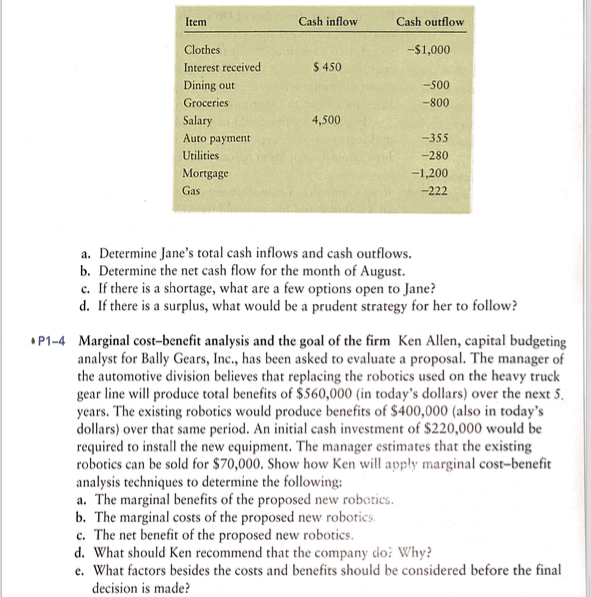

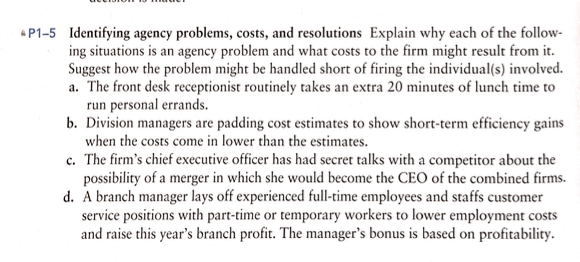

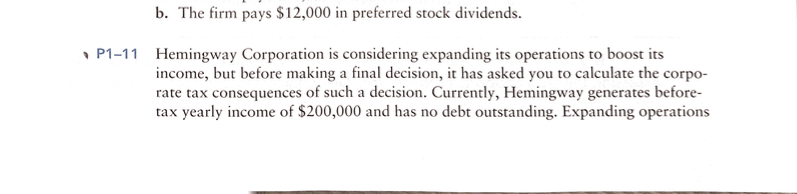

Hos Company, a manufacturer of pharmaceuticals, has pretax ordinary income of $500,000 and has just sold for $150,000 an asset purchased 2 years ago for $125,000. Using Table 1.2, calculate the tax liability for the company this year. LEMS All problems are available in MyLab Finance. The Mylab icon indicates problems in Excel format available in MyLab Finance. P1-1 Liability comparisons Merideth Harper has invested $25,000 in Southwest Devel- opment Company. The firm has recently declared bankruptcy and has $60,000 in unpaid debts. Explain the nature of payments, if any, by Merideth in each of the following situations. a. Southwest Development Company is a sole proprietorship owned by Ms. Harper. b. Southwest Development Company is a 50-50 partnership of Merideth Harper and Christopher Black c. Southwest Development Company is a corporation. P1-2 Accrual income versus cash flow for a period Thomas Book Sales, Inc., supplies textbooks to college and university bookstores. The books are shipped with a proviso that they must be paid for within 30 days but can be returned for a full refund credit within 90 days. In 2018, Thomas shipped and billed book titles total- ing $760,000. Collections, net of return credits, during the year totaled $690,000. The company spent $300,000 acquiring the books it shipped. a. Using accrual accounting and the preceding values, show the firm's net profit for the past year b. Using cash accounting and the preceding values, show the firm's net cash flow for the past year. c. Which of these statements is more useful to the financial manager? Why? Item Cash inflow Cash outflow -$1,000 $ 450 -500 -800 Clothes Interest received Dining out Groceries Salary Auto payment Utilities Mortgage Gas 4,500 -355 -280 -1,200 -222 a. Determine Jane's total cash inflows and cash outflows. b. Determine the net cash flow for the month of August. c. If there is a shortage, what are a few options open to Jane? d. If there is a surplus, what would be a prudent strategy for her to follow? P1-4 Marginal cost-benefit analysis and the goal of the firm Ken Allen, capital budgeting analyst for Bally Gears, Inc., has been asked to evaluate a proposal. The manager of the automotive division believes that replacing the robotics used on the heavy truck gear line will produce total benefits of $560,000 (in today's dollars) over the next 5. years. The existing robotics would produce benefits of $400,000 (also in today's dollars) over that same period. An initial cash investment of $220,000 would be required to install the new equipment. The manager estimates that the existing robotics can be sold for $70,000. Show how Ken will apply marginal cost-benefit analysis techniques to determine the following: a. The marginal benefits of the proposed new robotics. b. The marginal costs of the proposed new robotics. c. The net benefit of the proposed new robotics. d. What should Ken recommend that the company do: Why? e. What factors besides the costs and benefits should be considered before the final decision is made? AP1-5 Identifying agency problems, costs, and resolutions Explain why each of the follow- ing situations is an agency problem and what costs to the firm might result from it. Suggest how the problem might be handled short of firing the individual(s) involved. a. The front desk receptionist routinely takes an extra 20 minutes of lunch time to run personal errands. b. Division managers are padding cost estimates to show short-term efficiency gains when the costs come in lower than the estimates. c. The firm's chief executive officer has had secret talks with a competitor about the possibility of a merger in which she would become the CEO of the combined firms. d. A branch manager lays off experienced full-time employees and staffs customer service positions with part-time or temporary workers to lower employment costs and raise this year's branch profit. The manager's bonus is based on profitability. b. The firm pays $12,000 in preferred stock dividends. P1-11 Hemingway Corporation is considering expanding its operations to boost its income, but before making a final decision, it has asked you to calculate the corpo- rate tax consequences of such a decision. Currently, Hemingway generates before- tax yearly income of $200,000 and has no debt outstanding. Expanding operations Hos Company, a manufacturer of pharmaceuticals, has pretax ordinary income of $500,000 and has just sold for $150,000 an asset purchased 2 years ago for $125,000. Using Table 1.2, calculate the tax liability for the company this year. LEMS All problems are available in MyLab Finance. The Mylab icon indicates problems in Excel format available in MyLab Finance. P1-1 Liability comparisons Merideth Harper has invested $25,000 in Southwest Devel- opment Company. The firm has recently declared bankruptcy and has $60,000 in unpaid debts. Explain the nature of payments, if any, by Merideth in each of the following situations. a. Southwest Development Company is a sole proprietorship owned by Ms. Harper. b. Southwest Development Company is a 50-50 partnership of Merideth Harper and Christopher Black c. Southwest Development Company is a corporation. P1-2 Accrual income versus cash flow for a period Thomas Book Sales, Inc., supplies textbooks to college and university bookstores. The books are shipped with a proviso that they must be paid for within 30 days but can be returned for a full refund credit within 90 days. In 2018, Thomas shipped and billed book titles total- ing $760,000. Collections, net of return credits, during the year totaled $690,000. The company spent $300,000 acquiring the books it shipped. a. Using accrual accounting and the preceding values, show the firm's net profit for the past year b. Using cash accounting and the preceding values, show the firm's net cash flow for the past year. c. Which of these statements is more useful to the financial manager? Why? Item Cash inflow Cash outflow -$1,000 $ 450 -500 -800 Clothes Interest received Dining out Groceries Salary Auto payment Utilities Mortgage Gas 4,500 -355 -280 -1,200 -222 a. Determine Jane's total cash inflows and cash outflows. b. Determine the net cash flow for the month of August. c. If there is a shortage, what are a few options open to Jane? d. If there is a surplus, what would be a prudent strategy for her to follow? P1-4 Marginal cost-benefit analysis and the goal of the firm Ken Allen, capital budgeting analyst for Bally Gears, Inc., has been asked to evaluate a proposal. The manager of the automotive division believes that replacing the robotics used on the heavy truck gear line will produce total benefits of $560,000 (in today's dollars) over the next 5. years. The existing robotics would produce benefits of $400,000 (also in today's dollars) over that same period. An initial cash investment of $220,000 would be required to install the new equipment. The manager estimates that the existing robotics can be sold for $70,000. Show how Ken will apply marginal cost-benefit analysis techniques to determine the following: a. The marginal benefits of the proposed new robotics. b. The marginal costs of the proposed new robotics. c. The net benefit of the proposed new robotics. d. What should Ken recommend that the company do: Why? e. What factors besides the costs and benefits should be considered before the final decision is made? AP1-5 Identifying agency problems, costs, and resolutions Explain why each of the follow- ing situations is an agency problem and what costs to the firm might result from it. Suggest how the problem might be handled short of firing the individual(s) involved. a. The front desk receptionist routinely takes an extra 20 minutes of lunch time to run personal errands. b. Division managers are padding cost estimates to show short-term efficiency gains when the costs come in lower than the estimates. c. The firm's chief executive officer has had secret talks with a competitor about the possibility of a merger in which she would become the CEO of the combined firms. d. A branch manager lays off experienced full-time employees and staffs customer service positions with part-time or temporary workers to lower employment costs and raise this year's branch profit. The manager's bonus is based on profitability. b. The firm pays $12,000 in preferred stock dividends. P1-11 Hemingway Corporation is considering expanding its operations to boost its income, but before making a final decision, it has asked you to calculate the corpo- rate tax consequences of such a decision. Currently, Hemingway generates before- tax yearly income of $200,000 and has no debt outstanding. Expanding operationsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started