Answered step by step

Verified Expert Solution

Question

1 Approved Answer

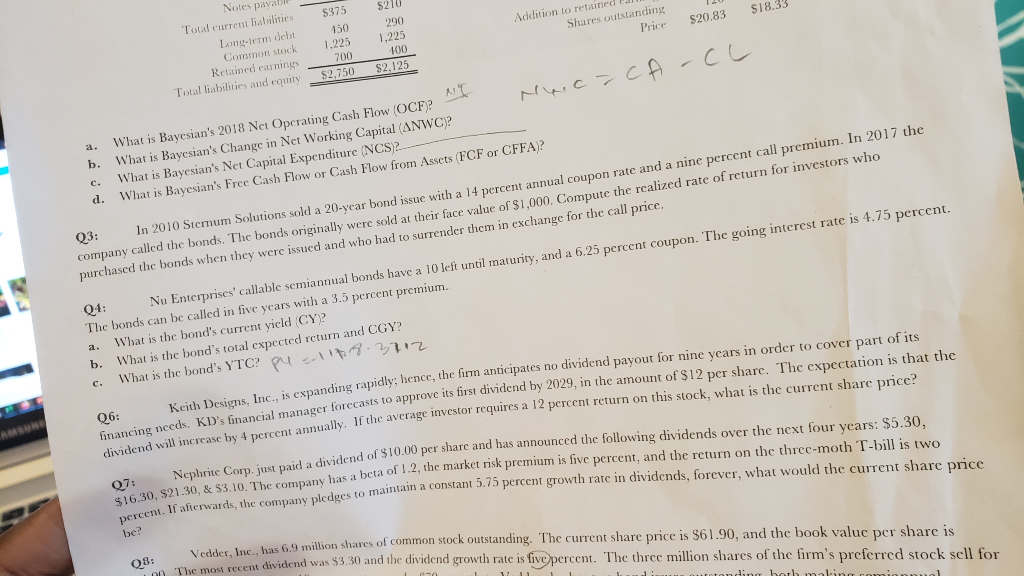

Questions 3 and 4 $18.33 $20.83 Notes pavalle Total current liabilities Long-term dels Common stock stock Retained earnings Total liabilities and equity $375 150 1.225

Questions 3 and 4

$18.33 $20.83 Notes pavalle Total current liabilities Long-term dels Common stock stock Retained earnings Total liabilities and equity $375 150 1.225 700 $2,750 $210 290 1,225 100 $2,125 Addition to retained a Shares outstanding Price Mhic-CA-CL a. What is Bayesian's 2018 Nct Operating Cash Flow (OCF)? b. What is Bayesian's Change in Not Working Capital (ANWC)? c. What is Bayesian's Net Capital Expenditure (NCS)--- d. What is Bayesian's Free Cash Flow or Cash Flow from Assets (FCF or CFFA)? Q3: In 2010 Sternum Solutions sold a 20-year bond issue with a 14 percent annual coupon rate and a nine percent call premium. In 2017 the company called the bonds. The bonds originally were sold at their face value of $1,000, Compute the realized rate of return for investors who purchased the bonds when they were issued and who had to surrender them in exchange for the call price, 04: Nu Enterprises' callable semiannual bonds have a 10 left until maturity, and a 6.25 percent coupon. The going interest rate is 4.75 percent. The bonds can be called in five years with a 3.5 percent premium. a. What is the bond's current yield (CY? b. What is the bond's total expected return and CGY? c. What is the bond's YTC? ou li .3712 Q6: spanding rapidly; hence, the fin anticipates no dividend payout for nine years in order to cover part of its Keith Designs, Inc., is expanding rapidly; nence, in forecasts to approve its first dividend by 2029, in the amount of $12 per share. The expectation is that the financing needs. KD's financial manager forecasts to approve its first dividend by 2029. in he average investor requires a 12 percent return on this stock, what is the current share price? listend will increase by 4 percent annually. If the average investor requires a 12 percent return on this stock when od of $10.00 per share and has announced the following dividends over the next four years: $5.30, 07: Nephrite Corp.just paid a dividend of S10.00 per share and has announced the follow beta of 1.2, the market risk premium is five percent, and the return on the three-moth T-bill is two $16.30, $21.30, & 53.10. The company has a bcta ol 1.2, the market risk premium is five percent o maintain a constant 5.75 percent growth rate in dividends, forever, what would the current share price crcent. If afterwards, the company pledges to mainta be? as 6.9 million shares of common stock outstanding. The current share price is $61.90, and the book value per share is dividend was $3,30 and the dividend growth rate is five percent. The three million shares of the firm's preferred stock sell for 08: :... totonding both molinominalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started