Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Questions 3 to 7 are based on the below information. Assume that you own an inventory of 100,000 barrels of oil. To hedge the price

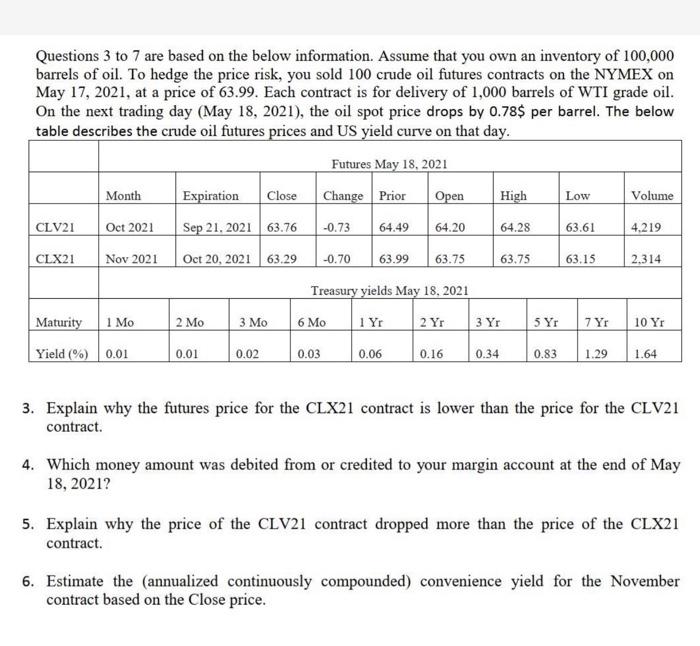

Questions 3 to 7 are based on the below information. Assume that you own an inventory of 100,000 barrels of oil. To hedge the price risk, you sold 100 crude oil futures contracts on the NYMEX on May 17, 2021, at a price of 63.99. Each contract is for delivery of 1,000 barrels of WTI grade oil. On the next trading day (May 18, 2021), the oil spot price drops by 0.78$ per barrel. The below table describes the crude oil futures prices and US yield curve on that day. Futures May 18, 2021 Month Expiration Close.

a.Explain why the futures price for the CLX21 contract is lower than the price for the CLV21 contract.

b.Which money amount was debited from or credited to your margin account at the end of May 18, 2021?

c. Explain why the price of the CLV21 contract dropped more than the price of the CLX21 contract.

d. Estimate the (annualized continuously compounded) convenience yield for the November contract based on the Close price.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started