Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Questions 33-36 please 33. Historically, small-firm stocks have earned higher returns than large-firm stocks. When viewed in the context of an efficient market, this suggests

Questions 33-36 please

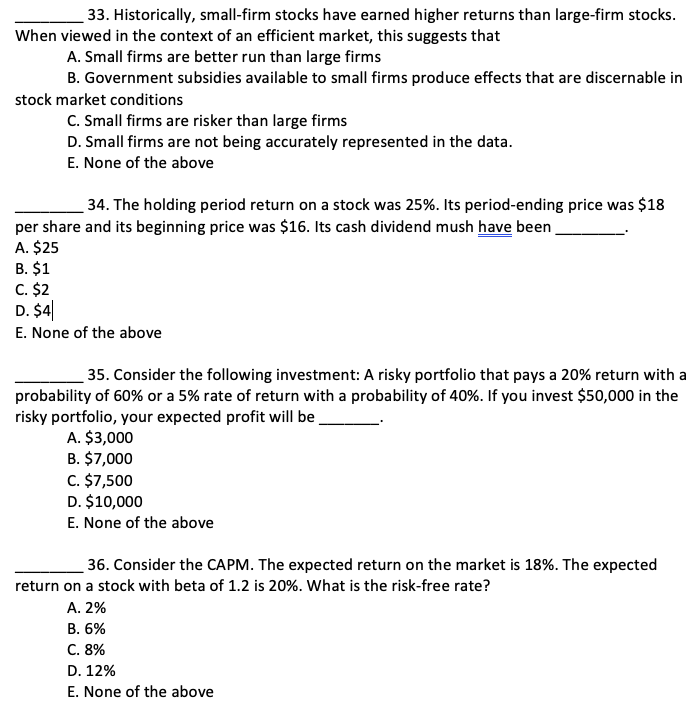

33. Historically, small-firm stocks have earned higher returns than large-firm stocks. When viewed in the context of an efficient market, this suggests that A. Small firms are better run than large firms B. Government subsidies available to small firms produce effects that are discernable in stock market conditions C. Small firms are risker than large firms D. Small firms are not being accurately represented in the data. E. None of the above 34. The holding period return on a stock was 25%. Its period-ending price was $18 per share and its beginning price was $16. Its cash dividend mush have been A. $25 B. $1 C. $2 D. $4 E. None of the above 35. Consider the following investment: A risky portfolio that pays a 20% return with a probability of 60% or a 5% rate of return with a probability of 40%. If you invest $50,000 in the risky portfolio, your expected profit will be A. $3,000 B. $7,000 C. $7,500 D. $10,000 E. None of the above 36. Consider the CAPM. The expected return on the market is 18%. The expected return on a stock with beta of 1.2 is 20%. What is the risk-free rate? A. 2% B. 6% C. 8% D. 12% E. None of the aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started