Answered step by step

Verified Expert Solution

Question

1 Approved Answer

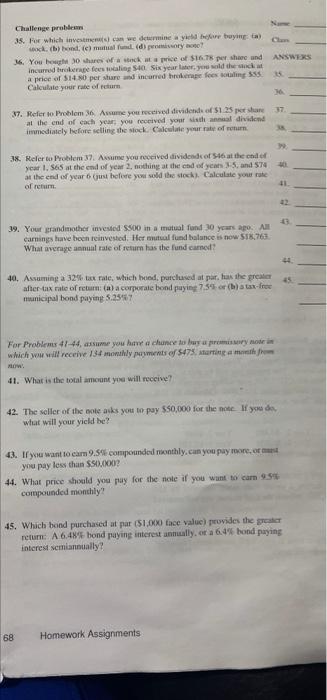

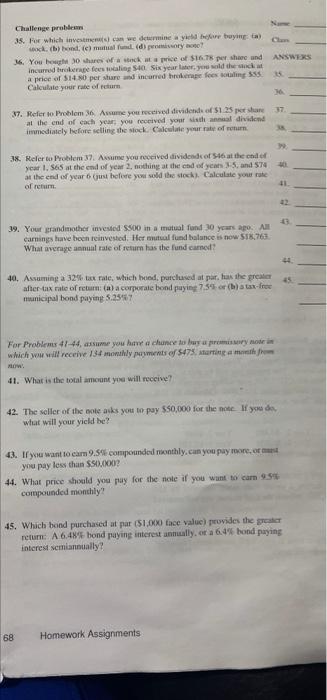

questions 35-45 Challenge problem N 35. For which investments can we determine a betina) Clu ock. (h)onde) mual fund dory 16. You are a stack

questions 35-45

Challenge problem N 35. For which investments can we determine a betina) Clu ock. (h)onde) mual fund dory 16. You are a stack at a price of $16.8 per shume and ANSWERS incurred were fees totaling $40. Six year later you sold the aprice of $14.0 por sure and incurred hope for doing 5515 Calculate your rate of retum 37 37. Refer to Problem 6. Assume you received dividends of $15 persone at the end of each year: you received your anal dividend immediately before selling the stock. Calculate your of return 38. Refer to Problem 37. Assume you received dividend of 16 at the end of year 1.565 at the end of year 2 nothing at the end of years 35 and 574 at the end of year 6 hefore you sold the stock. Calculate your rate of rerum 39. Your grandmother invested $500 in a mutual fund 30 years ago. Al camnings have been reinvested. Her mutual fund balance is now $18,763 What average annual rate of return has the fund cared? 5 40. Assuming a 32 tax rate, which bond purchased at par, hus the greater after tax rate of return: (a) a corporate bond paying 759 or () a tax-free municipal bond paying 5.25867 For Problem 47-44, assume you have a chance to buy a prsaryo which you will receive 134 monilly payments of 473. Martingam now 41. What is the total amount you will receive? 42. The seller of the note asks you to pay $50,000 for the one you do what will your yield be? 43. If you want to carn 9.5" compounded monthly can you pay more you pay less than SSO_0007 44. What price should you pay for the role if you want to carn 93 compounded monthly 45. Which bond purchased at par (51.000 face value) provides the greater retum A6,48% bond paying interest annually, or a 6.4% bond paying interest semiannually! 68 Homework Assignments Challenge problem N 35. For which investments can we determine a betina) Clu ock. (h)onde) mual fund dory 16. You are a stack at a price of $16.8 per shume and ANSWERS incurred were fees totaling $40. Six year later you sold the aprice of $14.0 por sure and incurred hope for doing 5515 Calculate your rate of retum 37 37. Refer to Problem 6. Assume you received dividends of $15 persone at the end of each year: you received your anal dividend immediately before selling the stock. Calculate your of return 38. Refer to Problem 37. Assume you received dividend of 16 at the end of year 1.565 at the end of year 2 nothing at the end of years 35 and 574 at the end of year 6 hefore you sold the stock. Calculate your rate of rerum 39. Your grandmother invested $500 in a mutual fund 30 years ago. Al camnings have been reinvested. Her mutual fund balance is now $18,763 What average annual rate of return has the fund cared? 5 40. Assuming a 32 tax rate, which bond purchased at par, hus the greater after tax rate of return: (a) a corporate bond paying 759 or () a tax-free municipal bond paying 5.25867 For Problem 47-44, assume you have a chance to buy a prsaryo which you will receive 134 monilly payments of 473. Martingam now 41. What is the total amount you will receive? 42. The seller of the note asks you to pay $50,000 for the one you do what will your yield be? 43. If you want to carn 9.5" compounded monthly can you pay more you pay less than SSO_0007 44. What price should you pay for the role if you want to carn 93 compounded monthly 45. Which bond purchased at par (51.000 face value) provides the greater retum A6,48% bond paying interest annually, or a 6.4% bond paying interest semiannually! 68 Homework Assignments

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started