Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Questions 4 a) A bank faces uncertainty of liquidity needs which are represented by deposit withdrawals following a normal distribution with mean of $2 million

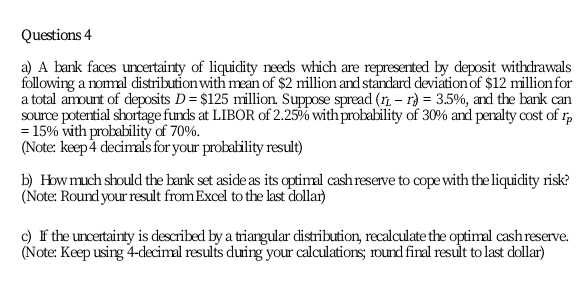

Questions 4 a) A bank faces uncertainty of liquidity needs which are represented by deposit withdrawals following a normal distribution with mean of $2 million and standard deviation of $12 million for a total amount of deposits D= $125 million Suppose spread (11 r) = 3.5%, and the bank can source potential shortage funds at LIBOR of 2.25% with probability of 30% and penalty cost of rp = 15% with probability of 70%. (Note: keep 4 decimals for your probability result) b) How much should the bank set aside as its optimal cash reserve to cope with the liquidity risk? (Note: Round your result from Excel to the last dollar) c) I the uncertainty is described by a triangular distribution, recalculate the optimal cash reserve. (Note: Keep using 4-decimal results during your calculations, wund final result to last dollar) Questions 4 a) A bank faces uncertainty of liquidity needs which are represented by deposit withdrawals following a normal distribution with mean of $2 million and standard deviation of $12 million for a total amount of deposits D= $125 million Suppose spread (11 r) = 3.5%, and the bank can source potential shortage funds at LIBOR of 2.25% with probability of 30% and penalty cost of rp = 15% with probability of 70%. (Note: keep 4 decimals for your probability result) b) How much should the bank set aside as its optimal cash reserve to cope with the liquidity risk? (Note: Round your result from Excel to the last dollar) c) I the uncertainty is described by a triangular distribution, recalculate the optimal cash reserve. (Note: Keep using 4-decimal results during your calculations, wund final result to last dollar)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started