Answered step by step

Verified Expert Solution

Question

1 Approved Answer

questions 4-9 ass what weul be a od $30 and 1 year hence is going to be either $120 r $0 Trader Bob s queting

questions 4-9

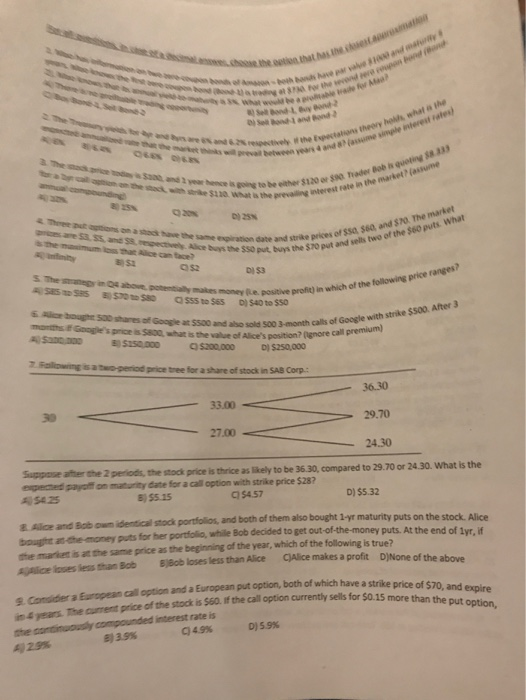

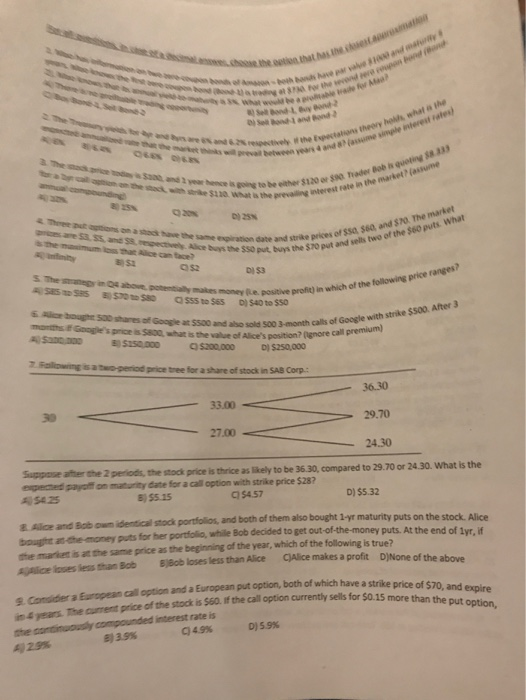

ass what weul be a od $30 and 1 year hence is going to be either $120 r $0 Trader Bob s queting be est rate in the market?(assume 20% D 25% 4 hree ut ations on a stock have the same expiration date strite prices of ssa sea and S70 The market the $70 put and sells two of the $60 puts what prices are 53. S5 and Ssrescectively Alice buys the $s0 put buy S4e te ss proey which of the tolouing price ranges ie oughe S0D shares of Goagle at $500 and aso sole s00 3-month cals aralipremium) months # Goagle's price is $800, what is the value of Alice's position?gnore Google with strike $500. After 3 )5150000 C $200,000 D) $250,000 s a two-period price tree for a share of stock in SAB Corp 36.30 33.00 30 29.70 27.00 24.30 Suppose after the 2 egected payolt on maturity date for a call option with strike price $28 5425 periods, the stock price is thrice as likely to be 36.30, compared to 29.70 or 24.30. What is the B) 55.15 3) $4.57 D) $5.32 t Alce and Bob own identical stock portfolios, and both of them also bought 1-yr maturity puts on the bought a the market is at the same price as the beginning of the year, which of the following is true? Ajlice lsses less than Bob 8 lss less than Alice QAlice makes a profit DjNone of the while Bob decided to get out-of-the-money puts. At the end of 1yr, if s-the money puts for her portolio, decided to and a European put option, both of which have a strike price of $70, and expire S. Consider a European call option in 4 years. The current price of the stock is $60. If the call option currently sells for SO.15 more than the put option, D) 59% C) 49% e) 39% A)29% ass what weul be a od $30 and 1 year hence is going to be either $120 r $0 Trader Bob s queting be est rate in the market?(assume 20% D 25% 4 hree ut ations on a stock have the same expiration date strite prices of ssa sea and S70 The market the $70 put and sells two of the $60 puts what prices are 53. S5 and Ssrescectively Alice buys the $s0 put buy S4e te ss proey which of the tolouing price ranges ie oughe S0D shares of Goagle at $500 and aso sole s00 3-month cals aralipremium) months # Goagle's price is $800, what is the value of Alice's position?gnore Google with strike $500. After 3 )5150000 C $200,000 D) $250,000 s a two-period price tree for a share of stock in SAB Corp 36.30 33.00 30 29.70 27.00 24.30 Suppose after the 2 egected payolt on maturity date for a call option with strike price $28 5425 periods, the stock price is thrice as likely to be 36.30, compared to 29.70 or 24.30. What is the B) 55.15 3) $4.57 D) $5.32 t Alce and Bob own identical stock portfolios, and both of them also bought 1-yr maturity puts on the bought a the market is at the same price as the beginning of the year, which of the following is true? Ajlice lsses less than Bob 8 lss less than Alice QAlice makes a profit DjNone of the while Bob decided to get out-of-the-money puts. At the end of 1yr, if s-the money puts for her portolio, decided to and a European put option, both of which have a strike price of $70, and expire S. Consider a European call option in 4 years. The current price of the stock is $60. If the call option currently sells for SO.15 more than the put option, D) 59% C) 49% e) 39% A)29%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started