Questions 6 through 10 please. Thanks!

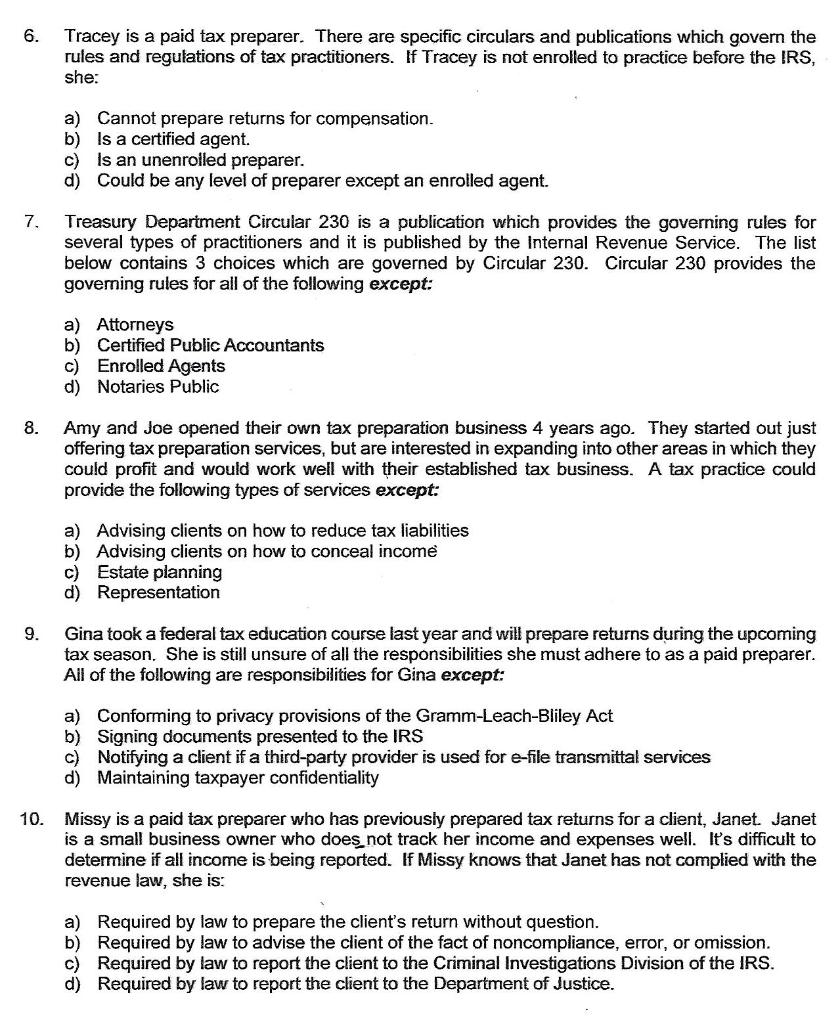

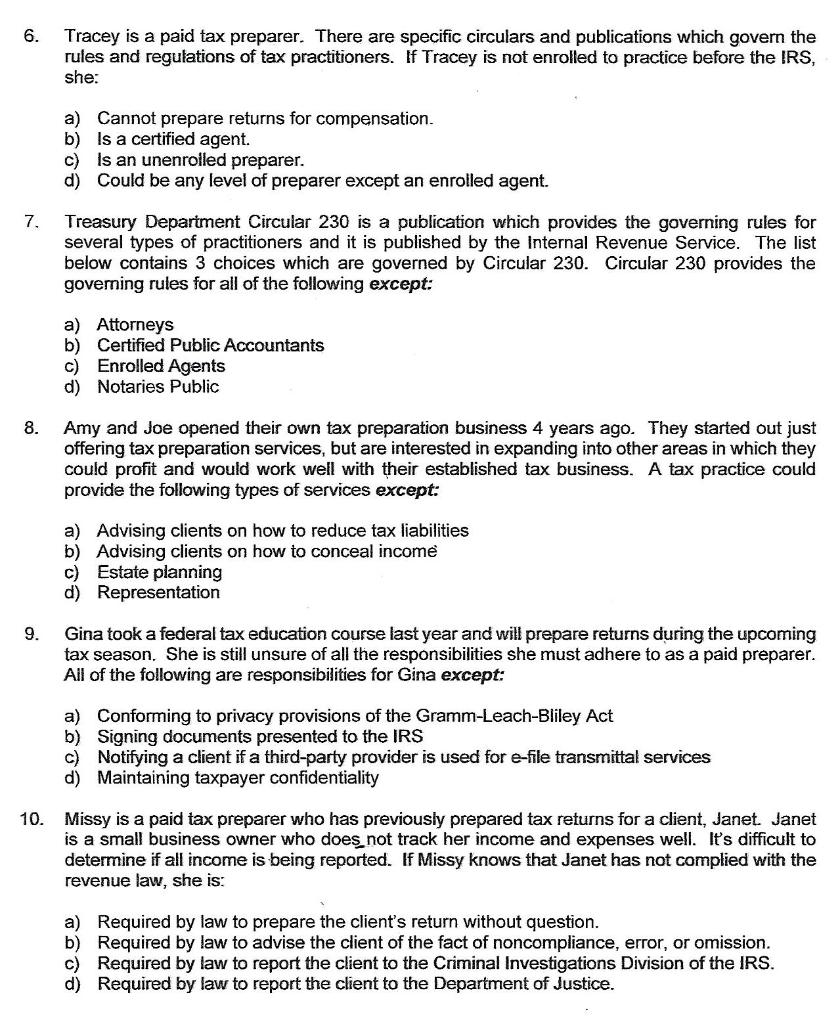

6. Tracey is a paid tax preparer. There are specific circulars and publications which govern the rules and regulations of tax practitioners. If Tracey is not enrolled to practice before the IRS, she: a) Cannot prepare returns for compensation. b) is a certified agent. c) is an unenrolled preparer. d) Could be any level of preparer except an enrolled agent. 7. Treasury Department Circular 230 is a publication which provides the governing rules for several types of practitioners and it is published by the Internal Revenue Service. The list below contains 3 choices which are governed by Circular 230. Circular 230 provides the governing rules for all of the following except: a) Attorneys b) Certified Public Accountants c) Enrolled Agents d) Notaries Public 8. Amy and Joe opened their own tax preparation business 4 years ago. They started out just offering tax preparation services, but are interested in expanding into other areas in which they could profit and would work well with their established tax business. A tax practice could provide the following types of services except: a) Advising clients on how to reduce tax liabilities b) Advising clients on how to conceal income c) Estate planning d) Representation 9. Gina took a federal tax education course last year and will prepare returns during the upcoming tax season. She is still unsure of all the responsibilities she must adhere to as a paid preparer. All of the following are responsibilities for Gina except: a) Conforming to privacy provisions of the Gramm-Leach-Bliley Act b) Signing documents presented to the IRS c) Notifying a client if a third-party provider is used for e-file transmittal services d) Maintaining taxpayer confidentiality 10. Missy is a paid tax preparer who has previously prepared tax returns for a client, Janet. Janet is a small business owner who does not track her income and expenses well. It's difficult to determine if all income is being reported. If Missy knows that Janet has not complied with the revenue law, she is: a) Required by law to prepare the client's return without question. b) Required by law to advise the client of the fact of noncompliance, error, or omission. c) Required by law to report the client to the Criminal Investigations Division of the IRS. d) Required by law to report the client to the Department of Justice