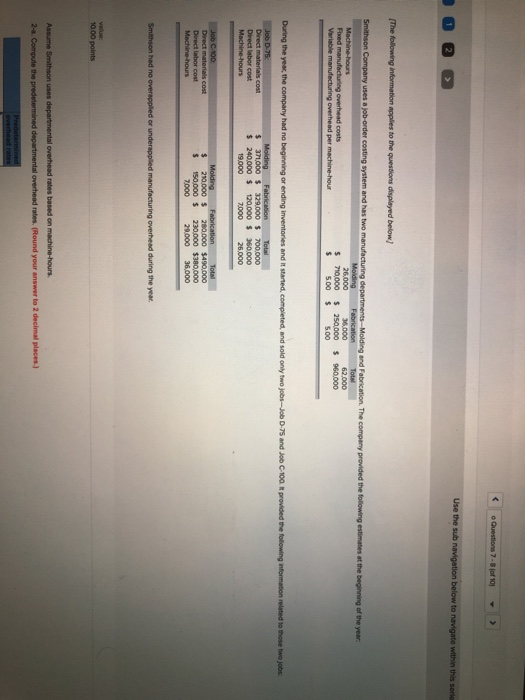

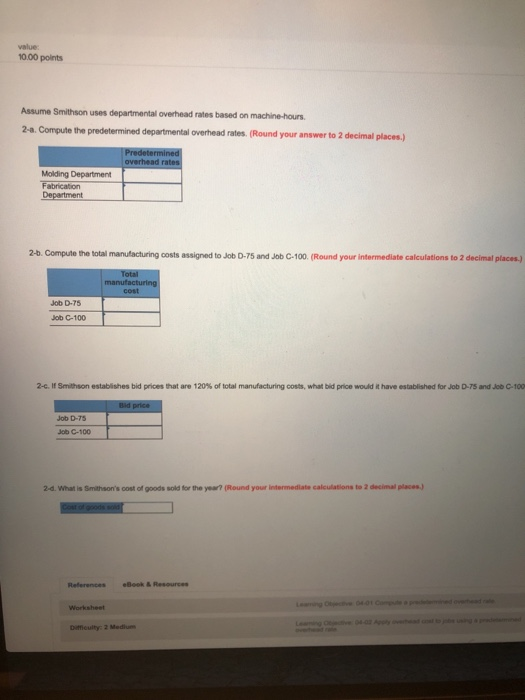

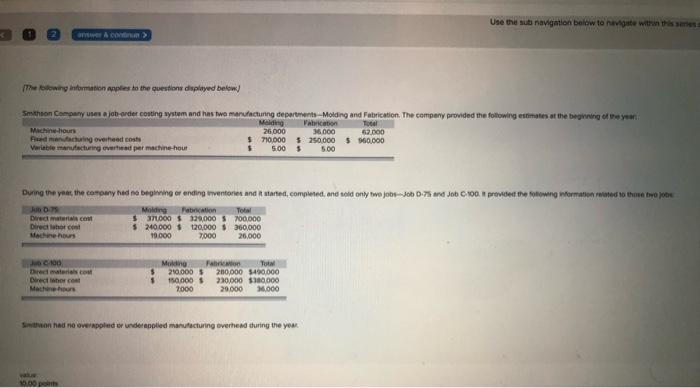

Questions 7-8 (of 10 Use the sub navigation below to navigate within this serie The following information applies to the questions displayed below Smithson Company uses a job-order costing system and has two manufacturing departments-Molding and Fabrication. The company provided the following estimates at the beginning of the year Molding 26.000 710,000 Fabrication 36.000 $ 250,000 5.00 Total 62,000 $ 960,000 Machine-hours Foxed manufacturing overhead costs Variable manufecturing overhead per machine-hour 5.00 During the year, the company had no beginning or ending inventories and it started, completed, and sold only two jobs-Job D-75 and Job C-100 it provided the folowing information related to those two jobs Fabrication 329,000 $ 120000 $ Job D-75 Molding 371,000 $ $ 240,000$ 19,000 Total Direct materials cost 700,000 360000 26,000 Direct labor cost Machine-hours 7000 Febrication 280000 $490.000 230,000 $380,000 29000 Total Job C-100 Direct materials cost Direct labor cost Mechine-hours Molding 210.000 $ 150,000 $ 7000 36,000 Smithson had no overappled or underappled manufacturing overhead during the year value: 10.00 points Assume Smithson uses departmental overhead rates based on machine-hours. 2-a. Compute the predetermined departmental overhead rates. (Round your answer to 2 decimal places) Predetarmineo overhead rates value: 10.00 points Assume Smithson uses departmental overhead rates based on machine-hours 2-a. Compute the predetermined departmental overhead rates. (Round your answer to 2 decimal places.) Predetermined overhead rates Molding Department Fabrication Department 2-b. Compute the total manufacturing costs assigned to Job D-75 and Job C-100. (Round your intermediate calculations to 2 decimal places.) Total manufacturing cost Job D-75 Job C-100 2-c. If Smithson establishes bid prices that are 120 % of total manufacturing costs, what bid price would it have established for Job D-75 and Job C-100 Bid price Job D-75 Job C-100 2-d. What is Smithson's cost of goods sold for the year? (Round your intermediate calculations to 2 decimal places) eBook & Resources References Leaning Otject 0401 Camte pr Worksheet Leaming Otve 04-02 Auty ovehad ot toin veed a d Difficulty: 2 Medium Use the sub navigation below to navigate within this series 1 2 answer & continue (The following information applies to the questions displayed below) Smithson Company uses a job-order costing system and has two manufacturing departments-Molding and Fabrication. The company provided the following estimates at the beginning of the year Fabrication 36,000 Molding 26,000 Total Machine-hours Fxed manufacturing overhead costs Variable manufecturing overhead per machine-hour 62.000 S 960,000 710,000 s 250000 5.00 5.00 During the year, the company had no beginning or ending inventories and it started, completed, and sold only two jobs-Job D-75 and Job C-100 t provided the following information related to those two jobs Job D-75 Direct materials cost Direct labor cost Machine-hours Fabrication 371000 $ 329.000 $ 700.000 $ 240000 $ 120,000 $ 360000 7,000 Molding Total 19000 26,000 Job C100 Direct materials cost Direct labor cos Machine hours Molding 210.000 $ 150.000 $ 7000 Fabrication 280,000 $490.00 230,000 $380,000 29,000 Total 36.000 Smithson had no overappled or underapplied manufacturing overhead during the yea value 10.00 points