Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Questions 8-10 refer to the information below. A liability of $7.5 million is due in 10 year's time. The yield curve is currently flat at

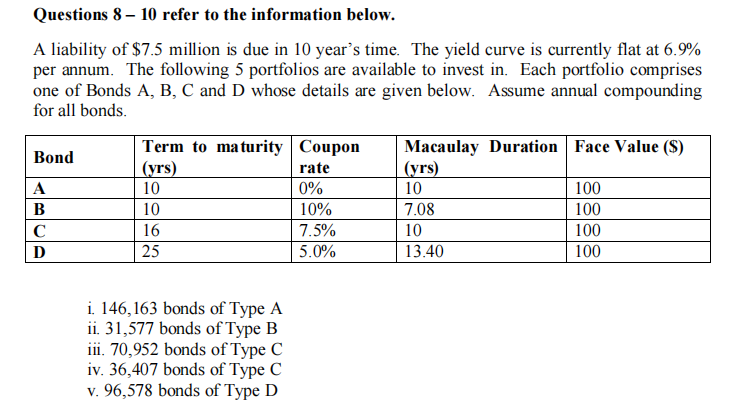

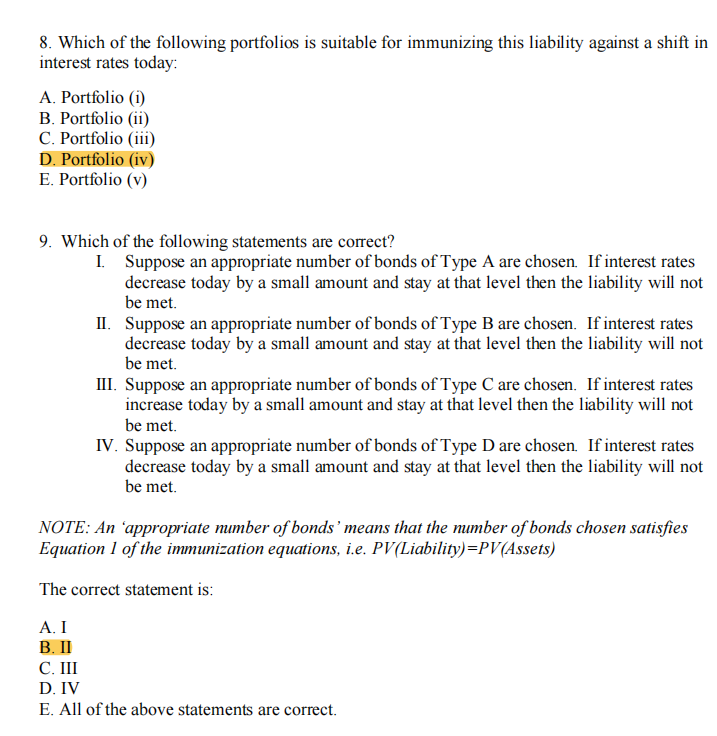

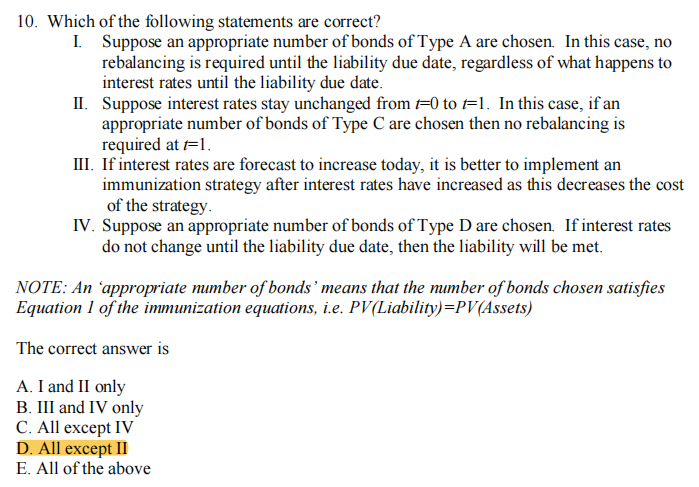

Questions 8-10 refer to the information below. A liability of $7.5 million is due in 10 year's time. The yield curve is currently flat at 6.9% per annum. The following 5 portfolios are available to invest in. Each portfolio comprises one of Bonds A, B, C and D whose details are given below. Assume annual compounding for all bonds. i. 146,163 bonds of Type A ii. 31,577 bonds of Type B iii. 70,952 bonds of Type C iv. 36,407 bonds of Type C v. 96,578 bonds of Type D 10. Which of the following statements are correct? I. Suppose an appropriate number of bonds of Type A are chosen. In this case, no rebalancing is required until the liability due date, regardless of what happens to interest rates until the liability due date. II. Suppose interest rates stay unchanged from t=0 to t=1. In this case, if an appropriate number of bonds of Type C are chosen then no rebalancing is required at t=1. III. If interest rates are forecast to increase today, it is better to implement an immunization strategy after interest rates have increased as this decreases the cost of the strategy. IV. Suppose an appropriate number of bonds of Type D are chosen. If interest rates do not change until the liability due date, then the liability will be met. NOTE: An 'appropriate number of bonds' means that the number of bonds chosen satisfies Equation 1 of the immunization equations, i.e. PV (Liability) =PV (Assets) The correct answer is A. I and II only B. III and IV only C. All except IV D. All except II E. All of the above 8. Which of the following portfolios is suitable for immunizing this liability against a shift in interest rates today: A. Portfolio (i) B. Portfolio (ii) C. Portfolio (iii) D. Portfolio (iv) E. Portfolio (v) 9. Which of the following statements are correct? I. Suppose an appropriate number of bonds of Type A are chosen. If interest rates decrease today by a small amount and stay at that level then the liability will not be met. II. Suppose an appropriate number of bonds of Type B are chosen. If interest rates decrease today by a small amount and stay at that level then the liability will not be met. III. Suppose an appropriate number of bonds of Type C are chosen. If interest rates increase today by a small amount and stay at that level then the liability will not be met. IV. Suppose an appropriate number of bonds of Type D are chosen. If interest rates decrease today by a small amount and stay at that level then the liability will not be met. NOTE: An 'appropriate number of bonds' means that the number of bonds chosen satisfies Equation 1 of the immunization equations, i.e. PV (Liability )=PV( Assets ) The correct statement is: A. I B. II C. III D. IV E. All of the above statements are correct

Questions 8-10 refer to the information below. A liability of $7.5 million is due in 10 year's time. The yield curve is currently flat at 6.9% per annum. The following 5 portfolios are available to invest in. Each portfolio comprises one of Bonds A, B, C and D whose details are given below. Assume annual compounding for all bonds. i. 146,163 bonds of Type A ii. 31,577 bonds of Type B iii. 70,952 bonds of Type C iv. 36,407 bonds of Type C v. 96,578 bonds of Type D 10. Which of the following statements are correct? I. Suppose an appropriate number of bonds of Type A are chosen. In this case, no rebalancing is required until the liability due date, regardless of what happens to interest rates until the liability due date. II. Suppose interest rates stay unchanged from t=0 to t=1. In this case, if an appropriate number of bonds of Type C are chosen then no rebalancing is required at t=1. III. If interest rates are forecast to increase today, it is better to implement an immunization strategy after interest rates have increased as this decreases the cost of the strategy. IV. Suppose an appropriate number of bonds of Type D are chosen. If interest rates do not change until the liability due date, then the liability will be met. NOTE: An 'appropriate number of bonds' means that the number of bonds chosen satisfies Equation 1 of the immunization equations, i.e. PV (Liability) =PV (Assets) The correct answer is A. I and II only B. III and IV only C. All except IV D. All except II E. All of the above 8. Which of the following portfolios is suitable for immunizing this liability against a shift in interest rates today: A. Portfolio (i) B. Portfolio (ii) C. Portfolio (iii) D. Portfolio (iv) E. Portfolio (v) 9. Which of the following statements are correct? I. Suppose an appropriate number of bonds of Type A are chosen. If interest rates decrease today by a small amount and stay at that level then the liability will not be met. II. Suppose an appropriate number of bonds of Type B are chosen. If interest rates decrease today by a small amount and stay at that level then the liability will not be met. III. Suppose an appropriate number of bonds of Type C are chosen. If interest rates increase today by a small amount and stay at that level then the liability will not be met. IV. Suppose an appropriate number of bonds of Type D are chosen. If interest rates decrease today by a small amount and stay at that level then the liability will not be met. NOTE: An 'appropriate number of bonds' means that the number of bonds chosen satisfies Equation 1 of the immunization equations, i.e. PV (Liability )=PV( Assets ) The correct statement is: A. I B. II C. III D. IV E. All of the above statements are correct Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started